Be the financial mastermind with edZeb and obtain one of the highest distinctions in the world of Finance

Co-Founder & CFO

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

Get Placed in Top

Companies Worldwide

including Big 4s

To Upscale Your

Financial Skills

High Paying Global

Careers

Easily do-able with a continuing college

degree

Total 190,000 Active Charterholders

91% of Fortune 500 Companies Trust CFA Members

| Offerings | ||

|---|---|---|

| Resume Building + Interview Preparation + Scouting Opportunities |  |

|

| Excellent Track Record of Faculty Members in Delivering Results |  |

|

| Free Career Counselling worth Rs. 10,000 |  |

|

| Assistance in writing CFA Scholarship Letter |  |

|

| Formula booklet |  |

|

| One-to-one doubts sessions |  |

|

| 7 full fledged mock exams |  |

|

| Revisionary lectures |  |

|

| Detailed Question Bank of over 2500+ questions |  |

|

| Full time expert faculties with experience of 10+ years |  |

|

| Attend Online/Offline/Pre-recordeed Classes with Backup of live classes |  |

|

| Detailed updated videos of around 200 hours covering all question from CFA Official Curriculum |  |

|

| Guest Lectures from Top Industry Professionals |  |

|

| Pass for Sure Assurance for CFA Prep Students |  |

|

| Expert CFA Faculty to answer last-minute questions |  |

|

| Current Market Trends & Exclusive Industry Insights |  |

|

| Dedicated Post-exam Improvement Strategies & Discussion |  |

|

| EMI with 0% Interest |  |

|

Mock Tests

10+ Years of CFA

Teaching Experience

Internship or

Placement Assistance

Dedicated Question

Bank Provided

Interactive Classes

Expertly Crafted

Study Materials

Personalised Study

Plans

Experienced Faculty

Practicals with Live Simulation

Solved end of Chapter Questions as provided in CFA Official Curriculum

1 - 1 Doubt Session

Personalised

Career Counselling

Tips and tricks to

solve Questions Quickly

More than 180 hours of Video Recorded Lessons

High Passing Rate

Eligibility is open to every student aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience.

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services

Students can access intuitive study material, live/pre-recorded lectures and quizzes in our modern Learning Management System

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective experience spanning more than 75 years

We provide comprehensive career

solutions for both Indian and international

job markets

All exams are computer-based

Level I exam is in

multiple-choice format

Exams are in proctored exam centres

Level I exam is offered quarterly per year

Level II exam is offered 3 times a year

Level III exam is offered 2 times a year

Begin your CFA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your CFA journey at edZeb with expert guidance, interactive learning, and practical lessons, preparing you for success in accounting and finance.

Guided over 10,000 CFA aspirants, our approach to practical exposure and valuable insights into valuations has been highly beneficial

We exclusively enlist full-time faculty, ensuring complete commitment and ownership

Attain the certification with edZeb’s passing rate exceeding 90% for CFA Level I and Level II vs global pass rate of 40%

To enhance retention, we employ practical and real-life examples throughout the training

| Offerings | Weekends / Weekdays |

|

|---|---|---|

| Level I | Price₹ 39,900 |

Price₹ 34,900 |

| Level II | ₹ 39,900 |

₹ 34,900 |

| Level I+Level II | ₹ 74,900 |

₹ 64,900 |

| Level I Plus (Level I + FM) | ₹ 79,900 |

₹ 69,900 |

| Level II Plus (Level II + FM) | ₹ 79,900 |

₹ 69,900 |

| Level I+Level II Plus (Level I + Level II + FM) | ₹ 1,09,900 |

₹ 99,900 |

| Placement Services | ₹ 39,900 |

₹ 39,900 |

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| Unit & Mock Tests |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Placement Assistance |  |

|

|

edZeb offers 100% placement assistance in your career. Our support ensures successful career placement in the industry.

.webp)

Hear it from the Learners

Hear it from the Learners

Hear firsthand experiences and success stories through heartfelt testimonials from our students, sharing their transformative learning journeys at our institution.

.webp)

.webp)

.webp)

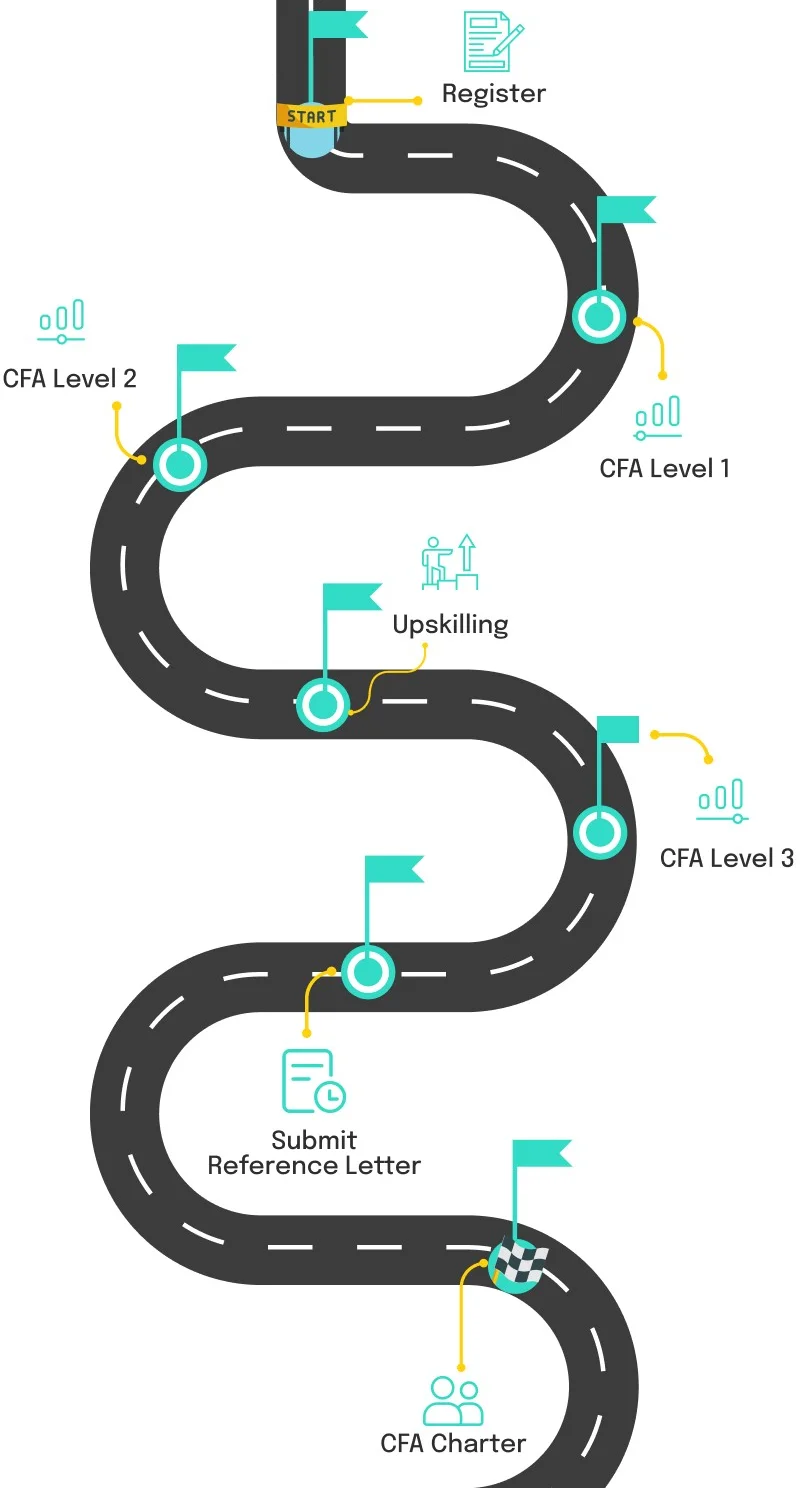

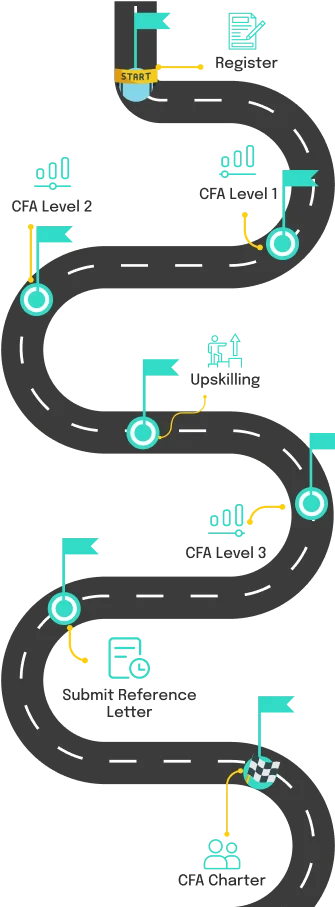

The structure of CFA is very organised and it comprises of three levels: Level I, Level II, and Level III. Each level focuses on different aspects of finance, investment analysis, and portfolio management.

To register for CFA coaching in india at edZeb, you must fill enquiry form online, connect with us directly on call or visit us at our Delhi and Mohali locations for further guidance.

The total duration of CFA course in India ranges from 1 to 3 years to pass all your levels. It sheerly depends upon the pace of your study and certain other factors.

The eligibility for CFA coaching with edZeb, candidates must have a bachelor’s degree or be in the final year of their undergraduate studies. Additionally, a strong interest in finance is essential for success in the CFA program.

Yes, CFA is a good career choice in India because they are demanded by investment banks, asset management firms, private equity companies, hedge funds, and consulting firms.

The salary of a CFA in India ranges from INR 6 to over 20 lakhs. However, it also depends on experience, employment type, and industry.

Both are regarded as difficult professional credentials, but most comparisons show that the CA is generally harder than the CFA course due to the longer duration, wider curriculum, and more demanding practical experience requirements.

yes, edZeb provide 100% placement assistance after completing the CFA in India. You will get jobs in the accounting and finance industry through its PAN India alumni network.

The percentage of people typically pass the CFA exams in India generally ranges between 35% to 45% for Level 1. Followed by Level II which has a success rate of 40% to 50% as compared to Level III, that is about 50%.

The minimum passing rate for the CFA exam at edZeb is 90% vs a global pass rate of 40%. Most of our students pass their CFA Level I and Level II exams.

edZeb is the best CFA coaching institute in India, offering practical hands on training, real world case studies, and tailored exam strategies to ensure students' success. Our expert faculty with 75+ years of combined experience ensures quality training. With flexible learning options, students can access pre-recorded, online, or offline classes.

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

₹ 10-12 LPA

₹ 5 – 10 LPA

₹ 6-8 LPA

₹ 10-12 LPA

₹ 9-11 LPA

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

Get in-depth details and information about edZeb’s Integrated CFA prep program offerings through our brochure.

contact

contact

With edZeb's best CFA course in India, you can prepare to ace your exam right away! We guarantee that the program at our institute will be dynamic and goal-oriented, giving you the understanding, skills, and confidence you need to gain the CFA certification. Our online CFA classes cover every updated aspect of the CFA syllabus and are meticulously curated by CFA-qualified experts and seasoned professionals.

We offer in-depth training and direction, covering everything from fundamental ideas to complex subjects to make sure you are ready beyond test success. We will transform you into an all-around player with our CFA trainers’ years of experience and practical knowledge. Take the first step toward a better future by enrolling right now!

In addition to providing students with comprehensive exam preparation, our CFA-integrated programs give them access to an LMS (Learning management system) interactive option that includes online study materials, recorded lectures, live lectures, mock exams, one-to-one doubt sessions, and much more. We provide you with all you require to become industry-ready and acquire much-needed industrial knowledge and skills.

So, get a counselling session from us before you start your chartered financial analyst course journey. Contact us at any time. Reach us to dispel any doubts, and we will be pleased to assist you. Enrol yourself at the best CFA coaching institute in India to start your path to a successful career in the accounting and finance industry. We also offer CFA coaching in Delhi, Mumbai, and also in other multiple cities of India. so if you want to enroll in a CFA course contact us today.

We at edZeb have achieved recognition as the best CFA training institute in India since our inception. The top trainers in this industry make up our CFA faculty, which attests to our commitment to quality. Our CFA tutors are seasoned professionals with extensive backgrounds in accounting and finance. Many of them have prestigious CFA qualifications and are well-known for their expertise.

They are well-versed in the chartered financial analyst curriculum and possess the skills and expertise required to deliver outstanding learning. By going over every topic on the CFA syllabus, they guarantee to ensure that you get comprehensive Chartered Financial Analyst classes online that will help you prepare for the CFA exams.

Our primary goal is to support students' confidence through engaging, dynamic, and interesting teaching strategies. Our faculty employs innovative methods to make complex concepts relatable and understandable so that you understand the study materials completely.

In addition to academic excellence, our CFA trainers infuse the classroom with real-world knowledge and practical experience. They provide case studies, recommendations, one-to-one doubt sessions, and insightful knowledge that broadens your understanding of this vertical.

We assure our students will receive ongoing support, guidance, and mentoring to enable them to accomplish their CFA career goals and confidently pursue their CFA Level 1, and Level 2 Coaching journey.

So get in touch with CFA Online Course Providers today to join the top Chartered Financial Analyst training online in India.

Enrolling at edZeb for the CFA course in India is a smart choice for advancing your career. Here, we also offer the most popular Financial Modelling Course for the students to provide them practical exposure to accounting, budgeting, forecasting, and many more. Here are reasons why it is the ideal partner for your CFA journey:

We prepare our students in the best possible manner with a goal in mind to not only help them pass their CFA exam but also teach them much-needed industrial knowledge and skills. Our standard record is that our passing rate exceeds 90% for CFA Level I and Level II vs a global pass rate of 40%.

We at edZeb understand the fact that the primary reason for anyone pursuing studies is to find a handsome salaried job, followed by a good reputation and respect. So, keeping this thing in mind, we have a dedicated placement cell to provide 100% placement assistance to our CFA students.

With nearly 75 years of combined experience, our teaching staff comprises highly skilled professionals who offer an extensive range of knowledge and expertise to the classroom. We are committed to providing each student with individualized support and excellent instruction.

From fundamental concepts to more complex topics, every facet of the CFA syllabus is covered in our meticulously designed for our Best CFA classes online, live CFA classes or those who are attending weekend CFA classes. We provide comprehensive study materials, practice exams, and interactive learning tools to ensure that students are CFA exam-ready.

We give every student individual attention and support, as well as tools and guidance created especially to support their preparation for success. To further improve your CFA learning experience, we also offer features that you won't find anywhere else, such as comprehensive study materials, practice tests, LMS, KICN teaching methodology, placement assistance and so much more. With our LMS interactive feature, you can access our pre-recorded lectures, mock test series, online classes, progression reports and much more. Therefore, we guarantee a high success rate for you whether you use our offline or online CFA course in India.

Our CFA classes aim to equip students with the knowledge and skills necessary for success in the accounting and finance industries. We emphasize the practical, real-world applications of CFA concepts heavily to ensure that our graduates are prepared for the demands of the industry.

So, don’t waste your precious time anymore, call us today, and book your counselling session with our senior counsellors today. Get minute details about our best CFA coaching center in India and kickstart your journey today.

Our Elite CFA Training Program sets you to be the financial mastermind with edZeb and obtain one of the highest distinctions in the world of Finance. Our trainer,

edZeb’s Co-Founder & CFO is CA, CFA Level II Cleared. He is Ex. Bajaj Finance, ICRA & EY. In his 10+ years of teaching experience has trained 10,000+ students being appointed in PAN India. After gaining industry insights, his passion for teaching and mentorship drew him to serve as a CFA faculty member training CFA Level 1 and CFA Level 2 students.

He assists students 24/7, approachable and friendly are adjectives to his personality. He is just a call away as he believes in quick query resolution. He is there to guide you through your CFA journey as smoothly as possible by providing personalized mentorship and sharing practical insights from his industry experience. His dedication to student success ensures that you receive the support and guidance needed to excel in your CFA exams and build a promising career in finance. Contact us today if you are looking for a CFA Coaching in Mumbai, Hyderabad, or any other city of India.

The most significant requirement for obtaining the CFA charter is passing all three tests, which demonstrate full knowledge of the subject matter. Each level of the curriculum builds on the prior level and becomes increasingly complex. Candidates report putting in more than 300 hours of study time on average to get through each level. Most major cities across the world have test centres that administer tests.

The CFA Level I Exam consists of 180 multiple-choice questions, divided into two 135-minute sessions with an optional break between them. Each session contains 90 questions. The exam covers 10 topic areas, with Ethics questions appearing as a group in the first session.

The Level I exam focuses on investment tools, asset classes, portfolio management, and ethical and professional standards.

The CFA Level II exam consists of 22 item sets, each containing a vignette with multiple-choice questions making a total of 88 multiple-choice questions. The exam duration is 4 hours and 24 minutes, divided into two equal sessions of 2 hours and 12 minutes each, with an optional break between these sessions.

The exam covers various CFA Program curriculum topic areas and these topics are randomly placed and may appear in either or both sessions. The financial statement analysis questions are based on IFRS unless specified as US GAAP.

Starting in 2025, the CFA Institute is introducing two new specialized pathways - Private Wealth and Private Markets - in addition to the current traditional Portfolio Management path. However, Candidates will have the opportunity to select the path most directly related to their interests and aspirations.

The CFA Level III exam consists of 22 sets (11 item sets and 11 essay sets), 12 points each. You have to complete it in 4 hours and 24 minutes, divided into two equal sessions with an optional break. Questions are based on vignettes, with topics randomly distributed out of which Portfolio Management and Wealth Planning comprise 30-35% of the content.

You have to answer descriptively in essay form where each set includes a vignette followed by 4 multiple-choice questions. The exam combines analytical and applied knowledge testing, emphasizing portfolio management topics.

The Chartered Financial Analyst (CFA) profession in India is a wide-ranging and lucrative career path, with India being the third largest market for such professionals. The demand for CFA is increasing due to the changing financial landscape. The CFA program consists of three levels, each offering job opportunities, and as experience and skills improve, salaries also rise. One of the most well-known financial courses is CFA, which leads to positions as a Corporate Financial Analyst, Private Banker, Business Analyst, Equity Analyst, and Finance Manager.

The skills that these professionals possess are in greater demand. For this reason, organizations that employ passed Level 1 CFA itself include KPMG, PwC, Deloitte, EY, JP Morgan Chase, Bank of America Merrill Lynch, Deutsche Bank, Credit Suisse, Motilal Oswal, and Anand Rathi. Moreover, CFA charterholders are employed by Morgan Stanley Wealth Management, Royal Bank of Canada, BofA Securities, UBS Group, HSBC Holdings, Wells Fargo and Company, PricewaterhouseCoopers, BlackRock, and TD Bank Financial Group.

A Level 1 CFA salary ranges from ₹4 to ₹8 lacs. Depending on the organization and profile, CFA Level 1 students are employed and compensated in packages that range from ₹4 to 6 lpa. A CFA Level 3 with complete qualification would have a greater salary range from ₹10 lpa onwards as a starting compensation.

So, don’t wait and take quick action by reaching out to our expert career counsellors to enrol yourself at the best CFA coaching center. edZeb alumni placed in MNCs across PAN India is a testament to being the best CFA training institute in India for the transformative impact of our coaching programs, not only in CFA coaching but also in financial modeling courses, CMA coaching, and ACCA coaching.