Headstart your successful career with our FMVA course to become more skillful in viewing current revenue, predicting future and making dynamic financial decisions.

Co-Founder & CFO

180+ Learning

Hours

Completion Certifications

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

To Learn How To Do Business Valuation

How to perform credit underwriting of the firms

How to build dynamic financial models from scratch

To Learn How To Earn Sustainable Income From Stock Market

To Learn Excel Skills

To Get a High Paying Job

| Offerings | ||

|---|---|---|

| Hands-on Experience on Capital IQ Software |  |

|

| Hands-on Experience on Sensibull Software |  |

|

| Equilty Research Reports from Investment Banking firm like Jefferies, JP Morgan & Morgan Stanley |  |

|

| Sectorial Research Reports from Rating Agencies such as Crisil, Icra etc |  |

|

| What is the Best way to Buy any Stock |  |

|

| What is the Best way to Sell any Stock |  |

|

| How to Earn Regular Dividends on Existing Stock |  |

|

| Quick Query Resolution |  |

|

| 1-1 Faculty Doubts |  |

|

| Guest Lecture from Industry Experts |  |

|

Mock Interview

Internship or Placement Assistance

Personalised Career Counselling

Practicals with Live Simulation

Interactive Classes

Expertly Crafted Study Materials

Personalised Study Plans

1 - 1 Doubt Session

Learning Management Software

More than 180 hours of Video Recorded Lessons

| Eligibility | |

|---|---|

| Suitable for CAs seeking a finance-focused role | |

| Tailored for CA final students aspiring for a finance career | |

| Ideal for MBA Finance graduates deviating from banking roles | |

| Geared towards determined females restarting their careers | |

| Open to undergraduates seeking in-depth financial knowledge | |

| Suitable for engineers aspiring for a finance career path | |

| Applicable for anyone aiming at roles in Investment Banking, Equity Research, Corporate Finance, and Investment Banking |

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services.

Students can access intuitive study material,

live/pre-recorded lectures and quizzes in our

modern Learning Management System.

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective

experience spanning more than 75+ years

We provide comprehensive career

solutions for both Indian and international

job markets.

Get in-depth details and information about edZeb’s FMVA Certification offerings through our brochure.

Boost your financial modelling expertise, earn prestigious industry credentials, and position yourself as a distinguished expert in valuation excellence.

Microsoft Excel

Corporate Finance

Valuation of Equity

Accounting

Personal Finance

Valuation of Real Estate

Financial Statement Analysis

Derivatives Trading

Credit Underwriting

Build Dynamic Financial Models

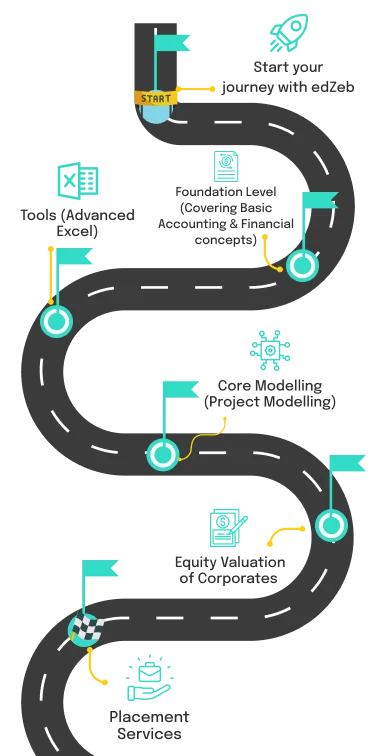

Begin your FMVA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your FMVA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Crack Jobs at best finance companies, leam with real work experience and get placed at top finance & accounting based job roles.

Personalized guidance to identify roles that suit your skills and interest

We help you from preparation to final selection

Crack Jobs at best finance companies, leam with real work experience and get placed at top finance & accounting based job roles.

Personalized guidance to identify roles that suit your skills and interest

We help you from preparation to final selection

| Offerings | Weekends / Weekdays |

|

|---|---|---|

| Financial Modelling | Price₹ 49,900 |

Price₹ 29,900 |

| Placement Services | ₹ 39,900 |

₹ 39,900 |

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Registration Support |  |

|

|

| Placement Assistance |  |

|

|

Our FMVA course focuses on sharpening your practical skills and preparing you for the real world.

Explore career paths with FMVA qualifications and check out the average salary prospects.

All salaries data is taken from

Explore career paths with FMVA qualifications and check out the average salary prospects.

All salaries data is taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

6-8 LPA

₹ 3-4 LPA

₹ 10-12 LPA

₹ 10-12 LPA

₹ 30-40 LPA

₹ 10-12 LPA

₹ 6-8 LPA

₹ 9-11 LPA

₹ 10-12 LPA

Register today to get LMS login & Start using our new era platform for all your course needs.

Our FMVA course focuses on sharpening your practical skills and preparing you for the real world.

Register today to get LMS login & start using our new era platform for all your course needs

contact

contact

With our best financial modelling course in India, we offer aspirants FMVA training that is practical and designed to help prepare them to take on every challenge in the corporate world. Our experienced and professional tutors and mentors aim to offer real-world case studies and facts for the financial modelling and valuation course.

We at edZeb are committed to guiding students in achieving their full potential and are passionate about providing top-notch education. As a global leader in financial modelling, we are dedicated to quality, innovation, and the success of our students.

You would be surprised to know that our excellent faculty and tutors have trained and certified over 25,000 students worldwide. Isn’t that impressive? Yes, it is. So, wait no more. Call us today and book an appointment for in-depth counseling. When you enroll at edZeb, you are certainly kicking off your career, with none other than our Financial Modelling Online Course!

Over our tenure in this industry, we created a robust global network of our students, most of whom work for Fortune 500 companies. Yes, you read that right. Our prominent alumni network is a reflection of our placement assistance program and how extremely successful it is!

So, it is your turn to make a wise decision today and join us at edZeb. We also provide financial modelling coaching in Delhi, Mumbai, Kolkata & throughout India.

We have often observed that students or aspirants usually get misled by false information or half information about the courses they wish to pursue. Thus, the very first step towards success is to know everything about the course before the actual commencement.

If you wish to know everything about the Financial Modelling course in India, you have just landed on the right FMVA learning platform. Read along to get the information that you have been looking for!

You are eligible to apply for our FMVA certificatio if you happen to match any of the following criteria mentioned below:

We at edZeb are ardent in making the entire learning process precise yet interesting, and full of real-life examples, the training modules are tailored for both fundamental and actual practical case scenarios.

So, if you want to join our Financial Modelling Course in Mumbai, Delhi or any other location and have a passion or deep desire to excel in this area, we believe that taking a detailed counselling session from our senior counsellors would be a great jumpstart for a clearer picture and stronger foundation in this industry.

We offer the best financial modelling course online in India, and we can certainly claim that you have landed at the right place if you want to boost your chances of landing a job, choose a wise career direction, or strengthen your knowledge of accounting and finance. Here are the benefits of joining a financial modelling and valuation analysis course with edZeb.

An additional benefit of enrolling at edZeb is that you will get an edge over clear placements including the information of candidates who have already been placed from our institute. We are committed to offering placement support following certified financial modelling course completion as well as assessment.

With a combination of lectures, case studies, and mock exams, you will gain the skills needed to apply your newly acquired knowledge to real-world issues, ensuring that you are ready for any challenges that may arise. Our financial modelling programs grant access to aspirants of an interactive LMS wherein they get to access recorded lectures, live lectures, mock exams, question sessions, and much more

The FMVA course offered by edZeb provides flexible scheduling options, including weekend and weekday classes, available both online and offline, so you can learn from the comfort of your home.

We follow the Knowledge Integrated with Corporate Needs (KICN) approach, which highlights practical knowledge because we want our students to mug up the syllabus. We provide comprehensive solution support, which includes career counseling, mentorship, and a screening of preparation.

Our most advanced learning management system gives students access to practice tests, live and pre-recorded lectures, and easily comprehensible study materials. LMS is accessed by our students at their own comfort and schedule, helping them learn at their own pace.

The faculty at edZeb has over 75 years of collective experience, having worked with major investment companies. The faculty members' combined experience in the financial and accounting sector has helped numerous students get placed in highly regarded organizations.

Our financial modelling classes is specially curated for aspirants who want to be professional financial analysts, equipping them with the skills and knowledge to excel in financial analysis, valuation, and decision-making. The well-designed curriculum equips you with the basics of advanced financial modelling and valuation analyst along with industry-specific details as well.

In the beginning, you will get an overview of financial modelling course covering its importance in the financial markets and how it gets applied in real-world situations developing an understanding of various financial modelling key concepts and terminology.

Then, you will get to learn big data analysis like balance sheets, income statement analysis, cash flow statement analysis, and Excel, its necessary shortcuts, formulas and functions to analyse data effectively.

The course also covers credit analysis, including key concepts, loan types, real-life scenarios, and the role of credit reporting. Stock markets and how you can make it a continuous source of earning.

Last but not least, Interview Coordination, including reviewing resumes, conducting mock interviews, and providing placement assistance.

A profession in financial modelling is quite lucrative on its own. Having a certification can help you land a job in a variety of establishments, including financial institutions, corporations, and banks.

But there are also plenty of other fields where having a solid understanding of financial modelling may be quite advantageous, such as risk analysis, corporate finance, equities research analysis, and investment banking.

Financial statements, M&A models, assessments, prediction models, and other crucial finance reports can all be generated. Financial modelling has various advantages that raise your profile in the business.

They use financial modelling to create accurate assessments and valuations, analyze factors like risks, capital, and inflation, and make business forecasts to earn 9 to 20 lacs, offered by top companies like JP Morgan, Goldman Sachs, Credit Suisse, HSBC, and MorningStar.

M&A analysts, who handle paperwork, calculations, and due diligence, benefit from specially designed M&A models. They can create valuations for businesses using a DCF model and make projections and calculations for the future. M&A analysts receive salaries ranging from Rs 2 to 25 lakhs, depending on experience and firm size. Companies like PwC, Accenture, Ernst & Young, Deutsche Bank, and Capgemini are among the companies hiring equity research analysts.

They use financial modelling to create company values and analyze market trends. Investment bankers earn an annual income between Rs 4 to 40 lakhs, depending on experience, location, and company. Companies like Axis Capital, Goldman Sachs, Edelweiss, ICICI Securities, Citibank, and Morgan Stanley require competent investment bankers.Our faculties have also designed an Investment Banking Course for detailed study about various investment banking topics.

Corporate finance professionals handle capital raising, transactions, and business developments that impact a company's worth. They can build company-specific models for decision-making and forecasting, and use financial statements and analyses. As professionals, their earnings range from Rs 3 to Rs 50 lakhs per annum from companies like Deloitte, KPMG, Ernst & Young, and McKinsey & Company offer corporate finance services.

Risk managers identify potential threats and research factors that could lead to losses or fraud. They use financial modelling to create risk models using distinct metrics, making predictions and taking preventive measures. The various career opportunities include working for companies like HDFC Bank, DBS, BNP Paribas, and Deutsche Bank, earning between Rs 3 to Rs 25 lakhs a year.

We, at edZeb, offer the best financial modelling course in India, especially designed to equip you with practical skills and in-depth knowledge. Our expert FMVA faculty, flexible learning options, and proven track record ensure you receive exceptional financial modelling coaching.

Join our network of successful alumni in top companies and take advantage of our comprehensive support. Contact us today to start your journey with edZeb and elevate your financial modeling career. Enroll now and set the stage for your professional success!