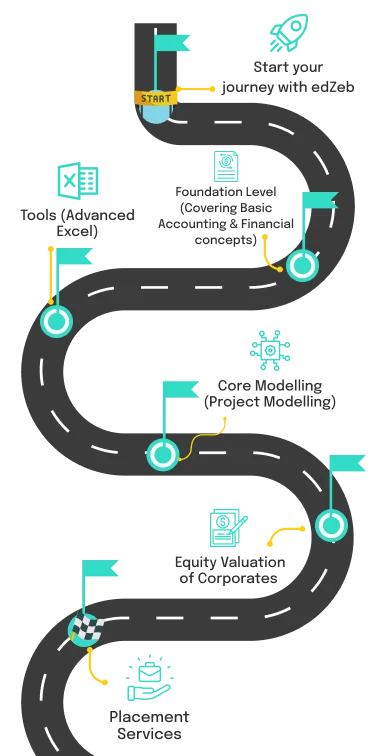

At edZeb, upskill your career with our Financial Modeling course in Hyderabad. Learn through live projects, gain insights from industry experts, and get placement assistance to secure your spot in the competitive finance world.

Co-Founder & CFO

180+ Learning

Hours

Completion Certifications

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

To Learn How To Do Business Valuation

How to perform credit underwriting of the firms

How to build dynamic financial models from scratch

To Learn How To Earn Sustainable Income From Stock Market

To Learn Excel Skills

To Get a High Paying Job

| Offerings | ||

|---|---|---|

| Hands-on Experience on Capital IQ Software |  |

|

| Hands-on Experience on Sensibull Software |  |

|

| Equilty Research Reports from Investment Banking firm like Jefferies, JP Morgan & Morgan Stanley |  |

|

| Sectorial Research Reports from Rating Agencies such as Crisil, Icra etc |  |

|

| What is the Best way to Buy any Stock |  |

|

| What is the Best way to Sell any Stock |  |

|

| How to Earn Regular Dividends on Existing Stock |  |

|

| Quick Query Resolution |  |

|

| 1-1 Faculty Doubts |  |

|

| Guest Lecture from Industry Experts |  |

|

Mock Interview

Internship or Placement Assistance

Personalised Career Counselling

Practicals with Live Simulation

Interactive Classes

Expertly Crafted Study Materials

Personalised Study Plans

1 - 1 Doubt Session

Learning Management Software

More than 180 hours of Video Recorded Lessons

| Eligibility | |

|---|---|

| Suitable for CAs seeking a finance-focused role | |

| Tailored for CA final students aspiring for a finance career | |

| Ideal for MBA Finance graduates deviating from banking roles | |

| Geared towards determined females restarting their careers | |

| Open to undergraduates seeking in-depth financial knowledge | |

| Suitable for engineers aspiring for a finance career path | |

| Applicable for anyone aiming at roles in Investment Banking, Equity Research, Corporate Finance, and Investment Banking |

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services.

Students can access intuitive study material,

live/pre-recorded lectures and quizzes in our

modern Learning Management System.

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective

experience spanning more than 75+ years

We provide comprehensive career

solutions for both Indian and international

job markets.

Get in-depth details and information about edZeb’s FMVA Certification offerings through our brochure.

Boost your financial modeling expertise, earn prestigious industry credentials, and position yourself as a distinguished expert in valuation excellence.

Microsoft Excel

Corporate Finance

Valuation of Equity

Accounting

Personal Finance

Valuation of Real Estate

Financial Statement Analysis

Derivatives Trading

Credit Underwriting

Build Dynamic Financial Models

Begin your FMVA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your FMVA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Crack Jobs at best finance companies, learn with real work experience and get placed at top finance & accounting based job roles.

Personalized guidance to identify roles that suit your skills and interest

We help you from preparation to final selection

Crack Jobs at best finance companies, leam with real work experience and get placed at top finance & accounting based job roles.

Personalized guidance to identify roles that suit your skills and interest

We help you from preparation to final selection

| Offerings | Weekends / Weekdays |

|

|---|---|---|

| Financial Modeling | Price₹ 49,900 |

Price₹ 29,900 |

| Placement Services | ₹ 39,900 |

₹ 39,900 |

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Registration Support |  |

|

|

| Placement Assistance |  |

|

|

Our FMVA course focuses on sharpening your practical skills and preparing you for the real world.

Explore career paths with FMVA qualifications and check out the average salary prospects.

All salaries data is taken from

Explore career paths with FMVA qualifications and check out the average salary prospects.

All salaries data is taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

6-8 LPA

₹ 3-4 LPA

₹ 10-12 LPA

₹ 10-12 LPA

₹ 30-40 LPA

₹ 10-12 LPA

₹ 6-8 LPA

₹ 9-11 LPA

₹ 10-12 LPA

Register today to get LMS login & Start using our new era platform for all your course needs.

Our FMVA course focuses on sharpening your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

contact

contact

edZeb, the most renowned edTech platform is introducing its financial Modelling course in Hyderabad. We have gained this reputation due to our years of expertise and success in this field.

We aim to provide class apart educational services in an atmosphere where students easily approach mentors, what else is needed? Right. No, we have many other services to offer our students from the commencement to the conclusion of your financial Modelling coaching.

Without any doubt, our mentors use the best possible teaching methods to impart learning, ensuring that students grasp even the most complex concepts with ease. Our dedicated staff supports students in every possible way, providing personalized guidance and resources to enhance their educational journey.

Furthermore, our robust placement cell plays a crucial role in assisting students in securing internships or jobs that align with their career aspirations and eligibility. By leveraging our extensive network of industry connections, we help students explore a wide range of opportunities in top companies, ensuring they are well-prepared to enter the workforce with confidence and competence.

Our financial modelling course in Hyderabad is gaining importance due to its practical finance skills, ability to predict business trends, and ability to raise equity.

Overall, our financial modelling coaching in Hyderabad is a valuable tool for businesses in today's data-driven world.

Financial Modelling coaching in Hyderabad is widely applied in many areas, such as investment analysis, forecasting, budgeting, decision-making, and business valuation. Informed strategic and operational choices are made with its assistance by examining financial data.

According to Glassdoor, The estimated total pay for Financial Modelling is ₹15,62,000 per year, with an average salary of ₹14,50,000 per year.

Financial Modelling analyst builds models using data from the organization, to make recommendations to improve productivity and identify potential risks. Their pay scales for entry-level positions start at Rs 3-5 lakhs and go up to Rs 19 lakhs.

Investment banking analyst responsibilities include market research, asset evaluation, data collection, and financial Modelling. The salary ranges from Rs 2.5 lakhs to Rs 25 lakhs, with an average earning of Rs 12 lakhs annually.

Private equity analyst manages portfolios, evaluate financial ratios, create reports, and analyze equity investment benefits. Salary ranges from Rs 3.2 lakhs to over Rs 44 lakhs per year.

Junior financial analysis manager is responsible for creating forecasts and budgets for a company, in addition to supporting senior management. As a junior, you can earn between Rs 7 lakhs to Rs 10 lakhs a year.

Financial modellers at hedge funds (HF) examine the risk-return characteristics of investment ideas using the DCF model, sensitivity analysis, and scenario analysis. The basic pay for junior analysts ranges from ₹50 to ₹66 lakhs per year which can increase and range between ₹50 to ₹75 lakhs annually.

It makes financial Modelling a good career, financial Modelling professionals stand out in terms of salary and job roles due to their ability to create accurate financial projections, assist in decision-making, and contribute to a company's financial strategy, leading to lucrative career opportunities.

Financial Modelling is a promising career path for those interested in the finance and accounting sector. It requires continuous practice to sharpen analytical skills, valuation, and estimation of financial performances.

To succeed in the finance domain, one must have a keenness to learn new skills, including understanding macro and microeconomics, financial Modelling, revenue valuation and estimation, data analysis using analytics and visualization techniques, communication and presentation skills, accounting and finance knowledge, interpersonal skills, and time management.

More than a degree or post-graduation certificate is required in the industry. Employers seek skilled professionals who have done professional financial courses. Out of many, one such course is Financial Modelling offered by edZeb in Hyderabad. It is an application-based program that improves your technical knowledge and practical skills. Such professional courses also provide you with a competitive edge over your peers.

At edZeb, we are committed to enabling students to realize their full potential and are passionate about providing excellent education.

In the competitive job market especially the finance domain, skills and expertise matter the most. Employers prefer those who have practical skill sets in addition to theoretical knowledge. Therefore, we have come up with a financial Modelling course in Hyderabad that will equip learners with a comprehensive skill set essential for success in finance.

Therefore, by completing a financial Modelling course at edZeb, learners will be fully equipped to tackle real-world financial challenges with confidence, precision, and a strategic mindset, setting themselves apart in the finance industry.

It is primarily because of our extensive curriculum and emphasis on providing hands-on learning experience, that we have been able to establish ourselves as the best financial Modelling coaching Institute in Hyderabad and have gained widespread recognition.

We have built an excellent track record for ourselves in the field because of our sheer dedication to our work. We take immense pride in announcing that our exceptional tutors and faculty have trained and certified over 25,000 students worldwide.

It is impressive, right? Our certified faculty has a collective 75+ years of experience in the field. They follow the Knowledge Integrated with Corporate Needs (KICN) teaching methodology, which strongly emphasizes practical knowledge. Its prime reason is that we don't want our students to just memorize the curriculum.

What’s more, students can access our carefully curated study materials, live and recorded lectures, and mock tests with the support of our most advanced learning management system (LMS).

We also assure you that the financial Modelling certificate in Hyderabad program that we offer at edZeb, will allow you to develop close relationships with mentors and instructors.

Our main objective is to foster an atmosphere of open communication with our students so they can ask questions and any doubts they may have.

As pioneers in the field of financial Modelling in Hyderabad, we are dedicated to excellence and creativity, which is reflected in the success stories of our students.