Fulfill your career dreams with edZeb’s CFA coaching in Chandigarh. Our expert mentors, practical learning, and placement assistance ensure that you are fully prepared for your exams and future opportunities. With flexible classes and real-world insights, we help you build a strong foundation for a thriving career in finance.

Co-Founder & CFO

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

Get Placed in Top

Companies Worldwide

including Big 4s

To Upscale Your

Financial Skills

High Paying Global

Careers

Easily do-able with a continuing college

degree

Total 190,000 Active Charterholders

91% of Fortune 500 Companies Trust CFA Members

| Offerings | ||

|---|---|---|

| Resume Building + Interview Preparation + Scouting Opportunities |  |

|

| Excellent Track Record of Faculty Members in Delivering Results |  |

|

| Free Career Counselling worth Rs. 10,000 |  |

|

| Assistance in writing CFA Scholarship Letter |  |

|

| Formula booklet |  |

|

| One-to-one doubts sessions |  |

|

| 7 full fledged mock exams |  |

|

| Revisionary lectures |  |

|

| Detailed Question Bank of over 2500+ questions |  |

|

| Full time expert faculties with experience of 10+ years |  |

|

| Attend Online/Offline/Pre-recordeed Classes with Backup of live classes |  |

|

| Detailed updated videos of around 200 hours covering all question from CFA Official Curriculum |  |

|

| Guest Lectures from Top Industry Professionals |  |

|

| Pass for Sure Assurance for CFA Prep Students |  |

|

| Expert CFA Faculty to answer last-minute questions |  |

|

| Current Market Trends & Exclusive Industry Insights |  |

|

| Dedicated Post-exam Improvement Strategies & Discussion |  |

|

| EMI with 0% Interest |  |

|

Mock Tests

10+ Years of CFA

Teaching Experience

Internship or

Placement Assistance

Dedicated Question

Bank Provided

Interactive Classes

Expertly Crafted

Study Materials

Personalised Study

Plans

Experienced Faculty

Practicals with Live Simulation

Solved end of Chapter Questions as provided in CFA Official Curriculum

1 - 1 Doubt Session

Personalised

Career Counselling

Tips and tricks to

solve Questions Quickly

More than 180 hours of Video Recorded Lessons

High Passing Rate

Eligibility is open to every student aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience.

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services

Students can access intuitive study material, live/pre-recorded lectures and quizzes in our modern Learning Management System

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective experience spanning more than 75 years

We provide comprehensive career

solutions for both Indian and international

job markets

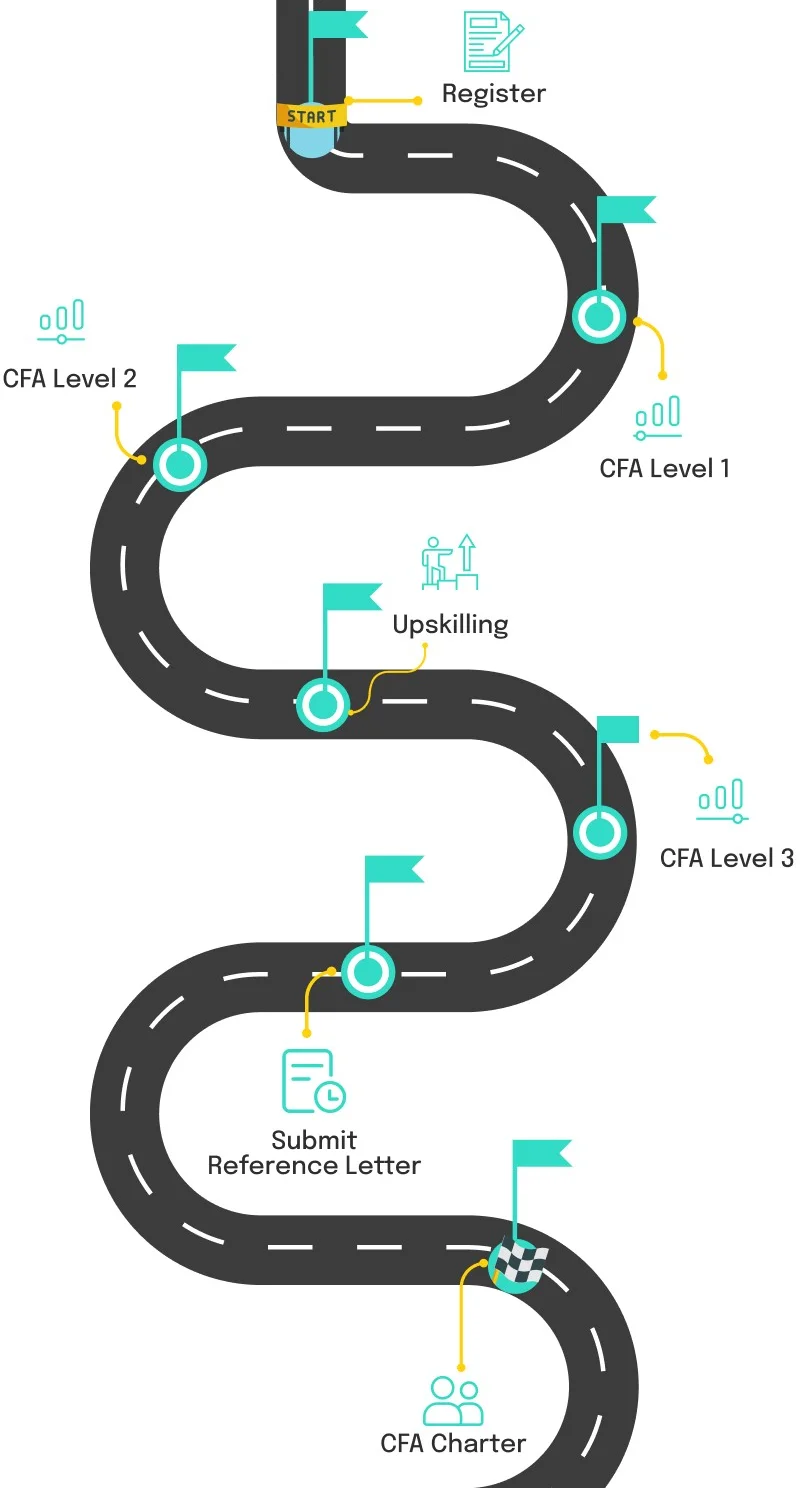

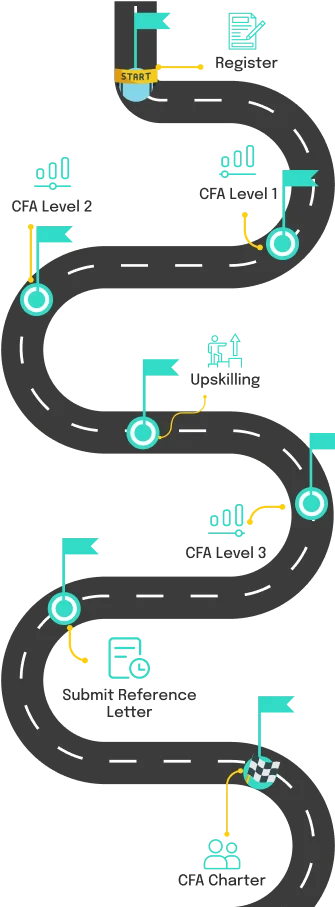

All exams are computer-based

Level I exam is in

multiple-choice format

Exams are in proctored exam centres

Level I exam is offered quarterly per year

Level II exam is offered 3 times a year

Level III exam is offered 2 times a year

Begin your CFA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your CFA journey at edZeb with expert guidance, interactive learning, and practical lessons, preparing you for success in accounting and finance.

Guided over 10,000 CFA aspirants, our approach to practical exposure and valuable insights into valuations has been highly beneficial

We exclusively enlist full-time faculty, ensuring complete commitment and ownership

Attain the certification with edZeb’s passing rate exceeding 90% for CFA Level I and Level II vs global pass rate of 40%

To enhance retention, we employ practical and real-life examples throughout the training

| Offerings | Weekends / Weekdays |

|

|---|---|---|

| Level I | Price₹ 39,900 |

Price₹ 34,900 |

| Level II | ₹ 39,900 |

₹ 34,900 |

| Level I+Level II | ₹ 74,900 |

₹ 64,900 |

| Level I Plus (Level I + FM) | ₹ 79,900 |

₹ 69,900 |

| Level II Plus (Level II + FM) | ₹ 79,900 |

₹ 69,900 |

| Level I+Level II Plus (Level I + Level II + FM) | ₹ 1,09,900 |

₹ 99,900 |

| Placement Services | ₹ 39,900 |

₹ 39,900 |

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| Unit & Mock Tests |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Placement Assistance |  |

|

|

edZeb offers 100% placement assistance in your career. Our support ensures successful career placement in the industry.

.webp)

Hear it from the Learners

Hear it from the Learners

Hear firsthand experiences and success stories through heartfelt testimonials from our students, sharing their transformative learning journeys at our institution.

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

₹ 10-12 LPA

₹ 5 – 10 LPA

₹ 6-8 LPA

₹ 10-12 LPA

₹ 9-11 LPA

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

Get in-depth details and information about edZeb’s Integrated CFA prep program offerings through our brochure.

contact

contact

Are you also the one whose constant hunt for the best CFA coaching in Chandigarh brought you here, then keep reading. You landed on the correct page.

edZeb in the industry has been recognized as the best CFA institute offering online and offline finance courses. An ed-tech institute founded by the CA Rank-Holders, Tech-Marketing Veterans & Big 4 Alumni.

We understand the increasing demand for professionals in the industry and that is why edZeb, is an initiative to prepare skilled professionals to fulfill this demand.

Employers seek professionals to tackle the complex challenges of modern finance. At edZeb, we equip our students with practical knowledge, industry-relevant skills, and real-world experience.

We offer an online CFA course in Chandigarh with a comprehensive curriculum following guidelines issued by the CFA institute. It is an expert-led course integrating case studies, hands-on projects, and expert mentorship. We make sure that our students are well-prepared to excel in competitive finance roles.

Get in touch with us and our expert counselors will guide you through the CFA journey with us. We will help you understand the exam structure, eligibility, and career pathways. Moreover, assisting you in choosing the right study plan and provide insights to ensure a smooth and successful learning experience with edZeb.

edZeb’s CFA course offers vast career opportunities in the finance industry. It is a globally recognized certification. The charter is issued by the CFA Institute by clearing all the prerequisites including exams and relevant experience. You are also eligible to work as you study or even after clearing each CFA Level. Let us further see what job roles you can do and an estimate of salaries that can be earned.

A credit analyst evaluates a person or company's creditworthiness to determine debt repayment ability. In India, the average salary is ₹9,00,000 per year, and Senior credit analysts earn between ₹8,00,000 and ₹14.50,000 per year.

Risk Analysts and Managers help you determine whether to proceed with a decision by assessing the risks that you or your company face, which earns an average of 8.7 Lacs annually.

A portfolio manager manages investments to maximize earnings within a timeframe, earning an average annual salary of 12.4 Lacs in India.

Wealth management advisors, and high-level financial professionals, holistically manage affluent clients' wealth, earning an average salary of 7.5 Lacs per year in India.

Investment strategists analyze economic indicators to advise portfolio managers on strategic asset allocation and trading strategies, earning an average annual salary of 12.7 Lacs.

Chief Investment Officers (CIOs) are executive-level employees. They manage investment strategies and portfolios for businesses or organizations. The average annual salary for a CIO in India is 63 Lacs.

A relationship manager is not only responsible for building client trust but also for maintaining it. They identify opportunities and suggest suitable products or services to increase customer base and revenue. In India, their average salary is 5 Lacs per year.

Adding CFA certification to your resume can significantly enhance your career prospects. It demonstrates expertise in investment management, financial analysis, and ethical practices. The certification sets you apart from your non-certified peers by showcasing your commitment to professional growth and opens doors to global opportunities in asset management, corporate finance, and investment banking.

So, what are you waiting for? Join online CFA coaching classes, you can enroll in our live online interactive classes mentored by the one and only CA Vikas Vohra.

No one can deny the fact that having a great mentor can significantly impact your learning curve and career growth. A mentor not only provides valuable insights and guidance but also helps you navigate challenges, build confidence, and stay motivated.

At edZeb, our experienced CFA training faculty includes industry veterans committed to mentoring students and equipping them with the skills needed to excel in the finance industry.

Led by expert CA Vikas Vohra, CA Vikas Vohra. Co-Founder & CFO at edZeb. Along with CA, he has also cleared CFA Level II. He started his industrial journey with Bajaj Finance, then joined ICRA & also worked at EY.

He has trained 10,000+ students in his 10+ years of teaching experience. After gaining industry insights, his passion for teaching and mentorship drew him to serve as a CFA faculty member training CFA Level 1 and CFA Level 2 students at edzeb’s best CFA coaching in Chandigarh.

Vikas sir is easily approachable and friendly to all the students. You can ask your doubts anytime, even on the phone, and he resolves our student’s queries. He believes in quick query resolution and he knows a minor confusion can also disturb the flow of study.

He is there to guide you through your CFA journey as smoothly as possible by providing personalized mentorship and sharing practical insights from his industry experience. His dedication to student success ensures they receive the support needed to excel in CFA exams and build a promising finance career.

Contact us today if you are looking for a CFA Coaching in Chandigarh, Mumbai, Hyderabad, or any other city in India. We serve online interactive classes throughout India. And you can locate us at Connaught Place, Delhi.

Our institute in Chandigarh offers the best CFA course in Chandigarh and if you have any doubts regarding that, we are pleased to inform you. You can also read our students' reviews and testimonials; we welcome your doubts to clarify them.

We aim to help students pass their CFA exam and acquire essential industrial knowledge and skills, with a passing rate exceeding 90% for CFA Level I and Level II, compared to a global pass rate of 40%.

edZeb recognizes that student's primary goal is finding a lucrative, well-respected job, and thus, we have a dedicated placement cell to offer placement assistance to CFA students.

Our teaching staff, with 75 years of combined experience, are skilled professionals dedicated to providing individualized support and excellent instruction to each student.

Our comprehensive CFA syllabus covers fundamental concepts to complex topics, offering online, live, and weekend classes. At CFA coaching in Chandigarh, we also offer study materials, practice exams, and interactive learning tools to prepare students for exams.

Our CFA course in Chandigarh offers personalized attention, support, and tools to help students prepare for success. We provide comprehensive study materials, practice tests, LMS, KICN teaching methodology, placement assistance, and more.

Our interactive LMS feature allows access to pre-recorded lectures, mock test series, online classes, and progression reports, ensuring a high success rate for both offline and online learning.

Our CFA classes equip students with essential knowledge and skills for success in the accounting and finance industries, emphasizing practical, real-world applications to prepare graduates for industry demands.

Therefore, book your counseling session with our senior counselors today and learn about our best CFA coaching center in India to start your journey. In addition to this we also provide a CFA course in Delhi, book your seat today.

More than any other accounting and finance course or certification, the CFA course is a doorway to a worldwide rewarding career in finance and accounting. Because of the rigorous curriculum of CFA and its esteemed reputation, the CFA course is an excellent model for anyone who wants to be successful in the international finance industry.

Your enrollment in the CFA coaching classes at edZeb assures comprehensive preparation not only for your exams but also for landing a competitive job in the industry. You will discover high salary packages, diverse applications, and a plethora of career prospects both in India and overseas.

CFA is a course with the potential to propel your career to new heights for which you have been wanting for years. We recognize that seeking the best CFA trainers in Chandigarh is the need of the hour, given its difficulty and need for gaining quality knowledge and skills. So, you have come to the correct place if that was your goal.

Since we at edZeb have been in this field for a long time, our students who excelled also refer us to their circle. So maintaining that kind of reputation is of utmost importance for us. Also, our alumni are currently employed by prestigious companies all over the world. So, if you want to grab the same opportunity, and do something big in your life, reach out to us today.!