edZeb offers the best CFA coaching in Delhi with a focus on personalized mentorship, high passing rates, and practical industry insights. Our comprehensive CFA course prepares you for success in the exams. Join us for the best CFA coaching and career growth opportunities in finance.

Co-Founder & CFO

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

1000+ Learning

Hours

Pass For Sure Assurance

1 - 1 Mentoring

Interactive LMS

100% Placement Assistance

Unlimited Doubt Sessions

Get Placed in Top

Companies Worldwide

including Big 4s

To Upscale Your

Financial Skills

High Paying Global

Careers

Easily do-able with a continuing college

degree

Total 190,000 Active Charterholders

91% of Fortune 500 Companies Trust CFA Members

| Offerings | ||

|---|---|---|

| Resume Building + Interview Preparation + Scouting Opportunities |  |

|

| Excellent Track Record of Faculty Members in Delivering Results |  |

|

| Free Career Counselling worth Rs. 10,000 |  |

|

| Assistance in writing CFA Scholarship Letter |  |

|

| Formula booklet |  |

|

| One-to-one doubts sessions |  |

|

| 7 full fledged mock exams |  |

|

| Revisionary lectures |  |

|

| Detailed Question Bank of over 2500+ questions |  |

|

| Full time expert faculties with experience of 10+ years |  |

|

| Attend Online/Offline/Pre-recordeed Classes with Backup of live classes |  |

|

| Detailed updated videos of around 200 hours covering all question from CFA Official Curriculum |  |

|

| Guest Lectures from Top Industry Professionals |  |

|

| Pass for Sure Assurance for CFA Prep Students |  |

|

| Expert CFA Faculty to answer last-minute questions |  |

|

| Current Market Trends & Exclusive Industry Insights |  |

|

| Dedicated Post-exam Improvement Strategies & Discussion |  |

|

| EMI with 0% Interest |  |

|

Mock Tests

10+ Years of CFA

Teaching Experience

Internship or

Placement Assistance

Dedicated Question

Bank Provided

Interactive Classes

Expertly Crafted

Study Materials

Personalised Study

Plans

Experienced Faculty

Practicals with Live Simulation

Solved end of Chapter Questions as provided in CFA Official Curriculum

1 - 1 Doubt Session

Personalised

Career Counselling

Tips and tricks to

solve Questions Quickly

More than 180 hours of Video Recorded Lessons

High Passing Rate

Eligibility is open to every student aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience.

With a focus on practical skills and industry relevance, edZeb empowers students to excel in their careers through rigorous training and mentorship, setting a benchmark in educational excellence

We provide complete career solution by

merging qualification, upskilling, and

placement services

Students can access intuitive study material, live/pre-recorded lectures and quizzes in our modern Learning Management System

Hands-on expertise in Knowledge Integrated with Corporate Needs (KICN) methodology

We cover career counselling, mentoring, evaluate

your preparation, you will receive

360- degree assistance

Our team of faculties have a collective experience spanning more than 75 years

We provide comprehensive career

solutions for both Indian and international

job markets

All exams are computer-based

Level I exam is in

multiple-choice format

Exams are in proctored exam centres

Level I exam is offered quarterly per year

Level II exam is offered 3 times a year

Level III exam is offered 2 times a year

Begin your CFA journey at edZeb with expert guidance,

interactive learning, and practical lessons, preparing you for

success in accounting and finance.

Begin your CFA journey at edZeb with expert guidance, interactive learning, and practical lessons, preparing you for success in accounting and finance.

Trust and Assurance

Guided over 10,000 CFA aspirants, our approach to practical exposure and valuable insights into valuations has been highly beneficial

Dedicated Trainers

We exclusively enlist full-time faculty, ensuring complete commitment and ownership

Impressive Success Rates

Attain the certification with edZeb’s passing rate exceeding 90% for CFA Level I and Level II vs global pass rate of 40%

Hands-On Learning Approach

To enhance retention, we employ practical and real-life examples throughout the training

| Offerings | Weekends / Weekdays |

|

|---|---|---|

| Level I | Price₹ 39,900 |

Price₹ 34,900 |

| Level II | ₹ 39,900 |

₹ 34,900 |

| Level I+Level II | ₹ 74,900 |

₹ 64,900 |

| Level I Plus (Level I + FM) | ₹ 79,900 |

₹ 69,900 |

| Level II Plus (Level II + FM) | ₹ 79,900 |

₹ 69,900 |

| Level I+Level II Plus (Level I + Level II + FM) | ₹ 1,09,900 |

₹ 99,900 |

| Placement Services | ₹ 39,900 |

₹ 39,900 |

| Particulars | |||

|---|---|---|---|

| Live Classroom/Online Lectures |  |

|

|

| Lecture Recordings |  |

|

|

| LMS Access |  |

|

|

| Unit & Mock Tests |  |

|

|

| edZeb Study Material (Soft Copy) |  |

|

|

| Placement Assistance |  |

|

|

edZeb offers 100% placement assistance in your career. Our support ensures successful career placement in the industry.

.webp)

Hear it from the Learners

Hear it from the Learners

Hear firsthand experiences and success stories through heartfelt testimonials from our students, sharing their transformative learning journeys at our institution.

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

Explore career paths with CFA qualifications and check out the average salary prospects.

Salary data has been taken from

₹ 8-10 LPA

₹ 6-9 LPA

₹ 3-8 LPA

₹ 10-11 LPA

₹ 10-15 LPA

₹ 10-12 LPA

₹ 5 – 10 LPA

₹ 6-8 LPA

₹ 10-12 LPA

₹ 9-11 LPA

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

We assure your success through our comprehensive support, expert guidance, and personalised resources.

Our CFA course focuses on refining your practical skills and preparing you for the real world.

Register today to get LMS login & Start using our new era platform for all your course needs.

Get in-depth details and information about edZeb’s Integrated CFA prep program offerings through our brochure.

contact

contact

Throughout our tenure in this vertical, edZeb has earned a reputation as the best CFA coaching in Delhi. Our goal is to boost the confidence of students by using dynamic, engaging, and methodology-objective teaching techniques.

Our CFA faculty uses cutting-edge techniques to make challenging concepts comprehensible and clear so that you completely understand the study materials.

Our trainers not only excel academically but also bring an array of real-world knowledge and practical experience to the classroom. They give you case studies, advice, and perceptive information that improves your understanding of this vertical.

We pledge to provide our students with the continuous support, guidance, and encouragement they need to achieve their professional objectives and pursue their CFA Level 1, and Level 2 journeys. To enroll in the best CFA classes in Delhi, contact our counselors and tutors today.

Our CFA tutors are highly qualified professionals with strong financial and accounting backgrounds. They possess esteemed CFA certifications and are widely recognized for their proficiency and real-world knowledge.

Our faculty have the knowledge and experience necessary to provide exceptional guidance, and they are well-versed in the CFA Course. Our faculty are the best trainers in this field, which reflects our proficiency and excellence over the years.

We as the best CFA institute in Delhi assure you thorough instructions that will aid in your CFA exam preparation by covering every subject on the CFA curriculum from foundational to advanced topics, to ensure that students are fully prepared for success. With over 75 years of combined experience, they provide an ideal blend of academic knowledge and practical application.

Our track record of success as the leading CFA course in Delhi is evidence of our expertise and professionalism. Our seasoned professionals and CFA-certified specialists comprise our knowledgeable faculty, who are committed to your success. What sets edZeb apart is our unwavering focus on student success and our dedication to excellence.

Our full curriculum is made to provide you with the knowledge, skills, and motivation you require to ace your CFA exams. Our classrooms are never overcrowded to boost teacher-student communication. This is another reason why we ace in this industry so effortlessly.

Our all-inclusive study materials, mock tests, and one-on-one counseling make sure students have everything they need to be successful in their CFA training. Whether you are a beginner or looking to improve your skills and knowledge, our coaching center is the greatest choice for your best CFA institute in Delhi.

Do not just take our word for it; come and experience the advantages of enrolling in edZeb and learning with our customized study plans exclusively for you. We also provide a host of extra benefits that you won't find anywhere else to enhance your learning processes, like comprehensive lectures covering the underlying facts, industry insights, time management skills, tips to perform under stress, and much more.

With our guidance and support, you will be ready to confidently take on the challenges of the CFA exams. Do not settle for anything less than the best when it comes to your preparation. Since your success is our primary objective, we are dedicated to helping you reach your goals. To begin your journey toward a successful career in finance and accounting, enroll today!

Additionally, we also provide CFA coaching in Chandigarh, so if you're interested in continuing your ACCA career in other areas, contact us now.

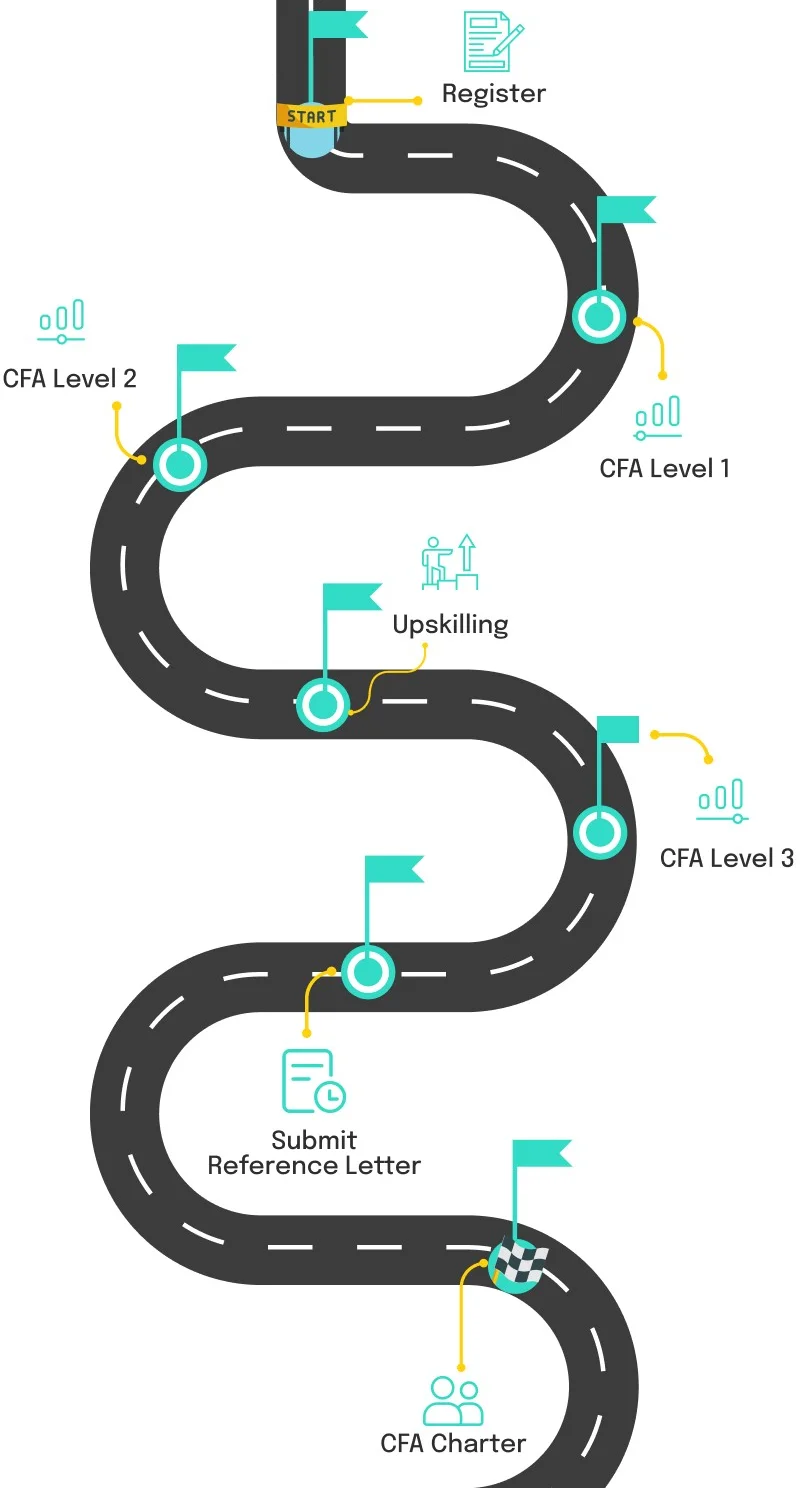

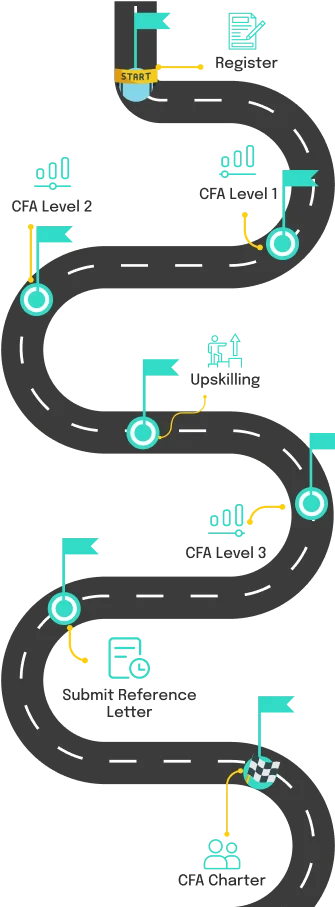

Becoming a CFA charter holder is a challenging but rewarding process that demonstrates a high level of expertise in investment analysis and portfolio management. The journey begins with enrolling in the CFA course in Delhi and registering for the Level I exam.

Candidates must then pass all three levels of the CFA exams, which cover a wide range of financial topics and require extensive study. Alongside exam preparation, aspiring charterholders need to accumulate 4,000 hours of qualified work experience in the investment decision-making process or in a role that adds value to this process. This experience can be gained before, during, or after participating in the CFA course.

Once the exams are passed and the work experience is completed, candidates must submit 2-3 professional reference letters that attest to their work experience and professional character. The final step is to apply for regular membership with the CFA Institute. Upon approval of the application and joining the institute, the candidate officially earns the prestigious CFA charter, marking a significant milestone in their professional career.

Portfolio Managers are investment decision-makers. They devise and implement investment strategies and processes to meet client goals and constraints, construct and manage portfolios, and make decisions on what and when to buy and sell investments. The average salary for a Portfolio Manager is ₹ 19,05000 per year in India.

Research Analysts engage in extensive data collection and investigative analysis to provide actionable insights. They explore a wide range of data sources and interpret complex information to support decision-making. The average annual salary for a Research Analyst in India is ₹ 5,00,000.

Financial Analysts use data to make informed investment recommendations and guide financial decisions. They analyze financial trends, market conditions, and company performance to advise on investment strategies. The average annual salary for a Financial Analyst in India is ₹ 6,00,000.

Credit Analysts specialize in evaluating bonds and assessing the risk of default. They focus on determining the creditworthiness of borrowers and investment quality. The average annual salary for a Credit Analyst in India is ₹8,00,000.

Equity Analysts evaluate investment and management performance, focusing on stock valuations and market trends. Their analysis helps in making investment decisions and forecasting future performance. The average annual salary for an Equity Analyst in India is ₹ 7,20,000.

Opting for online or offline classes for your CFA course in Delhi is an essential choice, which we truly understand. We at edZeb know the significance of offering options that suit your learning style and preferences. We offer our students both online and offline instruction as the top CFA coaching classes in Delhi.

While our offline CFA training center, primarily located in Delhi, has expanded our students' educational opportunities, our online learning platform has helped many of our students who are unable to join regular offline classes due to work or other reasons. So, reach out to our coaching class today and learn more.

At edZeb, you can choose the approach to learning that best suits you and connect with our knowledgeable and experienced trainers to create a unique educational experience. When taking our classes online, you have the freedom to study whenever and whenever you want. When it comes to studying, our students who have enrolled online have the resources they need to do so from anywhere at any time.

You can also participate in virtual study groups, receive individual guidance from teachers, and track your progress with personalized learning modules. Therefore, whether you use our offline or online best coaching institute for CFA in Delhi, we guarantee a high success rate for you. We also provide CFA coaching in Pune if you live there, get in touch with us today for more information.

Choosing the right CFA coaching in Delhi significantly impacts your career trajectory, and edZeb stands out as your premier choice. Our comprehensive CFA classes, whether online or offline, offer unparalleled flexibility and access to expert guidance tailored to your learning style and schedule.

With our proven track record, extensive resources, and personalized support, we ensure you’re well-prepared to excel in your CFA exams and advance in your finance career.

Don’t miss out on the opportunity to transform your professional journey with the best CFA coaching available in Delhi. Contact us today to enroll and take the first step toward achieving your career goals with edZeb's expert training and support. Whether you are starting your CFA journey or seeking to elevate your skills, our dedicated team is here to guide you every step of the way.

Join us at edZeb and unlock your potential in the world of finance.