ACCA, is it worth it? Is it worth DOING ACCA? Is it all worth the HYPE? Or Is ACCA difficult? You must have heard about it alot and if you haven’t, you are at the right place to know all about it.

ACCA stands for Association of Chartered Certified Accountants. It is widely recognized in 180 countries and opens up job opportunities to the best and most interesting roles all over the world. It makes you a highly sought-after professional with the expertise to face the challenges of the accounting and finance industry. Employers in the contemporary world need professionals with ACCA to not only tackle but also innovate solutions to the problems we are facing.

ACCA duration typically ranges from 2 to 3 years, depending on ACCA exemptions and study pace. This flexibility allows you to balance work and study effectively.

So, the big question remains is ACCA worth it Now? Should we Invest in ACCA?

Read the article further to get all your questions answered but first let us begin with the basic one, What is ACCA exactly?

What is ACCA?

ACCA is an accounting qualification that is accepted and respected worldwide. It enables ACCA professionals to work as accountants in countries like the US, UK, Australia, Canada, Europe, Singapore and many more. The ACCA salary in India is competitive, with increasing demand for skilled professionals in the accounting and finance sectors.

The qualification equips you with much-needed industrial knowledge and skills that make you highly sought after by top employers. The scope of ACCA in India is vast, with growing opportunities in multinational companies, financial institutions, and more.

As an ACCA member, you become part of our diverse body of 252,500 members and 526,000 students in 180 countries. To become one of the members, you must pass all 13 papers.

ACCA Exam Structure

With an emphasis on flexibility, ACCA allows students to continue their studies along with work and other life commitments. The ACCA syllabus is vast and covers nearly everything about finance, accounting, and management assurance: in fact, it is a wholesome education.

The ACCA program is divided into two levels: Fundamentals and Professional.

- The Fundamentals level comprises two modules called Knowledge and Skills. The Knowledge module introduces students to the core areas of financial and management accounting, whereas the Skills module includes key areas of financial reporting, taxation, audit, and performance management.

- The Professional level is an advanced level which is divided into Essentials and Options. The former module focuses on Strategic Business Leadership and Strategic Business Reporting, while the latter allows the students to specialize in Advanced Financial Management, Advanced Performance Management and Advanced Taxation Or Audit.

Is ACCA Worth It? Explore Key Benefits of ACCA Certification

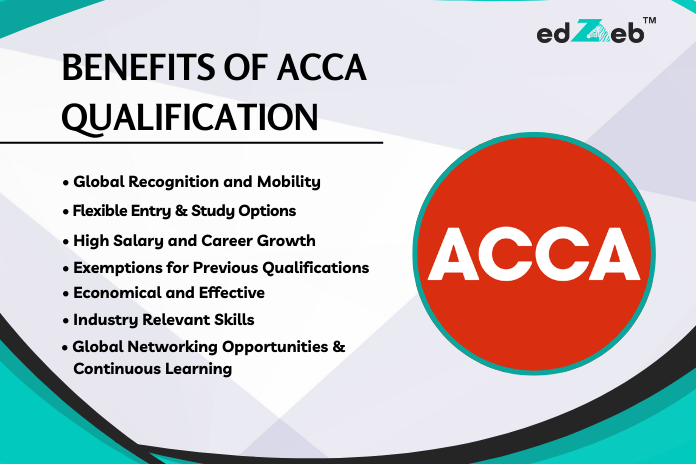

Indeed, ACCA improves life for students, graduates, and all working professionals. Probably this is the reason why ACCA has become one of the most popular qualifications in the finance sector. Read further and get to know the benefits of ACCA in detail.

Global Recognition and Mobility

ACCA is a professional accounting qualification internationally recognized among most countries, with compliance in over 180+ countries. It is valued throughout all parts of the world – be it India, the UK, the region of the Middle East, or anywhere else you plan to work. Thus, ACCA adds to global career options.

Flexible Entry & Study Options

Unlike the other accounting certifications, ACCA is open to students from all walks of life (12th pass, graduate, CA dropout, etc.). On-demand exams and the flexibility to study allow for balancing work with other commitments.

High Salary and Career Growth

Precisely the most sought-after qualification for global jobs is ACCA, in this category also some accountants perform audits, tax, and consultancy, among others, for banks, thus making financial services unique in finding jobs within the top global firms such as PwC, Deloitte, EY, KPMG, and BDO.

Exemptions for Previous Qualifications

A candidate having a background in commerce, accounting, or finance (for instance, B.Com, CA Inter, MBA) can avail of up to 9 paper exemptions and thus they have to put in a little less time and effort to complete the qualification comparatively.

Economical and Effective

Compared to other professional courses like CA or CPA, ACCA is an affordable qualification and can be completed in 2-3 years depending on the exemptions and the study pace.

Industry Relevant Skills

ACCA is primarily concerned with skill sets in financial and business practice such as IFRS, taxation, financial management, and audit, thus preparing the candidates for practical job experience.

Global Networking Opportunities and Continuous Learning

ACCA provides global networking opportunities with its 241,000 members and 542,000 students around the world. Furthermore, ACCA promotes lifelong learning through its CPD (Continuing Professional Development) programs.

You can take advantage of all these benefits of ACCA that it offers if you are considering doing it.

Is ACCA Worth It: Comparative Advantage

There is no doubt that ACCA is a globally recognized accounting qualification with a comprehensive curriculum. It covers business management and core accounting skills. So, the broader global reach and rigorous training make ACCA professionals versatile and adaptable to various finance sector roles. Thus, employers value professionals with expertise for their ethical standards and strategic thinking. ACCA members are known for their technical skills and professional values, making them preferred choices for high-profile roles.

Is ACCA Difficult?

Yes, the Association of Chartered Certified Accountants (ACCA) qualification is considered challenging. So, your frowning expression to the question, Is ACCA difficult? Has an answer that lies in its broad syllabus, challenging exams, and required practical experience. Below is the list of pointers indicating whether ACCA is difficult or not.

ACCA Learning

ACCA meets the learning style needs: self-study, distance learning, or face-to-face coaching. It enables access to education without regard to full personal or professional engagements. ACCA offers attractive and extensive study material, interactive online systems, and peer support forums to ensure students never lack provision and always share their journey.

Balancing ACCA with Work

Many ACCA members have successfully balanced work with their studies. It is by setting a routine to fit their schedule, practising prioritization, and taking advantage of flexible study modes. This highlights dedication, strategic planning, and effective utilization of the resources provided by the ACCA. Such stories also give a few practical tips for maintaining this balance, showing that finding what suits you is key.

Examination Process

The ACCA examination process involves several exams every year so that students can choose to sit in any of them according to their own timing and pace. Such regularity helps in better planning of studies as well as careers. Despite all odds, its passing rates are moderate at 55%. Success in ACCA exams highly depends on extensive preparation and serious study of practical concepts. Many have excelled in accessing and passing these examinations. This all was achieved through hard work and well-elaborated study.

ACCA Fees Structure

The ACCA fees structure in India varies per paper, with Applied Knowledge Level exams costing around ₹ 9,200, Applied Skills Level exams around ₹ 13,700, and Strategic Professional Level exams ranging from ₹ 17,400 to ₹ 24,200.

Additional ACCA fees structure includes study material and resources, coaching of classes, and annual subscription fees to ACCA, which is around 12,000 per year. The cost of these expenses can vary depending on the institute and program depth.

ACCA Affiliate Salary as per Career Choices

In case you do not know, an ACCA affiliate is an individual who has passed all the exams. So, the salary of an Association of Chartered Certified Accountants (ACCA) affiliate in India is as follows:

- Entry-level: INR 5.5–11 lacs per year

- Mid-senior: INR 11-17 lacs per year

- Senior: INR 19–30 lacs per year

ACCA affiliates can work in many different roles including Accountant, Financial analyst, Tax accountant, Senior accountant, Tax consultant, Internal manager, Finance manager, Director of Finance, Risk manager, and Chief risk officer and their salary depends on experience, job role, and location. So, the ACCA affiliate salary as per careers is as follows,

Career Level | Job Roles | Estimated Salary |

Entry-Level | Accountant, Tax Associate, Auditor | ₹4 – ₹8 LPA |

Mid-Senior Level | Financial Analyst, Internal Auditor, Risk Consultant | ₹6 – ₹15 LPA |

Senior Level | Finance Manager, Senior Auditor, Compliance Head | ₹15 – ₹25 LPA |

Executive Level | Finance Director, CFO, Risk Manager | ₹25 – ₹50 LPA |

Potential Challenges and Considerations of the ACCA

Most of you know that studying for the ACCA qualification has its benefits. Nevertheless, there are other challenges and considerations to take into account before deciding to pursue it. By recognizing such hurdles, preparation can be done in a better way for making an informed decision. Below are the challenges of the ACCA program that you may face.

Long Study Period

Though ACCA is flexible, it takes 2 to 3 years to pass all 13 papers, or even more, depending upon pace and ACCA exemptions. Ideally, the working-life-study balance is a tough one.

Competitive Exams

The ACCA exams, especially at the Strategic Professional Level, are tough. The exams require rigorous conceptual clarity, application-based learning, and exam-taking strategy. Also, subjects like Advanced Financial Management (AFM) and Strategic Business Reporting (SBR) subjects pose difficulties for many students.

Recognition Hurdles in Some Countries

Though ACCA is recognized worldwide, in certain countries like India and the US, it is not as widely accepted as CA is in India and CPA in the US. So, in some domestic markets, getting an ACCA degree may mean higher competition in the job market.

Cost of doing ACCA

The costs of obtaining the ACCA qualification include its exam fees, registration fees, annual subscription charges, and tuition fees.

Internships & Job Roles

Although ACCA candidates are recruited by the Big 4 firms and MNCs, still local employers prefer CAs for accounting and taxation roles, particularly in India. Candidates need to put in that extra effort to network and seek opportunities properly.

Continuous Learning and CPD Requirements

As an ACCA member, you must meet the Continuing Professional Development (CPD) requirement each year for membership retention, which means continuous learning and professional updates.

These above-listed challenges are important to be aware of but below are also the important things you must know before studying ACCA.

Career Goals

ACCA is a great pick for those aspiring for a global job in multinationals, consulting firms, or financial services.

Time & Discipline

Self-discipline and good study techniques are the secret keys to passing all the papers within an appropriate period.

Budgeting

Consider the total cost involved while doing ACCA including tuition, exam fees, and annual subscriptions so that you have an idea of the money getting invested into it.

Employer Recognition

Find out about the job opportunities available in your country of choice or the company of your choice and find out if they are aligned with what you have and want for your career from ACCA.

Making the Decision: Is ACCA Right for You?

Yes, pursuing ACCA is definitely the right choice for you unless you do not want to

- Build a global career in accounting and finance.

- Earn a prestigious qualification recognized in 180 countries.

- Secure high-paying job opportunities with top MNCs and Big 4 firms.

- Gain expertise in IFRS, taxation, audit, and financial management.

- Enjoy flexible exam schedules and faster career progression.

- Stand out from the competition with industry-relevant skills.

You must consider some factors before you consider doing ACCA such as

- Your career goals and interest in accounting & finance.

- Time commitment and exam flexibility.

- Cost of the qualification and return on investment.

- Recognition of ACCA in your target country.

- Job opportunities and industry demand.

- Your ability to balance studies with your personal commitments (if applicable).

So, you must consider these factors to make an informed decision. You must ensure that ACCA aligns with your professional as well as your personal goals. So, that provides you with the right balance between career growth and personal aspirations.

Conclusion

Certainly, ACCA is one of the strongest qualifications in recognition globally. In this respect, it offers career choices and prospects in highly paid jobs. While handling the exam rigours can be quite challenging, its benefits outweigh its few hurdles. The crux of the matter is a clear understanding of one’s career goals. It can be done easily by weighing its advantages and disadvantages to make an informed decision in consonance with one’s aspirations.

FAQ’s

Does ACCA have a future?

The ACCA qualification leads to a promising future with a variety of international career opportunities at competitive salary packages.

How much does an ACCA earn in India?

The salary of ACCA in India varies as per their level of expertise and experience. So, at the entry level in the industry, the freshers earn ₹5.5 – 11 lacs per year, followed by mid-senior level professionals earning ₹11 - 17 lacs per year and at senior level, an ACCA professional’s per year compensation is ₹19–30 lacs.

Is it easy to get a job after ACCA?

Getting a job offer for a skilled individual having the right set of qualifications is not a challenging task in itself. So, it is relatively easy to find a job after completing the ACCA qualification.

Does the Big 4 hire ACCA in India?

Yes, all the Big4s, Deloitte, PwC, EY, and KPMG actively hire ACCA-qualified professionals in India for their expertise in taxation, financial management, compliance and more. They are valued for their global accounting knowledge, analytical skills, and ability to work with international financial reporting standards. So, it makes them a preferred choice for roles in assurance, risk advisory, consulting, and financial reporting.