The Chartered Financial Analyst (CFA) and Certified Public Accountant (CPA) are two important certifications in the finance and accounting industries. When comparing CFA vs CPA, it’s essential to understand that, while they open opportunities for different professional paths, both provide prosperous options for future growth. Individuals who want to establish their career in finance must understand the basic differences between CPA and CFA. Some professionals opt for CFA after MBA to broaden their investment management skills, while others may pursue CFA after CA to enhance their expertise in financial analysis.

Therefore, in this blog, we will examine the difference between CFA and CPA which is better out of the two and might be more suitable for your professional goals. So, keep on reading!

Table of Contents:

CFA vs CPA: What Is the Difference?

Although these two certifications operate on totally different occupations and businesses, the recognized CFA (Chartered Financial Analyst) and CPA (Certified Public Accountant) certifications have associations with finance and accounting.

So, if you wish to get more details on CFA vs CPA which is better, delve into the article and know everything you need to know.

The CFA designation incorporates areas such as portfolio management, financial analysis, and ethics and is primarily focused on investment management and analysis. CFAs generally function in sectors where understanding of financial markets and investment strategies is essential such as asset management, equities research, or hedge funds.

Whereas, CPA certification is developed primarily for professionals working in accounting and auditing. Financial reporting, taxation, auditing, and compliance are all areas that come under the CPAs. They usually provide services like tax preparation, auditing, and financial consulting for accounting firms, government agencies, or corporate finance departments.

The CFA course is known for its major in financial analysis and investment principles, whereas the CPA exam places more emphasis on accounting principles, tax laws, and auditing standards. Despite the fact that both certifications require extensive preparation and one has to clear examination, the CFA program has a little higher edge over the CPA when it comes to future prospects.

Making a choice between the CFA and CPA ultimately is solely based on an individual’s interests and career goals. The CFA certification is for individuals who want to work in investment management and financial analysis; at the same time, the CPA certification is for aspirants who want to work in accounting, taxation, and audit.

Eligibility

When making a choice between a Chartered Financial Analyst (CFA) and a Certified Public Accountant (CPA), understanding CPA and CFA eligibility requirements can help you decide which is a better fit for your career goals in finance and accounting. Here’s a quick breakdown:

CFA:

Education: A bachelor’s degree or second-year university student status. Alternatively, you can qualify with four years of relevant work experience.

Work Experience: For full charter status, CFA Institute requires four years of professional work experience in finance, investment or a related field.

Membership: You must join the CFA Institute to be awarded the charter upon passing all three levels.

CPA:

Education: Most U.S. states require 150 semester hours of college credit, typically equivalent to a bachelor’s degree plus additional coursework (often an MBA or master’s degree).

Work Experience: Usually, 1-2 years of professional accounting experience under a licensed CPA.

Licensing: Candidates must pass the Uniform CPA Examination and meet state-specific licensing requirements.

Duration:

CFA:

- Total Duration: Typically, the CFA duration is 1 to 3 years.

- Levels: The CFA program has three levels, each generally requiring about 300 hours of study time. Exams are held twice per year for Level I and once per year for Levels II and III.

CPA:

- Total Duration: 1 to 1.5 years on average, depending on state requirements and individual study pace.

- Sections: The CPA Exam has four sections, which can be taken individually across 18 months.

CFA vs CPA Exam Differences

The CFA vs CPA Exam Topics differ significantly in content and focus. The CPA exam covers a broad range of topics, including auditing, financial accounting, taxation, and business law, reflecting the various responsibilities of accounting professionals. On the other hand, the CFA exam explores deeply investment analysis, portfolio management, economics, and ethics, curated by edZeb for professionals in investment management and financial analysis roles. Additionally, while the CPA exam is divided into four sections, the CFA exam consists of three levels, with a major focus on real-world challenges and analysis.

CFA Exam Structure

Three levels, each being tougher than the last, have a basic CFA exam structure. Level I focuses on understanding the fundamentals of investing tools and concepts. CFA Level 2 Syllabus explores asset valuation and the application of investment instruments in greater detail. Lastly, Level III evaluates the candidate’s practical implementation of the investment concepts and portfolio management strategies. It is a four hours thirty minutes exam, divided into morning and afternoon slots, and must be passed for each level. The majority of the exam questions are multiple-choice, however, Level III also includes essay and item sets. A candidate who is able to successfully complete all three levels and has relevant work experience is awarded the coveted.

CPA Exam Structure

Financial Accounting and Reporting (FAR), Business Environment and Concepts (BEC), Auditing and Attestation (AUD), and Regulation (REG) are the four areas of the specification that collectively make up the CPA exam. FAR concentrates on financial accounting and reporting standards, REG focuses on taxation and business law, BEC covers business concepts and communication skills, and AUD evaluates auditing procedures and professional standards. The exam duration is 16 hours in total, with four hours required for each section. Multiple-choice questions, task-based simulations, and written communication tasks are all included in the exams. To obtain the CPA designation, candidates must pass all four sections within the tentative 18 months. So, we have clearly mentioned CFA vs CPA Exam structure above for your reference, however, it is always advisable to get an in-depth counselling session in case of doubt.

CPA or CFA Which is Better?

Determining whether the CPA or CFA is better essentially depends on an individual’s personal career goals and aspirations. However, we have mentioned a few pointers that may help you choose the one that is more favourable to you.

The CPA certification is highly regarded in the accounting profession, offering opportunities in auditing, taxation, financial reporting, and advisory services. CPAs typically serve in public accounting firms, corporate finance departments, or governmental agencies, delivering essential financial and accounting expertise. The CPA certification presents a strong foundation in accounting principles, compliance, and regulatory standards, making it essential for career in finance, accounting, and business.

On the other hand, the CFA certification is well-suited for individuals interested in investment management, equity research, or portfolio analysis. CFAs include specialized knowledge in financial analysis, valuation techniques, and portfolio management, making them valuable assets in the investment industry. The CFA program highlights an in-depth understanding of financial markets, economics, and ethical principles, preparing candidates for complex investment decisions and risk management strategies.

Ultimately, the choice between a CPA vs CFA relies on the career aspirations and industry preferences of an individual as mentioned before. If your interests lie in accounting, taxation, or financial reporting, pursuing the CPA certification may be the ideal path for you in that case. In contrast, if you are passionate about investment analysis, asset management, or financial planning, obtaining the CFA certification may better align with your career goals. There are a number of benefits of getting CPA and CFA and can significantly enhance career prospects in their respective fields.

Career Paths

Let’s take a look at the CFA and CPA career paths to get a clarity on which of the two fields would be the perfect fit for you. Here we have discussed what does a CFA and CPA do in detail, so read along.

CFA Career Paths – What does a CFA do?

Performing in-depth financial analysis, managing investment portfolios, and making well-researched investment decisions are among the specializations of a Chartered Financial Analyst (CFA). He further Contributes to the success of investment firms, asset management companies, and financial institutions, and typically holds positions as portfolio manager, research analyst, risk manager, or financial advisor.

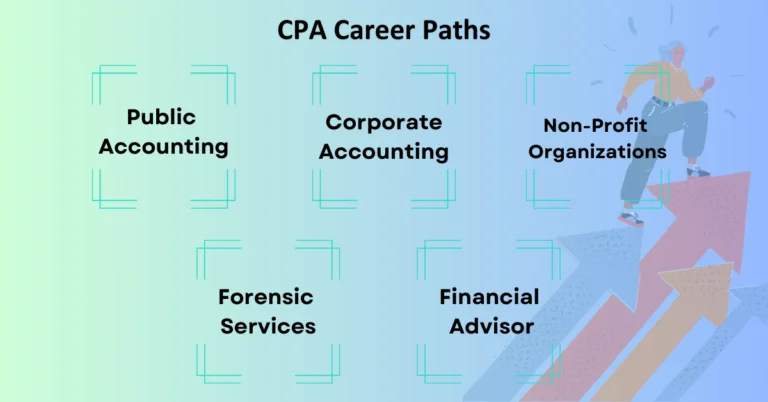

CPA Career Paths – What does a CPA do?

In the accounting and finance sector, a Certified Public Accountant (CPA) carries out an array of tasks, such as preparing tax returns, conducting financial audits, offering financial advice, as well as making sure regulatory requirements and more are covered. CPAs also help maintain financial integrity and transparency in a variety of contexts, including public accounting firms, corporate finance departments, and governmental, and nonprofit organizations.

CPA vs CFA Difficulty

It would not be justified to compare the level of difficulty between the CPA (Certified Public Accountant) and CFA (Chartered Financial Analyst) exams as it thoroughly depends on an individual’s aptitudes and grasping power.

CFA vs CPA which is Harder?

In general, the CFA exam is said to cover a wide range of investment-related topics and calls for in-depth preparation across three levels. On the other hand, the CPA exam covers a wider range of business and accounting topics, though the level of difficulty varies depending on how well-prepared you are in the subject matter. It would be totally naive to judge CFA vs CPA exam difficulty because they both require commitment and thorough preparation.

CFA vs CPA Pass Rate

We often notice that aspirants really want CPA and CFA passing rate insights to prepare themselves better for the examination and curriculum requirements. If you also wish for the same, we have penned down it for you below.

CPA Exam Pass Rate:

The passing rate for the CPA exam generally ranges from 45% to 60%. It certainly varies across different sections. The CPA exam consists of four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). Candidates must pass all four sections within an 18-month time period to earn the CPA certification. Additionally, the pass rates also depend on the comprehensive nature of the exam and the thorough preparation in order to get success in the examination.

CFA Exam Pass Rate:

The CFA passing rate is comparatively lower than the CPA exam. Level I has an average of around 40-45% pass rate, with Levels II and III averaging slightly higher. The CFA program consists of three levels, covering topics such as investment analysis, portfolio management, economics, and ethics. The low CFA pass percentage signifies the depth and complexity of the CFA curriculum. Despite the challenges, if you can complete all three levels of the CFA program then you have a significant achievement that indicates expertise in investment management and financial analysis.

Fee Structure

So, before you make up your mind for which course to go for, it is a wise move to check the CPA and CFA fee structure for your reference.

CPA Fee Structure

While the exact cost of the CPA exam varies and is regulated by the authority body, it normally costs between $800 and $1,000 for each of the four segments. Study materials, application fees, and registration fees could be additional costs. More attempt fees and review courses will be paid by candidates, which could further increase the total cost of earning the CPA certification.

CFA Fee Structure

Exam registration fees for the CFA program range from $700 to $1,450 per level (depending on the registration deadline), in addition to curriculum costs. The exam has a one-time registration fee of $450. The combined cost of the three tiers could be more than $3,000. Study materials, exam retests, and CFA Institute membership fees could be additional expenses. The extensive curriculum and international recognition of the CFA program make it an excellent investment for finance professionals, even with its high fee structure.

CFA vs CPA Salary

When comparing CFA vs CPA salary, both offer lucrative opportunities, but roles and industries vary. The CFA salary in India is typically higher in investment firms, while CPAs often excel in accounting roles.

CPA Salary Range

A number of factors, including industry, experience level, and location, influence a CPA’s pay range. Mid-career CPAs can make up to $100,000 per year, while entry-level accountants usually make between $50,000 and $70,000. It is particularly in high-demand industries or urban areas, CPAs with significant work experience, specialized knowledge, or leadership positions can command salaries exceeding $150,000 annually.

CFA Salary Range

It is primarily because of their specialized training in investment management and financial analysis that CFAs frequently get a greater salary than CPAs. Mid-career professionals may make $100,000 to $150,000 or more annually, while entry-level CFAs may make between $60,000 and $90,000.

Conclusion

In the fields of accounting, finance, and investment management, CFA compared to CPA are both highly lucrative career options. CFAs are experts in investment analysis and portfolio management, while CPAs are excellent in accounting, taxation, and auditing roles. The salary ranges for each of the certifications depend on the specializations; CPAs usually make high salaries in accounting and finance positions, while CFAs are paid more in positions involving investment management and financial analysis. Choosing between the CPA and CFA certifications ultimately is the final call of an individual’s personal career objectives, hobbies, and industry preferences. Both offer chances for career advancement and growth.