Chartered Financial Analysts (CFAs) in India get lucrative salaries due to their extensive training and hands-on expertise in the accounting and financing industry. In India, a CFA’s standard pay scale is from moderate to high; however, professional practitioners in the industry such as investment banking, portfolio management, and equity research are paid much more.

Also, If you’re considering becoming a CFA, it’s important to understand the CFA duration, as it plays a crucial role in how long it takes to start earning these competitive salaries.

Table of Contents:

- Scope of CFA in India

- Chartered Financial Analyst Salary Based on Levels

- Top Companies that Recruit CFA Professionals In India

- Jobs for CFA (Chartered Financial Analyst):

- CFA Salary in India Based on Job Profile

- Eligibility for CFA Course

- CFA Exam Structure:

- Top CFA Recruiters:

- Conclusion

- Frequently Asked Questions

Read along to learn more about CFA salary in India.

Scope of CFA in India

The demand for Chartered Financial Analysts (CFAs) in India is growing rapidly across a number of industries, including corporate finance, investment banking, asset management, and equity research. The scope of CFA in India in financial analysis, portfolio management, and investment decision-making makes them extremely valuable assets as per the corporate requirements these days.

Many professionals pursue CFA after MBA to complement their business knowledge and specialize in finance, making them well-equipped for senior roles in the finance industry. On the other hand, pursuing CFA after 12th offers young professionals an early start in the finance field, allowing them to build expertise and gain a competitive edge right from the beginning of their careers. CFAs are in an advantageous position in today’s time to pursue career opportunities in both domestic and international markets, contributing to the expansion and success of the financial sector, providing India’s ever-developing financial services and stronger integration into the global economy.

For those looking to enter this lucrative field, enrolling in a CFA Course can provide the necessary skills and qualifications to succeed. So, let us delve into the fact how much does a CFA earn now:

You can Check video to get the idea on how much does a CFA earn after completing CFA Level 1, CFA Level 2 & CFA Level 3.

Chartered Financial Analyst Salary Based on Levels

The certified chartered financial analyst salary (CFA) totally depends on the level of certification the experience an individual carries and his respective role in the industry. Read along to get a general overview:

CFA Level 1 Salary:

Entry-level salaries for CFA Level 1 candidates generally range from INR 6-10 lakhs per annum in India. These roles may include financial analysts, research associates, or junior investment bankers.

| Job Role | Experience | Salary (INR, PA) | Job Description |

| Equity Research Associate | 1-2 Yrs | 3.5-4.5 Lacs | An equity research associate helps with decision-making by analyzing financial data, assessing market trends, and making investment recommendations on stocks and securities. |

| Financial Planner | 5-10 Yrs | 4-4.5 Lacs | A financial planner helps clients reach their long- and short-term financial objectives by offering them tailored financial strategies and suggestions. |

| Equity Dealer / Trader – HNI Private Client | 4-9 Yrs | 5-10 Lacs | An equity dealer/trader for HNI private clients manages client portfolios, executes buy and sell orders, and provides high-net-worth individuals insight into the market for the best possible return on their investments. |

| Zonal Sales Manager-South India | 15-24 Yrs | 30-40 Lacs | A Zonal Sales Manager for South India is responsible for managing the sales force in the southern region, driving revenue growth, and overseeing sales operations in order to meet business objectives and increase market presence. |

*Note: The data provided is researched from various resources for reference purposes only.

CFA Level 2 Salary:

With the accomplishment of CFA Level 2, professionals are likely to get an increase in salary. Mid-level positions such as senior financial analysts, investment managers, or portfolio analysts may earn between INR 10-20 lakhs per annum, depending on experience and employer.

| Job Role | Experience | Salary (INR, PA) | Job Description |

| Equity Research Associate | 1-2 Yrs | 3.5-4.5 Lacs | An equity research associate helps with decision-making by analyzing financial data, assessing market trends, and making investment recommendations on stocks and securities. |

| Financial Planner | 5-10 Yrs | 4-4.5 Lacs | A financial planner helps clients reach their long- and short-term financial objectives by offering them tailored financial strategies and suggestions. |

| Equity Dealer / Trader – HNI Private Client | 4-9 Yrs | 5-10 Lacs | An equity dealer/trader for HNI private clients manages client portfolios, executes buy and sell orders, and provides high-net-worth individuals insight into the market for the best possible return on their investments. |

| Zonal Sales Manager | 15-24 Yrs | 30-40 Lacs | A Zonal Sales Manager is responsible for managing the sales force, driving revenue growth, and overseeing sales operations in order to meet business objectives and increase market presence. |

*Note: The data provided is researched from various resources for reference purposes only.

CFA Level 3 Salary:

Upon getting CFA Level 3, experts are open for senior-level roles in the finance industry. Salaries for these positions can vary from INR 15 lakhs to a hike of INR 30 lakhs per annum, with roles such as portfolio managers, senior investment bankers, or finance directors.

| Job Role | Entry-Level (0-2 years) | Mid-Level (3-7 years) | Senior-Level (8+ years) |

| Financial Analyst | ₹6 – ₹9 lakhs | ₹10 – ₹15 lakhs | ₹16 – ₹25 lakhs |

| Investment Analyst | ₹7 – ₹10 lakhs | ₹11 – ₹20 lakhs | ₹21 – ₹35 lakhs |

| Portfolio Manager | No entry-level | ₹18 – ₹30 lakhs | ₹31 – ₹50 lakhs |

| Senior Financial Analyst | No entry-level | ₹12 – ₹20 lakhs | ₹21 – ₹33 lakhs |

| VP, Finance | No entry-level | ₹30 – ₹50 lakhs | ₹51 – ₹80 lakhs |

| Chief Financial Officer | No entry-level | ₹50 – ₹1 crore | ₹1 crore – ₹2 crores (and above) |

| Chief Investment Officer | No entry-level | ₹55 lakhs – ₹1.5 crores | ₹1.5 crores – ₹2.5 crores (and above) |

*Note: The data provided is researched from various resources for reference purposes only.

It’s important to note that these salary ranges are a mirror reflection and can vary depending on factors such as location, industry, company size, and individual qualifications and experience.

Top Companies that Recruit CFA Professionals In India

| CFA Levels | Top Companies |

| CFA Level 1 | Crisil, HSBC |

| CFA Level 2 | The Goldman Sachs Group, Inc, Credit Suisse |

| CFA Level 3 | J.P. Morgan Chase & Co. (JPMC) |

*Note: The data provided is researched from various resources for reference purposes only.

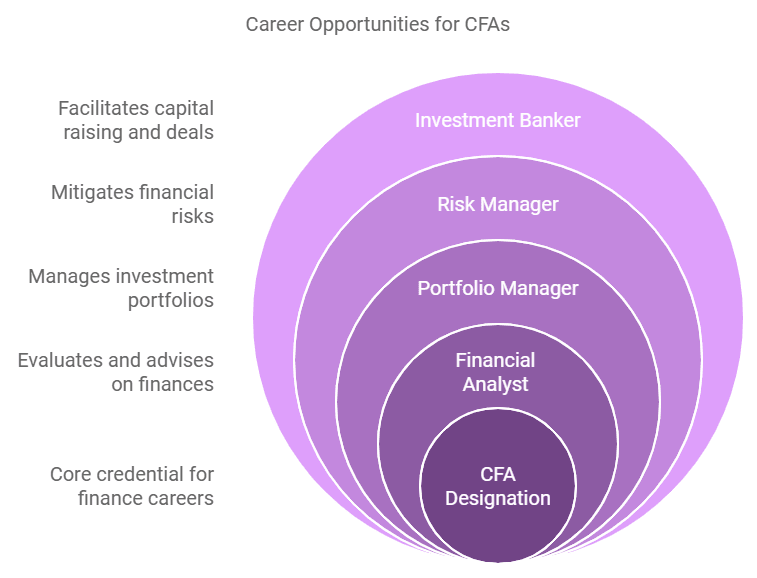

Jobs for CFA (Chartered Financial Analyst):

CFAs are qualified for a range of jobs within the financial sector, such as:

Financial Analyst:

Evaluating finances, bringing together reports, and offering advice to help with investment choices.

Portfolio Manager:

Managing investment portfolios, identifying market trends, and refining asset allocation plans.

Risk Manager:

A risk manager’s job is to identify and eliminate financial risks in an organization, including credit risk, operational risk, and market risk.

Investment Bankers:

They raise capital, assist with corporate finance transactions, and counsel clients on mergers and acquisitions.

Equity Research Analyst:

Investigating companies and industries in order to guide clients on investments.

CFA Salary in India Based on Job Profile

The Chartered Financial Analyst (CFA) designation is highly recognized in India and provides a number of possibilities for career growth in an extensive spectrum of finance industry sectors. Now let us look into the job profiles and range of CFA salary in India.

Certified Financial Analyst Salary:

Experience, industry, and job role are some of the factors that collectively decide a Certified Financial Analyst’s (CFA) salary in India. Entry-level CFAs can expect to make between INR 6 and 10 lakhs annually, while seasoned professionals can make up to INR 20 lakhs, especially in positions like roles such as portfolio management, investment banking, and equity research.

Salary for Portfolio Managers:

Keeping track of investment portfolios and maximizing returns for clients are essential responsibilities of portfolio managers. In India, portfolio managers may earn between INR 10 lakhs and more than INR 30 lakhs annually, based on experience, performance, and the assets they manage.

Salary for Finance Managers:

Within organizations, Finance Managers are in charge of budgeting, financial reporting, and financial operations. Finance managers in India may make between INR 8 lakhs and INR 20 lakhs a year, depending on experience, industry, and size of the organization.

Salary for Investment Bankers:

Investment bankers serve a vital role to business finance deals, such as capital raising, mergers and acquisitions, and strategic advisory services. In India, Investment Bankers can earn salaries ranging from INR 10 lakhs to over INR 40 lakhs per annum, depending on factors such as experience, deal volume, and performance.

Hedge Fund Manager Salary:

With the objective to generate returns for investors, hedge fund managers guide investment strategies and manage hedge fund portfolios. Hedge fund managers in India have the potential to make large bonuses dependent on fund performance, in addition to annual salaries ranging from INR 20 lakhs to over INR 50 lakhs.

In conclusion, there are many lucrative career options for CFAs in India in the finance industry, and salaries can vary depending on the job role, experience, and industry specialization of the applicants. Professionals who hold the CFA designation can pursue lucrative careers as investment bankers, portfolio managers, financial analysts, and more, helping India’s finance industry flourish.

Eligibility for CFA Course

Anyone interested in a career in finance, regardless of educational background, can apply to the CFA program. The CFA eligibility consists of the following:

- A bachelor’s degree from a recognized university or a comparable training program or professional experience.

- Meeting the requirements of the CFA Program, including accepting the Standards of Professional Conduct and the Code of Ethics established by the CFA Institute.

- satisfying one of the requirements listed below for education or work experience:

- possess four years of experience in a professional capacity, or

- possess a minimum of four years’ worth of work experience and education combined. These could be internships, part-time jobs, or full-time jobs.

CFA Exam Structure:

Three levels make up the CFA exam structure, with each level covering a distinct area of finance and investment management:

CFA Level I:

It covers the fundamentals of investing tools, such as quantitative methods, economics, corporate finance, financial reporting and analysis, equity and fixed-income investments, derivatives, alternative investments, and portfolio management.

CFA Level II:

In Level II, asset valuation is covered in more depth, building on the fundamental knowledge from Level I. It addresses subjects like portfolio management, derivatives, alternative investments, equity and fixed-income investments, and financial reporting and analysis. The exam format consists of item sets, or vignettes, that call for applying knowledge and analysis in real-world contexts.

CFA Level III:

This level puts a high priority on financial planning and portfolio management. It addresses issues including asset allocation, institutional investors, behavioral finance, private wealth management, and ethical and professional standards. The exam consists of constructed response (essay) questions and item sets resembling Level II.

Top CFA Recruiters:

CFA Charterholders are actively hired by a number of well-known corporations and financial institutions for a number of jobs for CFA (chartered financial analyst) in finance, investment management, and related industries. Among the leading CFA recruiters worldwide are:

- Investment banks include Bank of America Merrill Lynch, Morgan Stanley, JPMorgan Chase, and Goldman Sachs.

- Asset Management Companies: PIMCO, Fidelity Investments, Vanguard, BlackRock.

- Boston Consulting Group, Bain & Company, and McKinsey & Company are consulting firms.

- Moody’s Investors Service, Standard & Poor’s (S&P), and Fitch Ratings are the rating agencies.

- Venture Capital and Private Equity: KKR & Co, Sequoia and The Carlyle Group

- Hedge Funds: Bridgewater Associates, Citadel, Renaissance Technologies.

CFA Charterholders are respected by these organisations for their high standards of ethics and extensive education, which makes them valuable assets for positions that involve risk management, portfolio management, investment analysis, and other finance-related fields.

Conclusion:

The CFA program provides an opportunity for a rewarding profession in finance. CFA course eligibility is open to people from any educational background, and it offers a progressive exam structure that develops,/span> proficiency. Additionally, it provides opportunities for employment with prestigious financial institutions and multinational corporations.

FAQs

What is the average CFA salary in India?

The median CFA salary ranges from ₹7-12 lacs, mid-level CFA at ₹13-25 lacs, and at senior-level CFAs ₹26-50 lacs+ per annum with perks and incentives which completely depends upon the industry and location.

What is the highest salary of CFA?

Maximum CFA salary can go up in crores of packages as they start earning 50 lacs per annum at a senior designation and obviously at higher level, the number of opportunities coming your way also increases.

Who earns more, CA or CFA?

CAs earn more initially but they are limited to the regional boundaries of their country. CFA, on the other hand is a globally recognized affiliation so that is why CFAs earn better and more in the long run which completely depends on your location and designation.

What are normal job packages after CFA level 3?

In general, the CFA salary package after clearing Level 3 are higher which can range from INR 20 Lacs - INR 35 Lacs per annum. It is an approximate figure which can vary depending upon your placement industry and location.

What is CFA level 2 expected salary?

You can expect a salary package starting from 8 Lacs to 15 Lacs after clearing your CFA Level 2 exams.

What is the lowest salary of CFA?

CFAs earning potential is much higher but still if you are worried or have any concerns, you will definitely earn handsomely after your certification. The exact amount may vary but the earning potential would not be less than 5 Lacs in even the worst case scenario.

Is CFA worth it for banking?

Definitely, the banking industry demands CFAs to be in Investment Banking. In the certification you will learn about valuation of different financial instruments, wealth management and many other things.

What is the average CFA salary in India?

The median CFA salary ranges from ₹7-12 lacs, mid-level CFA at ₹13-25 lacs, and at senior-level CFAs ₹26-50 lacs+ per annum with perks and incentives which completely depends upon the industry and location.

What is the highest salary of CFA?

Maximum CFA salary can go up in crores of packages as they start earning 50 lacs per annum at a senior designation and obviously at higher level, the number of opportunities coming your way also increases.

Who earns more, CA or CFA?

CAs earn more initially but they are limited to the regional boundaries of their country. CFA, on the other hand is a globally recognized affiliation so that is why CFAs earn better and more in the long run which completely depends on your location and designation.

What are normal job packages after CFA level 3?

In general, the CFA salary package after clearing Level 3 are higher which can range from INR 20 Lacs - INR 35 Lacs per annum. It is an approximate figure which can vary depending upon your placement industry and location.

What is CFA level 2 expected salary?

You can expect a salary package starting from 8 Lacs to 15 Lacs after clearing your CFA Level 2 exams.

What is the lowest salary of CFA?

CFAs earning potential is much higher but still if you are worried or have any concerns, you will definitely earn handsomely after your certification. The exact amount may vary but the earning potential would not be less than 5 Lacs in even the worst case scenario.

Is CFA worth it for banking?

Definitely, the banking industry demands CFAs to be in Investment Banking. In the certification you will learn about valuation of different financial instruments, wealth management and many other things.