Are you thinking of pursuing a career as a Chartered Financial Analyst (CFA)? That’s amazing! The CFA Program is like a golden ticket to an advanced finance and investment management career.

Before you get right in, let us discuss the fundamentals first, particularly the CFA Level 1 exam eligibility requirements. When it comes to pursuing the CFA charter, confirming your eligibility for CFA ensures you’re fully prepared to start your journey with confidence. Everything you need to know from preparatory advice to qualifying requirements, we will cover it all in this comprehensive guide.

Table of Contents:

Understanding the CFA Program

The CFA program is widely recognized as one of the top qualifications in the investment and finance industry. It consists of three levels of exams i.e. Level 1, Level 2, and Level 3. Each level tests your knowledge and skills in different aspects of investment analysis and portfolio management.

This exam is all about laying a solid foundation that primarily focuses on essential concepts like investment tools and asset valuation.

The CFA designation is a highly regarded and acknowledged credential in the global financial markets making it a perfect fit for individuals who want to progress in the field of investment management and the CFA Level 1 is the gateway to it.

For most candidates, the CFA duration from Level 1 to final certification is around three years, though study time and exam schedules can impact this timeline.

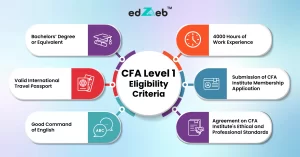

CFA Level 1 Eligibility Criteria

Understanding the CFA Level 1 eligibility criteria is crucial if you are serious about advancing your career in finance. Here’s a simple breakdown of what you need to know about the eligibility criteria for CFA level 1.

Academic Qualifications for CFA Level 1

To meet the eligibility for CFA Level 1 exam requirements, you need a bachelor’s degree or be in your second year of undergraduate studies.

Bachelors’ Degree

A Bachelor’s degree or equivalent from a recognized university or college is the primary requirement for enrolling in the CFA Level I. It is not necessary to have a degree in finance as degrees in any field work. However, if you have done B.B.A., B.Com., B.A.F. or if you have a background that includes finance, economics, or mathematics, you might find the study material a bit easier to digest.

Undergraduate Students

Students who are in the second year of their graduation also fulfill the eligibility criteria for CFA Level 1. The exam window must be within 23 months of your graduation month.

Work Experience Requirements for CFA Level 1

You might be wondering, “Do I need work experience to sit for the CFA Level 1 exam?” The answer to this question is no! While there are no specific work experience requirements, having relevant experience can help you understand the subjects better.

If you want to consider an alternative to the educational requirement then you may also fulfill the entrance requirements with professional work experience. Professionally qualified 4,000 hours or combining work experience and education over a minimum of 36 months also fulfills the CFA Level 1 requirements. The dates of education and professional work experience cannot coincide in order to meet the combination requirement.

Other Basic Eligibility Requirements for CFA Level 1

Now, let us cover the essentials to ensure you are fully eligible for the CFA Level 1 exam:

- You will need a valid international travel passport for exam registration and identification purposes.

- If you plan to enroll in the program, make sure to submit a completed CFA Institute membership application.

- A good command of English is needed to complete the process and understand complex questions.

- Lastly, you will need to agree to follow the CFA Institute’s ethical and professional standards.

A common question among candidates is about the CFA Level 1 age limit. Well, there is no specific age limit, making this opportunity accessible to everyone. While there is no strict CFA Level 1 age limit, candidates typically start in their early 20s to maximize career growth upon certification.

For national candidates, understanding the eligibility for CFA Level 1 India is crucial for a smooth start to the CFA journey. Ensuring you meet these criteria allows you to focus on preparing for the exam with full confidence.

Latest Guidelines of CFA Level 1 Requirements

The CFA Institute keeps its CFA Level 1 requirements up to date to align with industry standards. The before-mentioned eligibility criteria in this guide are according to the latest guidelines.

However, in 2024 there were some changes in the curriculum CFA Program for Corporate Issuers, Fixed Income, and Alternative Investments. A major change in the curriculum was brought about by the addition of learning modules at the CFA Program Level I. This improved the learning design to better suit the needs of adult learners.

Always check the CFA Institute’s official website for the latest updates on CFA Level 1 eligibility in India and other participating countries. Staying in the loop will help you ensure that you meet all requirements and can focus on what truly matters i.e. your preparation.

How Does Starting CFA Early Preparation Help?

By beginning your CFA preparation early you can get a significant edge. The average hours required for CFA Level 1 preparation is around 300 hours or more as reported by some successful candidates.

An early start on your CFA journey means more time for career advancement, opening doors to roles that offer a strong CFA salary in India. By starting early, you can:

- Break down the vast CFA syllabus into bite-sized pieces.

- Review concepts multiple times to reinforce your understanding.

- Take practice exams to get familiar with the CFA Level 1 pass criteria.

- Identify your weak spots and address them before it’s crunch time.

Keeping the passing criteria for CFA Level 1 in mind while starting your preparation can help set realistic targets, ensuring you are well-prepared to meet the necessary score benchmark. Starting your studies early increases your chances of passing on your first attempt in addition to boosting your confidence. It is worth your effort because the CFA Level 1 pass criteria normally call for a score of at least 70%! Although the number of hours required for CFA Level 1 may seem overwhelming at first, you can effectively manage them with a well-managed study schedule.

Self-Assessment Tips for CFA Level 1

Let’s face it, self-assessment can be intimidating but it is a necessary part of your CFA preparation. Here are some handy tips to help you assess your readiness for the CFA Level 1 exam:

- Eligibility: Confirm eligibility regarding academic qualifications and work experience.

- Practice Questions: Get a hand over practice questions to get a feel for the exam format. The passing criteria for CFA Level 1 generally require candidates to achieve a score of around 70%, making it essential to target this score in your practice exams.

- Mock Exams: By taking mock exams, you can replicate those actual exam conditions. This exercise can help you identify areas that require improvement. This can also help in improving your time management abilities.

- Fee: Make sure that you have a budget planned for your exam fees and study materials.

- Review Feedback: Understanding your mistakes is key to improvement. Never skip this.

- Stay Updated: Keep an eye on any changes regarding CFA Level 1 exam eligibility and requirements to ensure you’re fully prepared.

Tip: Be sure to verify your eligibility for CFA Level 1 in India to avoid any issues during registration. Meeting all criteria upfront lets you focus solely on preparing for the exam.

Conclusion

Passing the criteria for CFA Level 1 is the first step toward earning your CFA charter and a bright future in finance. It is way more than just a checkbox. By carefully understanding the eligibility for CFA Level 1 exam and meeting each requirement, you are setting yourself up to focus fully on what counts i.e. mastering the material. With dedication and clarity, you’ll be prepared not only to pass but to excel in Level 1, bringing you closer to the CFA designation and all the opportunities it offers.

FAQ’s

Can a 12th pass apply for CFA level 1?

You cannot sit directly for the exams as candidates need to be at least in their final year of undergraduate studies or meet other professional requirements. But yes, you can start your CFA preparation by enrolling in one of the best CFA coaching classes like the ones offered here, at edZeb.

Can I take CFA Level 1 before graduation?

Yes, students in the second year of their bachelor’s degree program are eligible to register for CFA Level 1. The exam must be 23 months or fewer before your graduation month.

Who should do CFA Level 1?

CFA Level 1 is ideal for finance professionals, recent graduates, or students aiming for a career in investment management, financial analysis, or related fields.

When can I start my CFA Level 1?

You can start CFA Level 1 once you’re in the second year of your bachelor’s degree or meet equivalent professional or educational eligibility requirements.

What is the minimum educational requirement for CFA Level 1?

The minimum requirement is to be in the last year of a bachelor’s program or have a combination of professional work experience and education.