Are you also struggling to track where your business’s money is going? A cash flow statement holds all the answers for it. A cash flow statement is a vital financial document that tracks the inflow and outflow of cash in a business over a specific period. By the end of this blog, you will know how to prepare, analyze, and use it to make informed financial decisions confidently.

Table of Contents:

What Is a Cash Flow Statement?

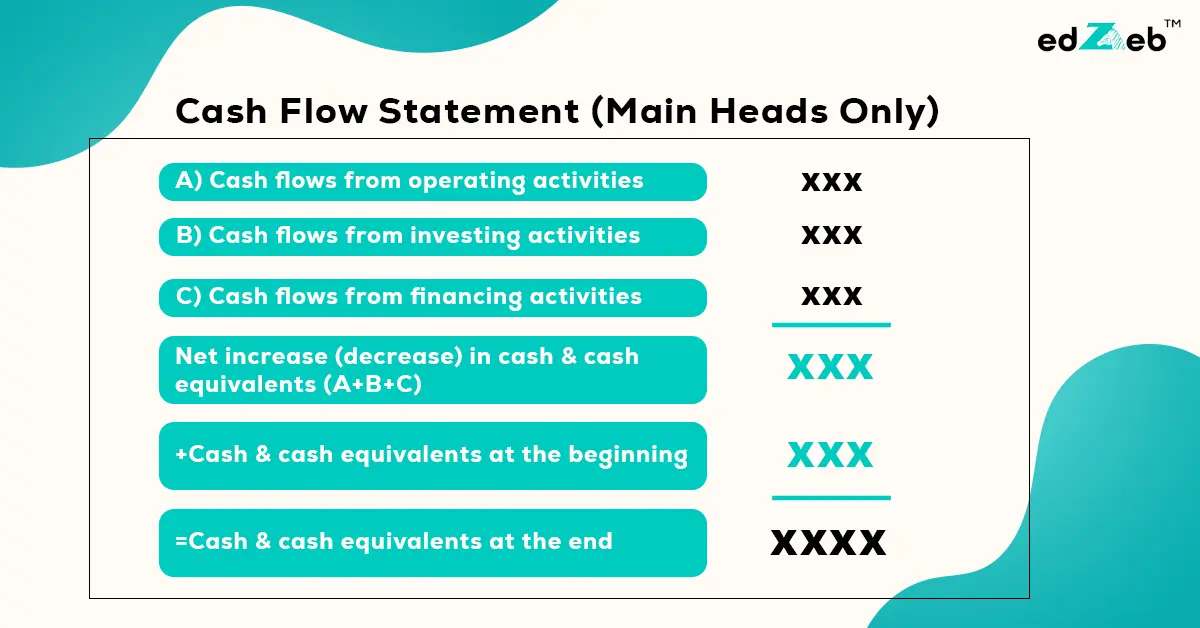

A cash flow statement (CFS) provides a detailed overview of how cash is generated and used in a business. It categorizes cash flows into three main activities: operating, investing, and financing. By analyzing a CFS, businesses can determine their liquidity and ability to cover expenses.

In accounting, what is a cash flow statement? It’s a standard report that accountants use to track cash movements, ensuring that the company operates within its means.

Why is a Cash Flow Statement Important?

A cash flow statement is critical for several reasons:

- Monitors Liquidity: Helps businesses maintain sufficient cash for day-to-day operations.

- Decision-Making: Informs investment and financing decisions based on available cash.

- Financial Health: Provides insights into the company’s ability to generate cash.

Compliance: Often required for financial reporting and audits.

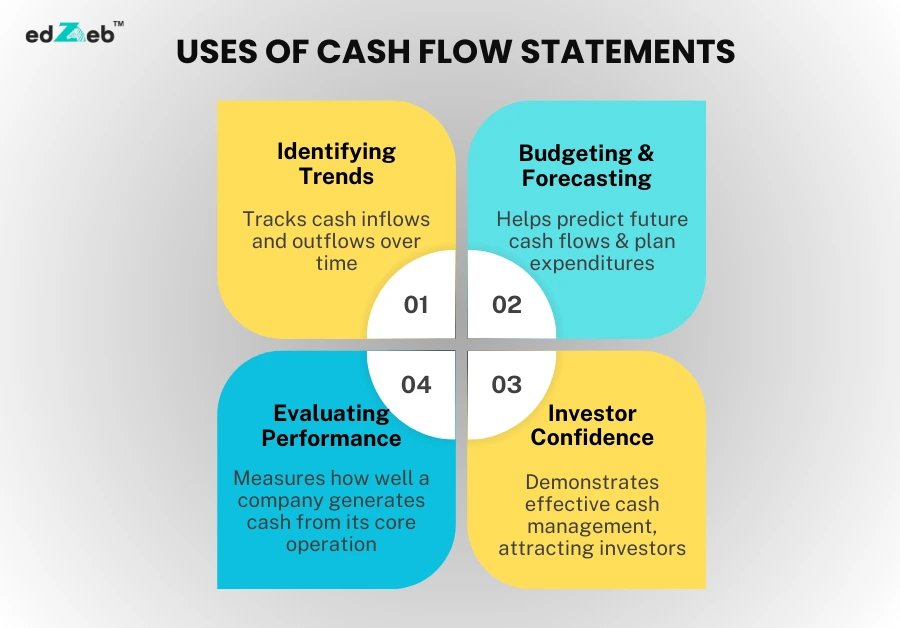

What Are the Uses of Cash Flow Statements?

Understanding what are the uses of cash flow statements is essential for business owners and stakeholders. Key uses include:

How to Prepare a Cash Flow Statement?

Preparing a cash flow statement involves several steps. Follow these guidelines for accuracy:

Collect Data

Gather income statements and balance sheets for the reporting period. Ensure the data is accurate and includes all relevant transactions, such as revenues, expenses, and non-cash items like amortization.

Classify Activities

Divide cash flows into three categories:

- Operating Activities: Include transactions related to the company’s core business operations, such as revenue collection and payment of operating expenses.

- Investing Activities: Record purchases or sales of long-term assets like equipment, property, or investments.

- Financing Activities: Capture activities involving the company’s capital structure, such as issuing shares, repaying loans, or paying dividends.

Calculate Cash Flow

- For Operating Activities, start with net income and adjust for non-cash expenses and changes in working capital (e.g., inventory, receivables, payables).

- For Investing Activities, list cash inflows from asset sales and cash outflows for purchases of new assets.

- For Financing Activities, document cash inflows from loans or equity issuance and outflows for loan repayments or dividend payments.

Reconcile

Verify that the sum of cash flows from all three activities matches the net change in the cash balance from the beginning to the end of the reporting period. If discrepancies arise, recheck the classification and calculations for errors.

Present the Statement

Organize the data into a clear and structured format, typically showing cash flows by activity and ending with the net cash flow.

Understanding how to prepare a cash flow statement is a critical skill for accounting professionals. Accurate preparation not only ensures compliance but also provides valuable insights into a company’s financial performance and sustainability.

How to Read a Cash Flow Statement?

Learning how to read a cash flow statement is equally important as preparing one. Here is the guide which can help you in the same:

- Examine the Operating Activities: This section shows cash generated from regular business operations. Positive cash flow here is a good sign.

- Review Investing Activities: Look for significant expenditures on assets that could indicate growth.

- Analyze Financing Activities: Understand how the company raises and uses funds through loans or equity.

- Assess the Net Cash Flow: The final figure reflects the overall liquidity position of the business.

By understanding how to read a cash flow statement, stakeholders can make informed financial decisions.

What Is the Cash Flow Formula?

The cash flow formula is very simple,

Net Cash Flow = Cash Inflows – Cash Outflows

Also,

- Operating Activities:

Net Income + Non-Cash Expenses (e.g., depreciation) + Changes in Working Capital - Investing Activities:

Cash from Sale of Assets – Purchase of New Assets - Financing Activities:

Cash from Issuing Debt/Equity – Repayment of Loans/Dividends - Total Cash Flow:

Cash Flow from Operations+ Cash Flow from Investing Activities+ Cash Flow from Financing Activities

This formula simplifies understanding how cash is generated and used in a business.

Example of a Cash Flow Statement

Let’s look at an example of a cash flow statement to see how it works:

CATEGORY | DETAILS | AMOUNT (₹) |

Operating Activities | ||

Net Income | Profit after accounting for all expenses | 40,00,000 |

Depreciation | Non-cash expense added back | 2,00,000 |

Changes in Inventory | A decrease in stock levels adds cash | 1,50,000 |

Net Cash (Operating) | Total cash from core business operations | 43,50,000 |

Investing Activities | ||

Purchase of Equipment | Cash spent on acquiring assets | (8,00,000) |

Sale of Investments | Cash received from selling assets | 4,00,000 |

Net Cash (Investing) | Net cash from investing activities | (4,00,000) |

Financing Activities | ||

Loan Repayment | Cash outflow for repaying debts | (15,00,000) |

Issued Equity | Cash inflow from issuing shares | 6,00,000 |

Net Cash (Financing) | Net cash from financing activities | (9,00,000) |

TOTAL CASH FLOW | Overall net cash flow during the period | 30,50,000 |

In this example, the company earned ₹43,50,000 from operations, invested ₹8,00,000 in equipment, and had financing activities resulting in a net outflow of ₹9,00,000. The total cash flow of ₹30,50,000 indicates an increase in cash reserves during the period.

This example of a cash flow statement provides a clear view of how businesses manage cash across different activities and ensures financial stability.

The Bottom Line

A cash flow statement is more than just a financial document—it’s a powerful tool that offers deep insights into the financial health of a business. By understanding what is a cash flow statement in accounting and learning how to prepare, read, and analyze it, you can make informed decisions and ensure liquidity. Whether it’s operating, investing, or financing activities, each component of a cash flow statement provides valuable information about cash movement within the business. Mastering this essential skill can help improve financial management and build a strong foundation for success.

At edZeb, we aim to simplify complex financial concepts and help learners gain practical skills they can apply immediately. So, are you ready to deepen your understanding of financial management? Start applying these insights today, and take the first step toward mastering your business finances!

FAQ’s

What are the 3 types of cash flow statements?

Operating Activities: Cash flows from core business operations.

Investing Activities: Transactions involving assets and investments.

Financing Activities: Movements related to loans, equity, and dividends.

What does a negative cash flow from financing mean?

A negative cash flow from financing indicates that the business is repaying more debt or distributing dividends than it’s raising through loans or equity.

How is cash flow calculated?

Cash flow is calculated using the formula: Net Cash Flow = Cash Inflows - Cash Outflows.

This involves summing cash activities across operating, investing, and financing categories.