In today’s competitive job market, it is highly appreciated to possess industry-required knowledge and skills by pursuing various certifications. However, possessing dual certifications not only sharpens your skills but also infuses a distinct edge, making you more adaptable and versatile in your career. Likewise pursuing ACCA after CA is a smart move that broadens your expertise and opens up global opportunities. Doing ACCA after CA also helps in enhancing your professional credentials and marketability.

Table of Contents:

About ACCA

If you are looking to work globally, then ACCA certification can enable vast career opportunities across 180+ countries. It equips you with comprehensive knowledge in accounting, finance, and management and anyone after passing higher secondary can start their ACCA journey, thus letting you get an early career advantage. Professionals possessing the certification earn significantly more than their peers.

About CA

The CA (Chartered Accountancy) program is a prestigious professional qualification in accounting. It offers in-depth expertise in auditing, taxation, and financial management. It prepares you for high-level roles in finance and business, with a strong emphasis on ethics, analytical skills, and regulatory compliance.

Is It Worth Doing ACCA After CA

Compared to ACCA, which has a passing percentage of 40–50%, the CA has a passing percentage of 4-5%, making it more in demand. It is always worthwhile to do ACCA following CA. You would get new abilities and gain recognition on a worldwide scale as a result. You would have several opportunities as a result. Taking into account your nine exemptions, you will need to pass four exams.

ACCA, a globally recognized qualification, offers numerous job opportunities in India and abroad. Many multinational companies and global consulting firms have offices in India, and many Indian companies have global operations.

To achieve global competitiveness, ACCA has a dedicated job portal with over 7300+ approved employers, offering thousands of job listings across various sectors like public practice, banking, financial services, defense, digital, education, and healthcare. The portal is an invaluable resource for those pursuing the ACCA Course, helping users find internships and job placements, and allowing them to browse job roles and sectors based on country, role, and sector. This helps individuals achieve global competitiveness and find the right career path for their future.

ACCA Exemptions for CA Foundation Level Students

ACCA exempts CA students from studying repeated subjects to avoid wastage of students’ efforts. However, there are no ACCA exemptions for CA students in the foundation level and they have to pass all the 13 ACCA exams to get ACCA certification.

Applied Knowledge Level:

Business and technology (BT)

Management Accounting (MA)

Financial Accounting (FA)

Applied Skill Level:

Corporate and Business Law (LW)

Performance Management (PM)

Taxation (TX)

Financial Reporting (FR)

Audit and Assurance (AA)

Financial Management (FM)

Strategic Professional Level:

Strategic Business Reporting (SBR)

Strategic Business Leader (SBL)

Advanced Financial Management (AFM)

Advanced Performance Management (APM)

Advanced Taxation (ATX)

Advanced Audit and Assurance (AAA)

ACCA Exemption for CA Inter (CA IPCC)

Students who have passed the CA Inter are qualified for the following ACCA exemptions from six papers (three papers each from the knowledge and skill level):

Applied Knowledge Level:

Business and technology (BT)

Management Accounting (MA)

Financial Accounting (FA)

Applied Skill Level:

Corporate and Business Law (LW)

Taxation (TX)

Audit and Assurance (AA)

After availing the exemption, students would need to clear the remaining 7 papers, 3 papers under skill level and 4 papers under professional level.

ACCA Exemption for CA with Experience

These students meet the ACCA qualifying requirements and can be exempted from nine examinations, including three knowledge and six skills-level papers.

Applied Knowledge Level:

Business and technology (BT)

Management Accounting (MA)

Financial Accounting (FA)

Applied Skill Level:

Corporate and Business Law (LW)

Financial Management (FM)

Financial Reporting (FR)

Performance Management (PM)

Taxation (TX)

Audit and Assurance (AA)

After availing of these 9 ACCA exemptions for CA, students would need to clear the remaining 4 papers under the professional level.

ACCA After CA Fees

The ACCA after CA cost depends on the ACCA paper exemptions, you just need to add up each ACCA paper’s fee. To illustrate ACCA after CA Fees, let us consider you have completed the CA Inter and are qualified for six ACCA exemptions, apart from that you have to appear for the remaining 7 papers, 3 papers under skill level and 4 papers under professional level. Let us see the ACCA after CA fees so that you can calculate fees accordingly,

ACCA Exemption Fee

Knowledge Level per paper: £84

Skills Level per paper: £111

ACCA Exam Fees

Each Applied Skill Level Paper costs: £143

Each Strategic Professional Level Paper costs: £252

Ethics and Professional Skills Module costs: £79

Coaching Fee:

(Note: subject to different institutes in the market)

Total Cost:

add all the costs listed above after multiplying them with the exact number of exams as the cost given is per exam.

Following this way, you can calculate the exact amount of ACCA after CA cost to invest in gaining the certification, and while doing that do not forget to add the ACCA registration cost of £30 along with its annual subscription fee of £134, which is due each year to keep your student status active.

ACCA After CA Salary

The demand for ACCA professionals has surged among the top MNCs in India as they offer consulting, taxation, audit, and advisory services. However, having a CA with an ACCA certification, not only opens wider horizons in the job market across countries but also leads to more job stability and eligibility for senior finance roles.

Therefore, the average ACCA after CA salary for professionals with both credentials is significantly higher compared to ACCA alone which typically is a 20–25% hike. Otherwise, this ACCA after CA salary prospect is influenced by various factors, including experience, job title, organization, industry, and location, which influence salary levels. To get a comprehensive understanding of the ACCA Salary in India, you can also read our detailed blog that explores the salary trends and what impacts them.

ACCA After CA Duration

The ACCA course duration after CA differs as per the number of exams exempted for the CA students. The ACCA exams are conducted at regular intervals within a year.

Applied Knowledge Level Exams can be taken anytime by the ACCA aspirants whereas the Applied Skill Level and Strategic Professional level exams are conducted once after every quarter in the months of March, June, September, and December. So the ACCA course duration after CA differs.

ACCA can be completed within 3 years, however, ACCA after CA duration is around 1 to 1.5 years to pass their ACCA exams. The ACCA paper exemptions given to CA students result in accelerating the ACCA journey consuming less time in gaining the certification.

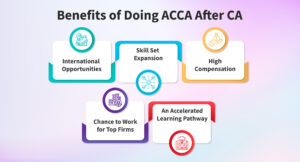

Benefits of Doing ACCA After CA

Without any doubt, dual qualifications provide an edge over peers having a single qualification, so pursuing ACCA after CA provides significant advantages.

International Opportunities

ACCA is an internationally recognized accounting and finance certification. Due to this professionals find relevant job roles in developed and developing nations like the UK, UAE, and Singapore. However, CA is limited to India and allows candidates to work within Indian firms.

Skill Set Expansion

ACCA after CA enhances an individual’s expertise in some of the finance domains like global taxation laws, forensic auditing, corporate regulations, financial derivatives, investment appraisals, and ESG aspects, making individuals with dual certifications valuable assets for organizations.

High Compensation

No doubt ACCA and CA have a handsome salary package but comparing it to the dual degree route is nothing like earning almost 50% higher than the professionals with a single qualification.

Chance to Work for Top Firms

CAs can function in a variety of countries because ACCA is widely recognized and explores overseas job opportunities with MNCs, including BIG 4.

An Accelerated Learning Pathway

CA students get exempted from many ACCA papers and that is how pursuing ACCA after CA accelerates the learning pathway taking approximately a year or two to pass the rest of the ACCA exams.

Is ACCA qualification and CA a good combination?

Having a dual degree is always beneficial and combining ACCA with CA is definitely a good combination, as both of them are most respected professional certifications in finance and accountancy. When you combine the two credentials, you build a powerful professional brand and acquire a marketable skill set that is well-rounded.

Moreover, it also depicts your strong commitment to learning. Pursuing ACCA after CA improves your ongoing education and career prospects compared to possessing a single qualification which can improve your accounting, auditing, and taxation if you do CA or financial management, performance management, and corporate reporting in the case of ACCA.

Consequently, an ACCA qualification combined with a CA helps you understand international accounting standards and practices. In return, making you more employable across borders, so doing ACCA after CA is a fantastic combination.

Conclusion

In the end, it can be said that pursuing ACCA after CA is a smart move because it lets you enhance your career prospects. Doing ACCA after CA will improve your understanding of international accounting standards and financial management, increasing your chances of employability in the finance industry.

FAQs

Who earns more, ACCA or CA?

Freshers in ACCA and CA can earn ₹6-8 lakhs annually, while CA members earn ₹6-7 lakhs and ACCA members have better scope so their earning potential is more than the CAs ₹4-10 lakhs and more.

Is CA and ACCA a good combination?

A Chartered Accountancy (CA) and Association of Certified Chartered Accountants (ACCA) qualification complement each other. It is a good combination because it strengthens the professional profiles. CA focuses on accounting, auditing, and taxation, while ACCA concentrates on financial management, performance management, and corporate reporting.

How long will it take to complete ACCA after CA?

The CA professionals get ACCA exam exemption so based on those exemptions, they may take a year or two to appear for the rest of the ACCA papers.

Can CA apply for ACCA?

Chartered Accountants can apply for the Association of Chartered Certified Accountants (ACCA) qualification anytime, equipping them with additional skills like leadership management, strategy development, and communication, complementing the CA course.