Most students and professionals seeking a career in ACCA or the financial and accounting industry often find themselves struggling between ACCA vs CA. No doubt, choosing one over the other is a topic of significant confusion. See for a fact, you must agree that both ACCA and CA are prestigious courses following unique paths that lead to similar job profiles.

Here at edZeb, we would like to take this opportunity and delve deeper into the intricacies of both the courses and their various aspects to help you decide: CA vs ACCA which is better for your interest.

Table of Contents:

- What is ACCA?

- What is CA?

- Difference Between ACCA and CA

- Eligibility and Educational Requirements for ACCA and CA

- ACCA vs CA Exam Structure and Content

- Duration and Flexibility

- CA vs ACCA Salary

- Career Opportunities and Specializations

- ACCA vs. CA Difficulty

- Cost and Investment

- Conclusion

- Frequently Asked Questions

What is ACCA?

ACCA is abbreviated for Association of Chartered Certified Accountants. It is the oldest and most credible global professional accounting body. So, what is ACCA certification? With the growing scope of ACCA in India, it is a comprehensive affiliation that mostly focuses on the application of your previously gained knowledge in the business domain. To become an ACCA affiliate, the candidate has to pass all 13 subjects falling under 3 levels (Applied Knowledge Level, Applied Skills Level and Strategic Professional Level). It would take at max 3 years to complete depending upon the exemptions granted to the students, it may take less time than that as well.

It is an understanding-based course that brings conceptual information to real life. It is fundamentally aimed to enhance key skills valued by the corporates such as Business acumen, Problem-solving, Critical Thinking and Storytelling.

What is CA?

So, to shed light on the question, what is CA? CA (Chartered Accountants) are certified by the Institute of Chartered Accountants of India (ICAI). They are highly sought-after professionals in India and the Middle East. Following a rigid pattern of examination, it may take around 5 years to complete the course (including 36 months of experience) which is divided into 3 levels, foundation Level, CA inter and final.

Students pursuing a chartered accountancy must appear for at least one group’s Inter and Final exams (including all papers within that group). In general, students perceive this to be somewhat rigorous. Therefore, the candidates not only have to demonstrate their academic knowledge but also time management.

Difference Between ACCA and CA

We have compiled a comprehensive Chartered Accountant vs ACCA qualifications to help you make an informed decision. The table here outlines the main difference between ACCA and CA, covering various aspects like course structure, flexibility, curriculum focus, and more.

| Aspect | ACCA | CA |

| Qualification Body | Association of Chartered Certified Accountants (UK-based) | National bodies (e.g., ICAI in India, ICAEW in the UK) |

| Course Structure | 13 exams (Applied Knowledge, Applied Skills, Strategic Professional) | Multiple stages (foundation, intermediate, final exams) + Ethics and professional skills module |

| Work Experience | 3 years of practical experience | Extensive practical training (2.5 to 3 years) |

| Flexibility | More flexible in exam scheduling and study pace | Structured with set exam schedules |

| Duration | Typically 3-4 years | Typically 3-5 years |

| Curriculum Focus | International standards (financial, management accounting, etc.) | National standards (financial accounting, taxation, corporate laws) |

| Career Opportunities | International roles (financial analyst, management accountant) | National roles (financial auditor, tax consultant, corporate advisor) |

CA And ACCA Eligibility Criteria With Educational Requirements

Before learning about the specifics of both the courses including ACCA salary, CA salary, ACCA vs CA difficulty level, the cost incurred, and job prospects, you should be aware of ACCA eligibility criteria along with CA course eligibility, to pursue any of these esteemed accounting certificates.

| Aspect | ACCA | CA |

| Educational Requirements | The ACCA eligibility criteria is a minimum of three GCSEs and two A Levels (or equivalent) or it can continued after passing your metric | Chartered Accountant course eligibility is the completion of 10+2 or equivalent for foundation-level |

| Graduate entry with possible exemptions | for intermediate-level Chartered Accountant course eligibility is a Bachelor’s degree with possible exemptions |

ACCA Course Eligibility Criteria

It is a course that can be pursued by anyone who is studying or a professional aspiring to build a career in finance and accounting with flexible entry points based on prior academic background, qualification, and experience. Other than that ACCA Course Eligibility Criteria is also

- 10th Pass Out

- 12th Pass Out from any stream

- Graduate & Post Graduate

- CA Intermediate

- CA, CMA (5+ Years Experience)

*Note: The ACCA students can get up to 9 paper exemptions depending on their prior knowledge and expertise.

CA Course Eligibility

Generally speaking, students can begin CA after class 12. The Chartered Accountant course eligibility to enter into the foundation level is passing +2 with an aggregate of 55% from a recognized board of examination. But for ACCA, you can begin immediately following the tenth class. Thus, you can start with a two-year advantage. Accordingly, it is referred to as “The First Mover Advantage” in the business lexicon.

*Note: CA students will only be at the foundation level and can be exempted based on their prior knowledge and expertise.

ACCA vs CA Exam Structure and Content

ACCA vs CA difficulty is quite possibly based on the ACCA exam structure which differs from that of CA, as these exams are conducted and recognized by two different organizations. Let us quickly go through the syllabus and the structure of exams to decide on which course to pursue.

| Aspect | ACCA | CA |

| Exam Levels | Applied Knowledge, Applied Skills, Strategic Professional | Foundation, Intermediate, Final |

| Core Subjects | Financial Accounting, Management Accounting, Taxation, Audit, Law | Accounting, Corporate Laws, Cost Accounting, Taxation, Auditing |

| Advanced Subjects | Strategic Business Reporting, Strategic Business Leader, Options | Advanced Accounting, Strategic Financial Management, Electives |

| Professional Skills | Ethics and Professional Skills Module | Advanced Auditing and Professional Ethics |

| Practical Training | 36 months of relevant work experience | 2.5 to 3 years of articleship |

ACCA Exam Structure And Content

Based on your prior academic qualifications, if you are pursuing ACCA after graduation, CA Inter, M.com etc. candidates can get up to 9 exemptions. And they must pass the remaining subjects of ACCA Course listed in three different levels. So, based on the number of exemptions, you would be able to further expedite your journey to complete ACCA faster.

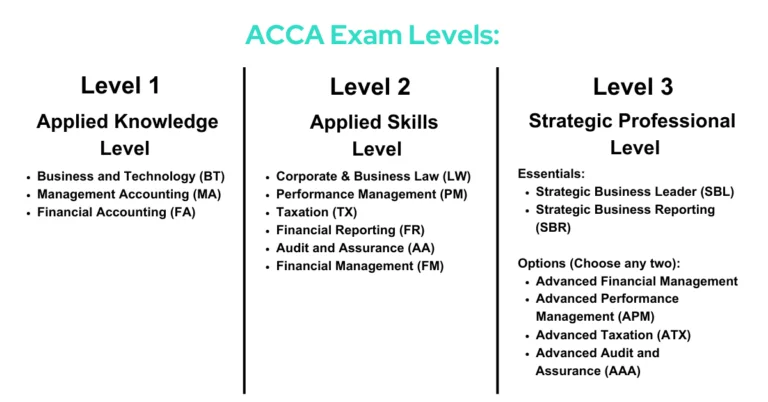

Exam Levels:

Level 1: Applied Knowledge Level

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

Level 2: Applied Skills Level

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

Level 3: Strategic Professional Level

- Essentials:

Strategic Business Leader (SBL)Strategic Business Reporting (SBR) - Options (Choose any two):

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance (AAA)

Practical Experience Requirement (PER):

36 months of relevant work experience. After clearing each level of the ACCA exam, students are awarded certificates, making them more acceptable in the job market for internships and jobs. These certificates include a Diploma in Accounting and Business, an Advanced Diploma in Accounting and Business, and a Strategic Professional Certificate (subject to specific conditions).

ACCA Exam Format:

- Applied Knowledge Exams are computer-based exams, and each one is typically 2 hours long. All objective-type questions.

- Applied Skills Exams can be either computer-based or paper-based, depending on the location. They are typically 3 hours long, with an additional 15 minutes for reading and planning. It includes both objective as well as subjective type questions.

- Strategic Professional Exams are 3 hours and 15 minutes long. The Strategic Business Leader (SBL) exam is an integrated case study, while the other exams involve a mix of computational and written questions.

CA Exam Structure And Content

The CA exam structure in India is divided into three levels: CA Foundation, CA Intermediate, and CA Final. Each level has its own set of subjects and examination patterns.

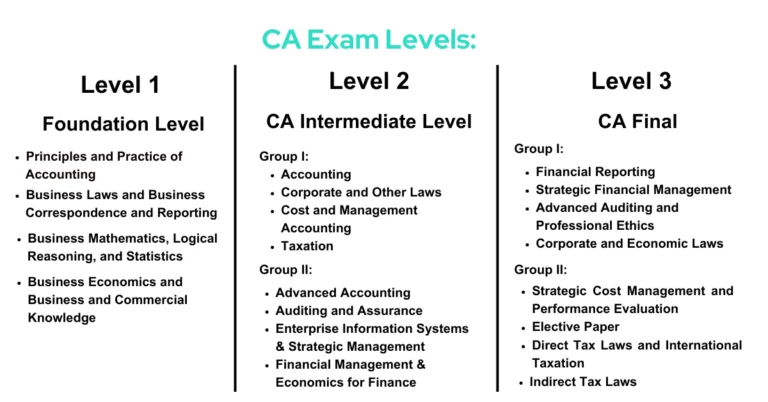

Level 1: CA Foundation Level

It consists of four papers, each of which is worth 100 marks.

1. Principles and Practice of Accounting

2. Business Laws and Business Correspondence and Reporting

- Business Laws

- Business Correspondence and Reporting

3. Business Mathematics, Logical Reasoning, and Statistics

4. Business Economics and Business and Commercial Knowledge

- Business Economics

- Business and Commercial Knowledge

Level 2: CA Intermediate Level

The graduates and postgraduates can directly enter to CA inter-level. It consists of two groups, each containing four papers and each paper is worth 100 marks.

Group I:

1. Accounting

2. Corporate and Other Laws

- Company Law

- Other Laws

3. Cost and Management Accounting

4. Taxation

- Income Tax Law

- Indirect Taxes

Group II:

1. Advanced Accounting

2. Auditing and Assurance

3. Enterprise Information Systems &

4. Strategic Management

- Enterprise Information Systems

- Strategic Management

5. Financial Management & Economics for Finance

- Financial Management

- Economics for Finance

Level 3: CA Final

Candidates can appear for the Final exams only after completing the required practical training (articleship). The Final level consists of two groups, each containing four papers and each paper is worth 100 marks.

Group I:

1. Financial Reporting

2. Strategic Financial Management

3. Advanced Auditing and Professional Ethics

4. Corporate and Economic Laws

- Corporate Laws

- Economic Laws

Group II:

1. Strategic Cost Management and Performance Evaluation

2. Elective Paper (One of the following)

- Risk Management

- Financial Services and Capital Markets

- International Taxation

- Economic Laws

- Global Financial Reporting Standards

- Multidisciplinary Case Study

3. Direct Tax Laws and International Taxation

- Direct Tax Laws

- International Taxation

4. Indirect Tax Laws

- Goods and Services Tax (GST)

- Customs and FTP

Practical Training:

Chartered Accountant (vs ACCA) has to attend a three-year CA practical training which is commonly known as articleship. It must be completed under a practicing CA after clearing either one or both groups of the CA Intermediate. Candidates must pass each exam with a minimum of 40% marks in each paper and an aggregate of 50% in each group to qualify for the next level or to be declared successful at the Final level.

Duration and Flexibility: ACCA vs CA

ACCA qualification is comparatively more flexible than CA and obviously, the duration of both exams varies as the curriculum.

| Aspect | ACCA | CA (India) |

| Minimum Duration | 2-3 years (with exemptions for relevant degrees) | 4.5 years (Foundation route), 3 years (Direct Entry) |

| Group Flexibility | Exams can be taken one at a time, in any order after prerequisites are met | Exams can be taken one group at a time or both groups together |

| Study Period | No fixed study period; students can choose the pace and order of exams | Fixed study periods: 4 months (Foundation), 8 months (Intermediate), and integrated with articleship (Final) |

| Practical Experience Requirement | 3 years, can be completed before, during, or after exams | 3 years of articleship under a practicing CA |

| Attempt Flexibility | No limit on the number of attempts | No limit on the number of attempts |

| Breaks in Studies | Flexible; students can take breaks between exams | Flexible; students can take breaks between levels, but re-registration may be required |

Comparative Evaluation

ACCA can be completed in 2 to 3 years and ACCA offers students high-level flexibility in choosing their exam subjects, with timelines for each level (Knowledge, Skill, and Professional) and the order in which they want to appear. Students can book and appear for exams on demand in the applied knowledge level, whereas in Level 2 and Level 3 exams occur once every quarter (March, June, September, and December). This reduces pressure and burden on students, allowing them to concentrate better and pass their exams.

However, it would take a student at least five years to earn the CA credential, which includes training for an articleship. Graduates and postgraduates are exempt from the CA foundation level, which could boost their rate of CA completion.

CA vs ACCA Salary

Let us see the CA salary package in India and the ACCA salary of affiliates globally.

| Aspect | CA (India) | ACCA |

| Starting Salary | INR 6-8 lakhs per annum (USD 8,000-10,500) | GBP 25,000-30,000 per annum (USD 32,000-38,000) |

| Mid-Level Salary | INR 12-20 lakhs per annum (USD 16,000-27,000) | GBP 40,000-60,000 per annum (USD 51,000-76,000) |

| Senior-Level Salary | INR 25-50 lakhs per annum (USD 33,000-67,000) | GBP 70,000-100,000+ per annum (USD 89,000-127,000+) |

| Top Positions | Chief Financial Officer, Finance Director, Partner | Chief Financial Officer, Finance Director, Partner |

| Influence of Location | Higher salaries in metropolitan cities like Mumbai, Delhi | Higher salaries in financial hubs like London, Singapore |

Comparative Evaluation

CA salary packages in India vary based on city, industry, and individual skills. CAs with Big Four firms or metropolitan areas earn higher salaries. However, ACCA salary packages reflect global recognition, with opportunities in numerous countries, with higher salaries in developed countries and financial hubs. So, the CA vs ACCA salary has a significant difference.

Career Opportunities and Specializations: ACCA vs CA

The given table provides a general overview of some of the specialized options for career in ACCA for the affiliation holders.

| Specialization | ACCA | CA (India) |

| Focus | International | Indian |

| Ideal for | Working in MNCs, international firms | Working in Indian companies, public sector |

| Common Specializations | Audit & Assurance, Financial Management, International Tax | Direct Tax, Indirect Tax, Statutory Audit |

| Job Roles | Tax Advisor, Management Accountant, Financial Analyst, CFO. | Chartered Accountant, Audit Manager, Tax Consultant, Financial Controller, Business Advisor. |

Comparative Evaluation

ACCA provides global exposure through a variety of international work options across sectors. On the contrary, a CA certification offers a solid platform for prominent positions inside the nation of certification, with the possibility of expanding internationally with further training.

ACCA vs. CA Difficulty

Comparatively, Difficulty level of ACCA is relatively easy to crack due to the exam pattern, structure and flexibility of the course and on top of that ACCA course eligibility is 10th pass. Students seeking early career start can pursue ACCA at a very young age compared to Chartered Accountant course eligibility.

CA’s difficulty level is due to its rigid structure. The main reason being CA candidates devote at least five years to their studies, put in a great deal of hard work, practice countless questions, go through multiple review cycles, and control their stress.

| Aspect | ACCA | CA |

| Difficulty | Generally considered easier | Generally considered harder |

| Reasons for Difficulty | Fewer papers, shorter duration, individual subject exams | More papers, longer duration, specific exam groups |

| Passing Rate | Higher | Lower |

| Global Recognition | Wide (180+ countries) | Limited (primarily country of certification) |

| Career Prospects | More international opportunities | Strong in the country of certification |

| Exam Flexibility | High – retake only the failed subject | Limited – retake the entire group if you fail a subject |

Comparative Evaluation

Chartered Accountant vs ACCA, both are equally challenging accounting courses, with ACCA being more extensive and self-guided, and CA being more country-specific and structured. But the choice is based on individual career goals, learning preferences, and professional aspirations, rather than perceived difficulty.

Cost and Investment

You will feel that the affiliation cost is expensive but in reality, it is an investment for your future.

| Qualification | ACCA | CA |

| Costs Involved | The costs vary depending on exemptions, location and mode of study. | Costs depend on the country, exam attempts, and mode of study. |

| Benefits and ROI | High global recognition worldwide, career mobility and potential for higher salaries, particularly in international roles and senior positions. | CA certification offers significant ROI in highly valued countries, leading to high-profile roles in accounting and finance with strong long-term prospects and salary benefits. |

Comparative Analysis

To finish your CA, you must invest roughly 2.5–3 lakhs, but a 3.5–4 lakh is invested for ACCA over 2.5–3 years. Since ACCA candidates complete their qualifications at least two years ahead of time and begin earning income two years earlier, they can recover their costs and start being financially independent two years sooner than a CA would.

Conclusion

Here the discussion on ACCA vs CA comes to an end. Choosing between them depends on an individual’s career goals. ACCA is ideal for international careers with its global recognition and flexible exam structure. However, CA favours a strong focus on Indian accounting standards and opportunities in the Indian market. So, before selecting a course consider your learning style and desired work location to make the best choice because both qualifications.

FAQ’s

Is ACCA tougher than CA or Is ACCA easier than CA?

To be frank, ACCA is easier as it gets completed in less than 3 years and its exam structure and pattern is more flexible than CA. ACCA candidates get The First Mover Advantage whereas Chartered Accountant course eligibility is +2 passouts and it takes a rigorous 5 years to complete.

What is the pass rate difference between CA and ACCA?

The passing rate for students pursuing a CA is relatively low—between 5 and 10%. However, based on the various levels, this might be a little higher. The global passing percentage for ACCA is 40%, meaning that 40 out of 100 students are probably going to pass the exam. The passing rate at edZeb ranges from 75 to 80%. Hence, 75–80 pupils out of a class of 100 would pass the ACCA.

CA vs ACCA Which is Better for Your Career?

ACCA is globally recognised so, it will increase its scope of employability across various industries but CA affiliation is restricted to national boundaries. Now it is up to the individual to decide on ACCA vs CA: Which is Better for Your Career? based on your interest, future prospects etc.

Is ACCA tougher than CA or Is ACCA easier than CA?

To be frank, ACCA is easier as it gets completed in less than 3 years and its exam structure and pattern is more flexible than CA. ACCA candidates get The First Mover Advantage whereas Chartered Accountant course eligibility is +2 passouts and it takes a rigorous 5 years to complete.

What is the pass rate difference between CA and ACCA?

The passing rate for students pursuing a CA is relatively low—between 5 and 10%. However, based on the various levels, this might be a little higher. The global passing percentage for ACCA is 40%, meaning that 40 out of 100 students are probably going to pass the exam. The passing rate at edZeb ranges from 75 to 80%. Hence, 75–80 pupils out of a class of 100 would pass the ACCA.

CA vs ACCA Which is Better for Your Career?

ACCA is globally recognised so, it will increase its scope of employability across various industries but CA affiliation is restricted to national boundaries. Now it is up to the individual to decide on ACCA vs CA: Which is Better for Your Career? based on your interest, future prospects etc.