If you’ve ever asked yourself, Is CFA worth it?. The consistent demand for CFA charterholders across global finance roles speaks for itself. The Chartered Financial Analyst (CFA) program is a globally recognized certification that offers top-notch skills in investment analysis, portfolio management, and financial decision-making. It is a valuable asset for college students pursuing a career in finance, as it equips them with the necessary skills for success in investment banking, asset management, and any finance-related field.

For professionals considering a career boost, pursuing CFA after MBA or CFA after CA can significantly enhance your expertise and open up higher-level opportunities in finance. Although challenging and requiring significant preparation and dedication, the CFA program is a valuable asset for those interested in pursuing a career in finance.

So in this blog, we will discuss the CFA course eligibility criteria, and how early you can start preparing for your CFA exam.

Table of Contents:

Understanding CFA Eligibility Criteria

Understanding the CFA duration gives you clarity on how to pace your preparation across all three levels. Along with it, if you want to enroll in any program, a certain level of understanding and knowledge is required.

So be informed of the CFA eligibility criteria described below in detail.

CFA Level 1 Eligibility

Graduates

Complete a bachelor’s program or equivalent from a college/university, ensuring it is comparable to the desired program.

Undergraduates

Chartered Financial Analyst Institute has increased the eligibility for CFA, so students with two years left in their undergraduate education will be able to appear for the Level 1 exam.

Professional Experience

Applicants are required to have a minimum of 4,000 hours of work experience and/or 3 continuous years of higher education without overlap between education dates and professional work experience. The case of higher education should take 1,000 hours per year. Your professional work experience does not have to be investment-related, but internships/articleships are accepted if paid. Last but not least, the work experience with a family-owned business also qualifies CFA Level 1 eligibility criteria only if it is paid for.

International Passport

All CFA Program candidates must have a valid international travel passport to sit for the exam.

Language Proficiency

The CFA Program exams are exclusively conducted in English, so it is necessary to have sound knowledge of the English language to read comprehension and formulate complex financial scenarios.

Participation Country Resident

CFA Institute may not operate in certain countries, so it’s recommended to review the OFAC policy to check if your country is subject to any sanctions.

CFA Level 2 Eligibility

You can sit for the CFA Level 2 exam after passing CFA Level 1 and completing your graduation.

To sit for the Level II exam, you must be within 11 months of graduation, you must have completed your bachelor’s degree or have 4,000 hours of professional work experience, and you must be 23 months or fewer before your graduation month.

CFA Level 3 Eligibility

Levels 1 and 2 of the CFA should have been completed before registering for the CFA Level 3 exam.

Why Did The CFA Institute Make This Amendment?

The CFA Institute has announced significant improvements to its CFA Program, aiming to prepare future investment professionals for successful careers and provide the industry with well-trained, ethical professionals, as part of its ongoing efforts to evolve the program.

The six amendments are as follows:

First Amendment

The CFA Program will introduce self-contained digital practical skills modules to teach candidates on-the-job, practical applications. The initial modules include Financial Modelling for Level I, Analyst Skills at Level II, Python Programming Fundamentals, and Python, Data Science and Artificial Intelligence for Level II. Additional modules are in development for Level III for the 2025 exam series. Starting in 2024, at least one practical skills module must be completed for each level.

Second Amendment

Starting in 2025, Level III will introduce specialized pathways, with a common core of study for all three. Candidates can choose from Portfolio Management, Private Wealth, or Private Markets, each rigorously pursuing the CFA charter, a credential for the traditional version of Level III.

Third Amendment

The CFA Program is implementing an improved digital badging strategy to highlight the importance of Level I and Level II achievements to candidates, as it is believed that formal acknowledgement of these achievements would be beneficial in their search for internships and full-time positions.

Fourth Amendment

The CFA Program is reducing the volume of study materials at each Level to maintain a 300-hour preparation time for each exam. Research indicates that today’s candidates spend over 300 hours on each level. Best instructional design practices are being implemented to ensure efficient, accessible, and relevant content while maintaining the program’s rigor and value-add. Some introductory content from undergraduate studies will remain available in preparatory materials but not be tested on exams.

Fifth Amendment

Level I candidates can purchase the CFA Program Practice Pack, which includes 1000 new practice questions and six additional Level I mock exams, starting May 2024. Currently, candidates can access two mock exams at no extra cost eight weeks before their exam window. The CFA Institute has identified a high demand for more mock exams and practice questions.

Sixth Amendment

The Level I eligibility for CFA Exam has been extended by a year to individuals two years away from completing their undergraduate degree, as announced on November 16, 2022.

Chartered Financial Analyst Eligibility in India

Understanding the requirements of the affiliation to make sure you fulfill the following CFA eligibility criteria.

CFA Level 1 Eligibility Criteria in India

Make sure you fulfill all the requirements discussed above for CFA level 1, but what’s unique for CFA participants in India is that they can appear for Level 1 in their final year of a Bachelor’s program.

Requirements of CFA Level 2 & 3 in India

For CFA Level 2 you must have a graduation degree or equivalent and a CFA Level 1 pass and after passing Level 2, you can register for CFA Level 3. So the requirement criteria for Indian and International students remain the same here.

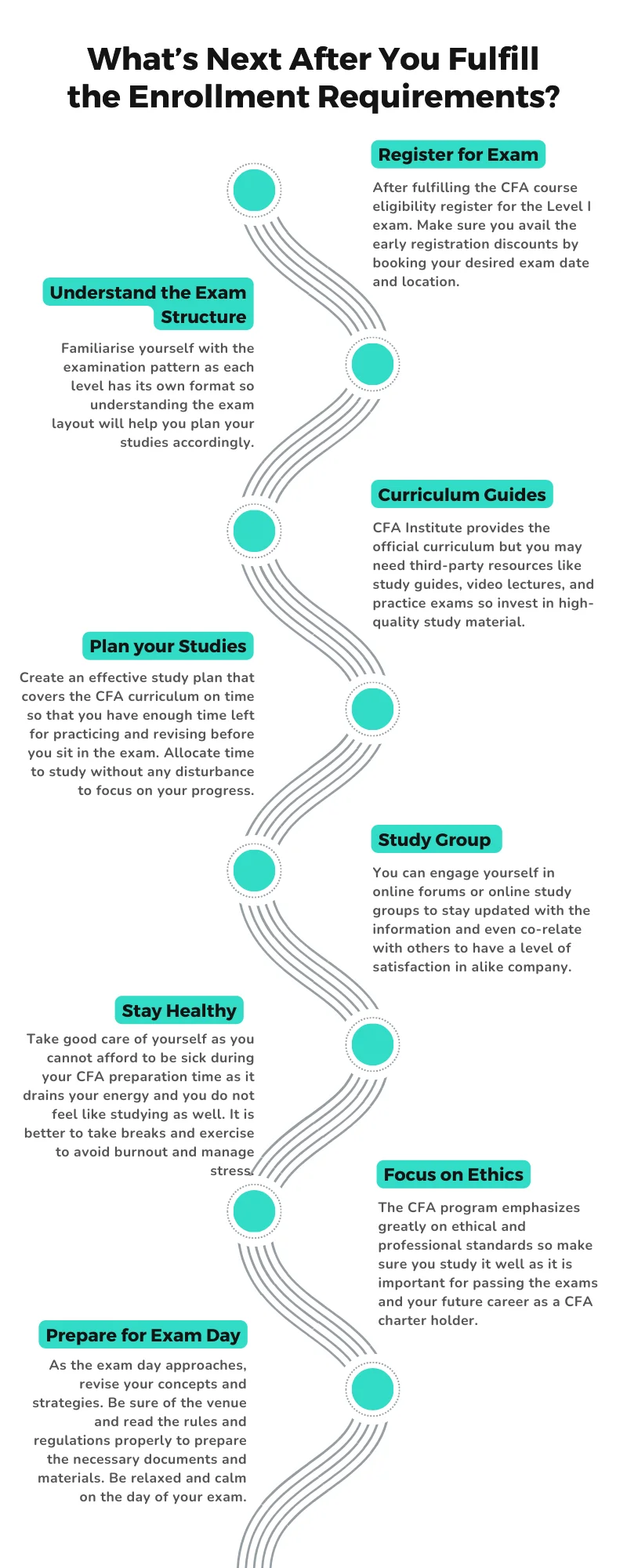

What’s Next After You Fulfill the Enrollment Requirements?

To stay on track and maximize your chances of success, it’s essential to follow a well-structured CFA Roadmap. This roadmap helps you navigate through each exam level with clarity, right from preparation to final certification.

After fulfilling the Chartered Financial Analyst eligibility criteria, the next step is to register yourself and you will be on your way to becoming a Chartered Financial Analyst.

Register for Exam

After fulfilling the CFA course eligibility register for the Level I exam. Make sure you avail the early registration discounts by booking your desired exam date and location.

Understand the Exam Structure

Familiarise yourself with the examination pattern as each level has its own format so understanding the exam layout will help you plan your studies accordingly.

Study Material

CFA Institute provides the official curriculum but you may need third-party resources like study guides, video lectures, and practice exams so invest in high-quality study material.

Plan your Studies

Create an effective study plan that covers the CFA curriculum on time so that you have enough time left for practising and revising before you sit in the exam. Allocate time to study without any disturbance to focus on your progress.

Study Group

You can engage yourself in online forums or online study groups to stay updated with the information and even co-relate with others to have a level of satisfaction in alike company.

Stay Healthy

Take good care of yourself as you cannot afford to be sick during your CFA preparation time as it drains your energy and you do not feel like studying as well. You lose all your focus and rhythm of study. It is better to take breaks and exercise to avoid burnout and manage stress.

Focus on Ethics

The CFA program emphasizes greatly on ethical and professional standards so make sure you study it well as it is important for passing the exams and your future career as a CFA charter holder.

Prepare for Exam Day

As the exam day approaches, revise your concepts and strategies. Be sure of the venue and read the rules and regulations properly to prepare the necessary documents and materials. Be relaxed and calm on the day of your exam.

Follow these steps to successfully prepare for the CFA exams after fulfilling the CFA course eligibility. Stay focused, disciplined, and motivated, and you will be well on your way to earning the prestigious CFA designation.

When Is The Best Time To Start Preparing For The CFA Exam?

Timing, no doubt, is crucial so the right time to start preparing for your CFA exam can considerably affect your performance and success. So read further to know about the points you should take care of while preparing.

Exam Dates

CFA institute conducts exams multiple times a year, so having prior knowledge of the upcoming CFA exam dates will help you schedule your study plan that aligns with your routine.

Begin Early

It is recommended to at least start preparing 5 months before your exam so that you can thoroughly study the topics, revise and practice extensively to avoid that last-minute stress.

Study Plan

Make a plan to study effectively and for this, you can divide your syllabus into sections and set realistic goals to cover them in the allocated time period. You can also set a number of hours to study daily and master a topic at a time.

Personal Commitments

Balancing personal commitments be it related to work, family or any other is not so easy. So keep them in the loop and schedule things accordingly so that it does not affect your studies.

Take Mock Exams

Incorporating practice exams in your study plan will help you analyze your progress and you can identify your weaker areas of study to improve those before appearing for your CFA exam.

Seek Support

You can ask for support from our mentors or alumni as their expert advice can provide valuable insights and enhance your preparation. If not then there is an option to join CFA study groups to seek solutions to your problems. If studying exhausts you, then you must open up about it to your family, friends or loved ones.

Stay Consistent

Consistency is the key to success. A regular study routine, staying focused and avoiding procrastination will enhance your effort over time and yield better results than cramming in the final weeks.

These guidelines will, therefore, help you determine the best time to start preparing for your CFA exam and set yourself up for success. Just remember, that the earlier you start, the more time you have to grasp complex concepts and refine your strategies.

5. Conclusion

Preparing for the CFA exam is a demanding yet rewarding journey. CFA affiliation can significantly enhance your career in the finance industry. Understanding the CFA eligibility criteria and planning out your study schedule is crucial in your path to becoming a Chartered Financial Analyst. At edZeb, we are committed to supporting you throughout this process with expert guidance and comprehensive resources. Start your CFA course preparation early, and stay disciplined to maximize your chances of success.

FAQs

Can I take Level 1 during my final year of college in India?

Yes, final-year college students are eligible to take their CFA Level 1 but ensure your exam date does not clash.

Is CA, CS, or CWA equivalent to a Bachelor’s degree for CFA eligibility?

Yes, CA, CS, or CWA is equivalent to a bachelor’s degree providing eligibility for CFA, so you need not a traditional graduation degree.

Can I appear for multiple levels in the same exam cycle?

You can only register for one level per exam cycle and each level requires separate preparation and examination.

Are there age restrictions for CFA eligibility in India?

There are no age restrictions mentioned by the CFA Institute in India or globally.

Is coaching necessary to prepare for CFA?

It is not necessary if you can handle the rigour of its curriculum, carry out a study plan, schedule balance between work and study, manage time well, and stay disciplined, then why not? However, joining reputed CFA coaching platforms like edZeb in Delhi can simplify the rigour to a great extent.

Can I take Level 1 during my final year of college in India?

Yes, final-year college students are eligible to take their CFA Level 1 but ensure your exam date does not clash.

Is CA, CS, or CWA equivalent to a Bachelor’s degree for CFA eligibility?

Yes, CA, CS, or CWA is equivalent to a bachelor’s degree providing eligibility for CFA, so you need not a traditional graduation degree.

Can I appear for multiple levels in the same exam cycle?

You can only register for one level per exam cycle and each level requires separate preparation and examination.

Are there age restrictions for CFA eligibility in India?

There are no age restrictions mentioned by the CFA Institute in India or globally.

Is coaching necessary to prepare for CFA?

It is not necessary if you can handle the rigour of its curriculum, carry out a study plan, schedule balance between work and study, manage time well, and stay disciplined, then why not? However, joining reputed CFA coaching platforms like edZeb in Delhi can simplify the rigour to a great extent.