CFA, abbreviated for Chartered Financial Analyst. Is CFA worth it? Will it help in building a career in Finance? Is it easy to do?

Everyone considering CFA comes across these questions and stays stressed as they are also in the consideration phase and are googling a lot to reassure themselves that they will be able to achieve their career goals with this gold standard qualification recognized worldwide.

Read this article further and have a clear mind before you proceed with the CFA qualification. Here’s what you need to know.

CFA and Its Importance

The Chartered Financial Analyst (CFA) is for all the aspirants who want to make careers in the finance industry. It is considered as the gold standard of investment credentials. It will enable finance aspirants with industry-relevant skills to become professionals. For that, they progress through its rigorous curriculum, covering investment management, financial analysis, and ethical standards.

Well, is CFA really worth it? Follow us while we answer it in more detail.

Adding a globally recognized certification to your resume allows you to pursue various jobs after CFA. These include portfolio managers, investment bankers, equity researchers, and financial analysts like prestigious opportunities in the finance industry.

Companies hiring CFA professionals include the Big 4s: KPMG, PwC, Deloitte, and EY. Other MNCs such as JP Morgan Chase, Bank of America Merrill Lynch, Deutsche Bank, Credit Suisse, Motilal Oswal, and Anand Rathi. Also, the companies employing CFA charter holders include Morgan Stanley Wealth Management, Royal Bank of Canada, BofA Securities, UBS Group, HSBC Holdings, Wells Fargo and Company, BlackRock, and TD Bank Financial Group. Choosing CFA After 12th is an excellent way to fast-track your career in finance.

These listed companies hire CFAs at competitively higher salaries. They are also given incentives and other pers as per the company norms. The salaries also vary as per the level of experience and expertise one must possess and depending upon the location and type of organization you are working for. Thus, you shall see, is CFA worth it or not for investing enough time and money.

Benefits of CFA Designation

As a CFA charter holder, you will be able to take advantage of its various benefits, be it career advancement, networking opportunities, and global recognition. Let us read in detail to get a better idea of all the benefits of CFA designation, and to get an idea of whether CFA worth it or not.

Career Advancement

Salary Hike

CFA holders do earn higher salary packages as compared to their peers with no professional qualification. Moreover, many financial professionals report higher salaries after becoming a CFA charterholder. CFA Salary in India has been steadily increasing, with demand for skilled professionals in areas such as investment banking, portfolio management, and equity research driving up salary expectations for those holding the CFA designation.

Faster promotions

Having a CFA designation can lead to faster promotions as your qualification lets you reach the C-suite network.

More career paths

As a CFA charter holder, the designation can open doors to more job opportunities in fintech, private equity, consulting, and financial advisory, making it a valuable credential for finance professionals. Now it is up to you to take into consideration whether CFA worth it or not.

Global Recognition

Job Mobility

The CFA charterholders can work anywhere in the world because the designation is globally recognized.

Competitive Edge

The CFA charter holder designation gives you a competitive edge in the job market as it helps you stand out to your potential employer.

Networking Opportunities

Official Events

The CFA Institute organises various events, seminars, and webinars allowing professionals to connect with each other.

Access to a Network

The CFA credential gives you access to a network of distinguished achievers which again will be a plus point to improve your social and professional circle.

Knowledge Enhancement

Demonstrate Expertise

The CFA program will equip you with skills that let you demonstrate your mastery of essential financial concepts and analytical skills.

Make Real World Contributions

The CFA curriculum covers alternative investment strategies such as private equity, hedge funds, real estate, and commodities letting you change how processes are carried out worldwide.

Therefore, your CFA qualification lets you enter a whole new world of prestige, credibility, and professional recognition. It elevates your social status, positioning you among elite finance professionals and granting you access to exclusive networks, high-profile job opportunities, and global career prospects. What do you think about is CFA worth it? Will you be able to avail the benefits of CFA?

What Does a CFA Do?

A Chartered Financial Analyst (CFA) is a professional equipped with expertise to analyze investments, manage portfolios, assess financial risks, and make strategic financial decisions. They work in a variety of industries, including banking, insurance, and investment firms.

So what does a CFA do is as follows:

- Analyze financial data and markets

- Develop investment strategies

- Manage client portfolios

- Evaluate investments, such as stocks, bonds, derivatives, and alternative investments

- Help determine asset allocation for investment funds

- Assess financial risks and prepare forecasts

- Plan cash flows

- Evaluate financial performance

- Participate in financial aspects of contracts and calls

- Develop and implement tools for analyzing financial portfolios

It is a very rewarding designation to possess but to earn it, you must pass three exams that assess your knowledge of these topics. Would you consider doing CFA is it worth it?

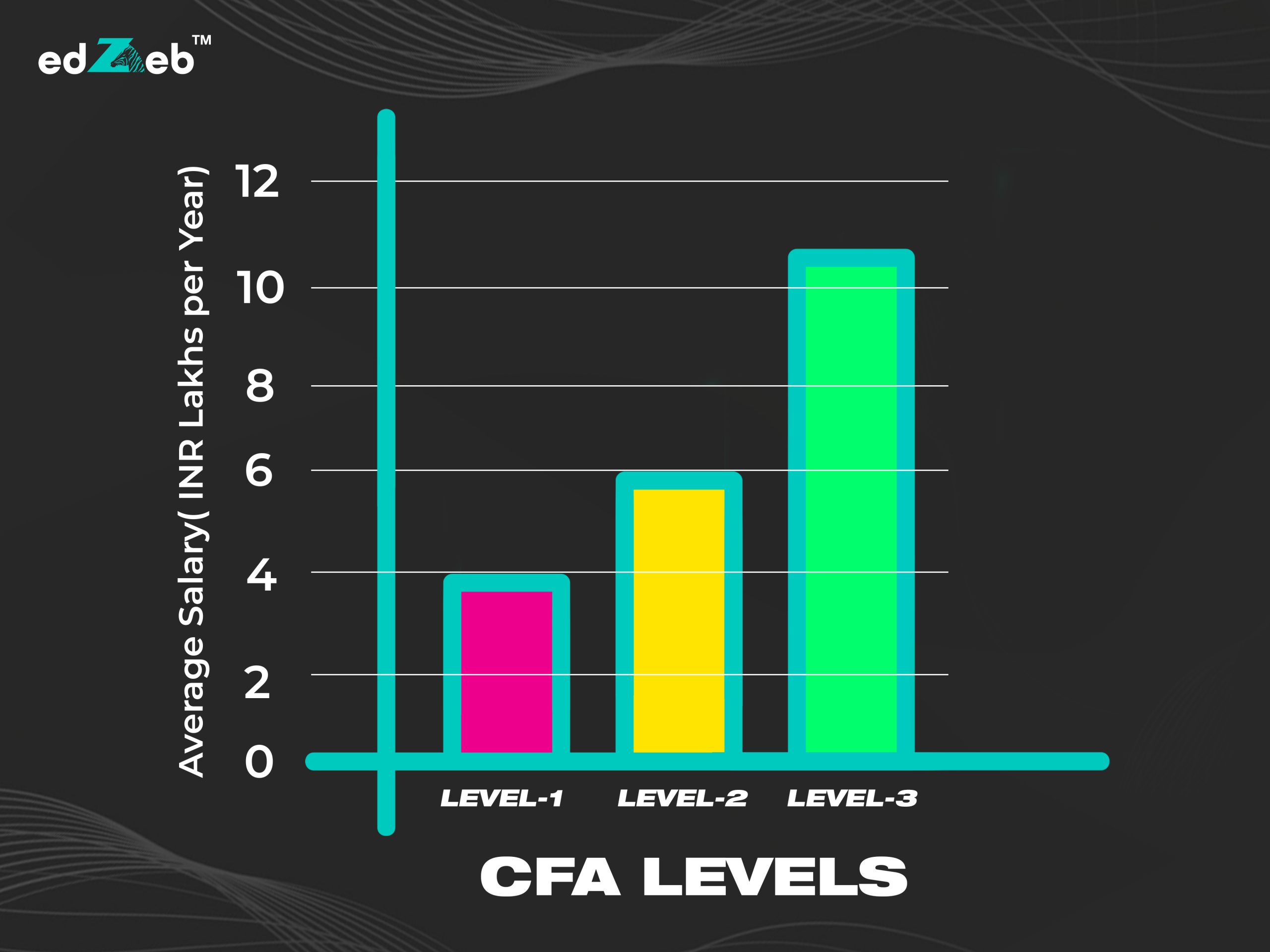

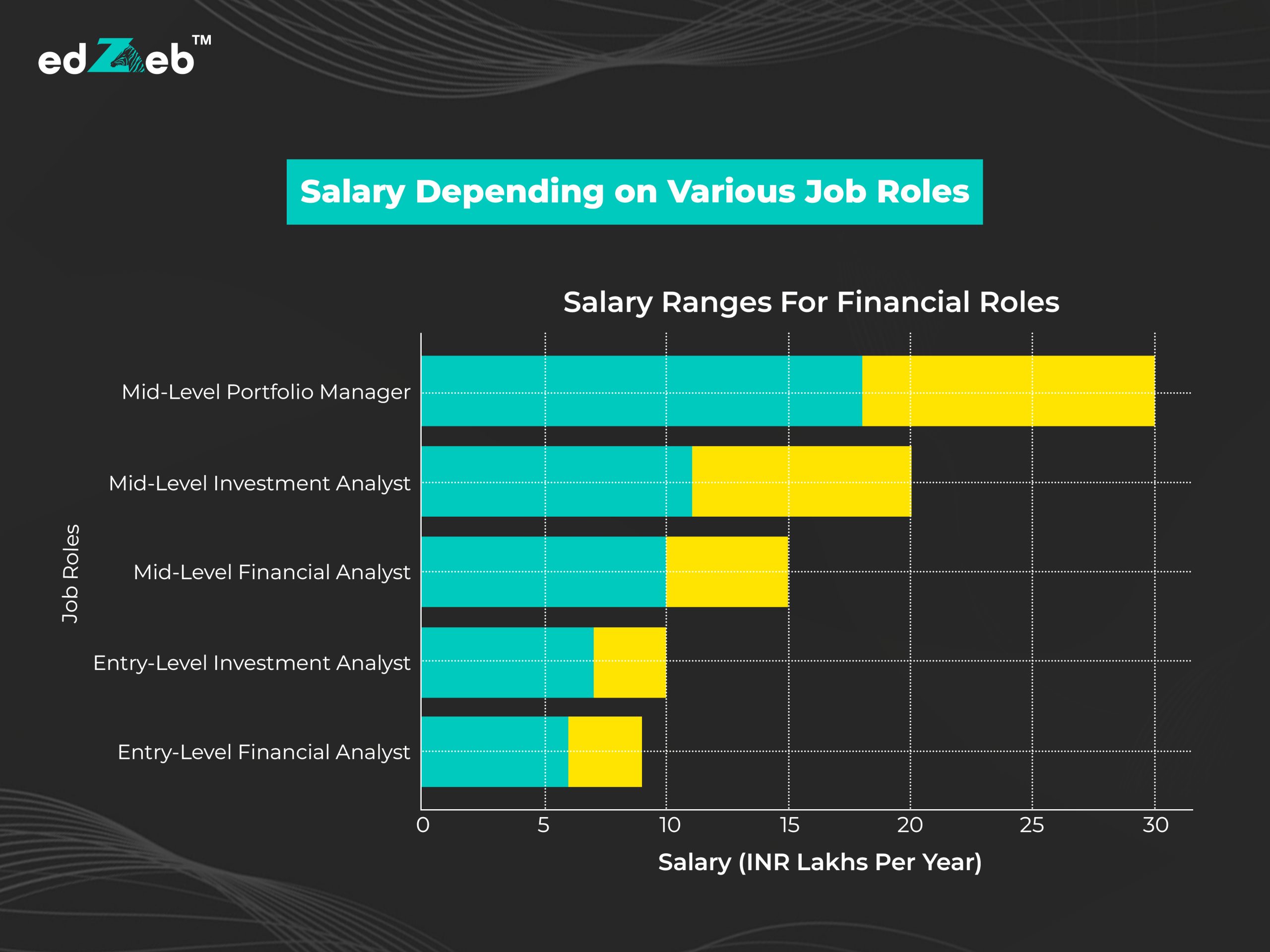

How Much Does a CFA Earn?

The salary of a Certified Financial Analyst (CFA) in India ranges from INR 6–20 lakhs per year. However, it can vary depending on various factors like experience, job role, and industry. Here is a brief information on the CFA salary by level and by role.

Salary Depending on various Job Roles

Challenges of Pursuing the CFA

Without any doubt pursuing the CFA designation presents several challenges. It may include the demanding curriculum, substantial time commitment, and potential for high exam anxiety, but it is also a valuable path for career advancement in finance.

So, below is a detailed explanation of what challenges you may come across while pursuing the CFA.

Curriculum

The CFA curriculum covers a wide range of topics, including ethics, quantitative methods, economics, financial reporting, corporate finance, and various investment areas. This wide range of topics makes it challenging to master.

Time Commitment

It is a professional designation so each of the three CFA levels requires a significant amount of study time. It includes hundreds of hours of preparation per level and subject. Plus, committing time to one thing can be difficult to balance with work and other commitments.

Exam Difficulty & Pass Rates

The CFA exams are known for being rigorous, as many students find it difficult either devote time to study or face any other challenge which leads to a relatively low overall pass rate.

Financial Strain

For the CFA qualification, you have to pay its registration fees, study materials, and coaching fees if you opt for it adds up to the overall cost of doing CFA.

Professional Growth

To stay updated with current trends and developments in the financial industry is important. So, that is what is crucial for maintaining your CFA charter.

Maintaining the Charter

After you gain the CFA designation, you must fulfil the reporting requirements to ensure professional conduct. You shall also reflect on the ongoing learning commitments to maintain the charter.

Factors to Consider While Deciding Whether CFA is Worth it

To be certain on deciding whether you should pursue CFA or is it even worth pursuing CFA?

You must consider some of the following important factors that is CFA worth it, before coming to a conclusion.

Job Market

One must be aware of the demand for CFA across industries. Pursuing any qualification will only benefit you when there is a high scope of career prospects across borders. CFA is one such qualification with a higher career scope allowing you to work in different countries as it is recognized globally.

Interests and Goals

It is one of the important factors to consider if your goals and vision align with the outcome of the time invested in pursuing the CFA qualification or not. If you are passionate towards finance then only you will be able to bear the rigour of the qualification otherwise it genuinely gets difficult if you are disinterested in doing it just for the sake of earning a designation. So, what say, is CFA worth it?

Monetary Challenges

The professional qualifications, along with time require money to pay for registration, exams, study material etc, or if you join any CFA coaching classes. You shall decide on your budget before pursuing it to avoid this additional stress later on.

Time Management

Preparing for CFA requires you to devote long hours from your daily routine to crack exams and balancing it with your other commitments is challenging. So, frame a plan that works out for you.

Return On Investment ROI

After doing CFA you will get high salaries across industries without any regional restrictions. So the ROI on this qualification is quite promising. You can also start working as soon as your CFA Level 1 exam is cleared.

Considering these factors will help you make this crucial decision to move further in your life. However, just be sure that your interests and your goals are aligned. Right? So CFA is it worth it for you?

Jobs After CFA?

We understand that CFAs are in high demand due to their expertise and global perspective. It constitutes to be the main reason that professionals are offered various jobs after CFA.

| Job Role | Primary Responsibilities | Average Salary (INR per annum) |

Portfolio Manager | Manages investment strategies and client portfolios | ₹19 lakhs |

Research Analyst | Collects and analyzes financial data for recommendations | ₹5 lakhs |

Financial Analyst | Studies data and trends to recommend investments | ₹6 lakhs |

Credit Analyst | Evaluate credit risk and bond investments | ₹8 lakhs |

Equity Analyst | Analyzes stock price trends and company performance | ₹7.2 lakhs |

Chief Investment Officer (CIO) | Oversees investment strategies for businesses | ₹60 lakhs |

Relationship Manager | Builds and maintains client relationships | ₹5 lakhs |

CFA Vs Other Finance Certifications

The Chartered Financial Analyst (CFA) designation is one of the most prestigious finance certifications globally, but it’s often compared to other qualifications like CPA, FRM, CAIA, CFP, and ACCA. The CFA duration is usually between 2.5 to 4 years, depending on individual progress.

Certification | Focus Area | Difficulty | Duration (in years) | Career Opportunities | Global Recognition |

CFA (Chartered Financial Analyst) | Investment Management Equity Research Portfolio Management | Very High | 2.5 – 4 | Investment Banking Asset Management Risk Analysis | High |

CPA (Certified Public Accountant) | Accounting Auditing Taxation | High | 1 – 2 | Auditing Taxation Corporate Finance | High (mostly in the US) |

FRM (Financial Risk Manager) | Risk Management Derivatives Credit Risk | High | 1.5 – 2 | Risk Management Hedge Funds Credit Analysis | High |

CAIA (Chartered Alternative Investment Analyst) | Alternative Investments Private Equity Hedge Funds | Moderate | 1 – 2 | Hedge Funds Private Equity Asset Management | Niche (Alternative Investments) |

CFP (Certified Financial Planner) | Wealth Management Financial Planning | Moderate | 1 – 2 | Personal Finance Financial Planning Advisory Services | High |

ACCA (Association of Chartered Certified Accountants) | Accounting Financial Management Taxation | Moderate | 2 – 3 | Accounting Auditing Consulting | High (Global, UK-focused) |

Out of all these qualifications, CFA is best for those who want to build their careers in investment banking, portfolio management, and equity research.

Conclusion

CFAs are highly sought-after professionals in India as well as abroad due to their knowledge and expertise. If you’re looking to pursue a CFA course, edZeb Institute is the best place to kickstart your journey toward becoming a CFA charterholder. The CFA qualification is recognized worldwide which improves your career prospects across different sectors. Though difficult, the long-term benefits include higher salaries, opportunities for job placement, and acceptance within the industry. Your career goals must align with CFA to handle the rigour that you have to go through while pursuing it. This hard work and commitment will definitely reward you with a highly esteemed career in finance.

FAQ’s

Is CFA better than MBA?

Both CFA and MBA are valuable but CFA is better for those who want a deep specialization in finance, particularly investment analysis and portfolio management. An MBA provides a broader business perspective, making it better for those seeking leadership roles across different industries and functions.

Is CFA tougher than CA?

Both the qualifications CFA and CA need a significant amount of hard work and dedication. However, CA is considered the toughest exam instead of CFA, it is the gold standard qualification in the finance industry.

Is CFA a hard exam?

Obviously, the designation makes you a finance pro so it needs you to go through the rigour to understand the niche better for you to excel in your career. So, yes you have to study hard to pass the exams.

How difficult are the CFA exams?

CFA exams are difficult to crack as it is the main parameter to judge the knowledge and skills that you portray within the time limit. So, the CFA exams need you to prepare your best for the upcoming challenges that you are going to face out there in the real world.