There are almost 15 lacs of students opting to study commerce out of which many of them further choose accounting courses to build a lucrative career path. So, today this article here will inform you all about the top 10 accounting courses that you can take up in India and make global careers.

Table of Contents:

What is Accounting?

Accounting is a process of recording, classifying, summarizing, analyzing, and reporting financial transactions of a business or organization in a systematic manner. This financial information is essential for the stakeholders, such as business owners, investors, creditors, and regulatory agencies to make informed decisions.

Accounting helps us understand and manage the financial health of the business due to which it has become a highly sought-after skill in various industries. Many commerce students are heading towards accounting courses in India that can help them gain expertise and achieve career goals. The table below enlists the accounting courses list in brief.

Course Name | Offered By | Eligibility |

ACCA | ACCA Global | Completion of Class 12 or Graduate |

CMA | Institute of Management Accountants (IMA) | Bachelor’s degree or pursuing graduation |

CA | Institute of Chartered Accountants of India (ICAI) | Completion of Class 12 or Graduate |

Financial Modeling | Various Institutes | No formal prerequisites, commerce background preferred |

M.Com in Accounting and Finance | Indian Universities | Bachelor’s degree in Commerce or related field |

Diploma in IFRS | ACCA Global | Graduate with 3+ years of work experience |

Diploma in Accounting and Finance | Various Universities | Completion of Class 12 |

MBA in Finance | Various Universities | Bachelor’s degree; Entrance exams |

CIMA | CIMA Global | Completion of Class 12 or Graduate |

CPA | American Institute of CPAs (AICPA) | Bachelor’s degree; Additional credit requirements |

Let us read further about the details of these top 10 accounting courses in India, and help you choose the one that aligns with your goals and aspirations.

List of Top 10 Accounting Courses in India

Association of Chartered Certified Accountants(ACCA)

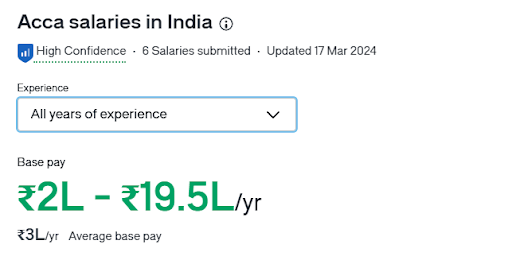

ACCA is a global qualification that enables professionals to work in 180+ countries after passing all three examination levels: Applied Knowledge Level, Applied Skills Level, and Strategic Professional Level. Many institutes are offering ACCA qualifications like edZeb, Zell education, Quintedge, and others in the market.

Eligibility

Anyone interested can do it, ACCA eligibility requires you to be a 10th pass out. So, it is among the accounting courses in India after graduation proving to be immensely beneficial in raising your career prospects.

Duration

The ACCA program can be completed within 3 years, the rest depends on the ACCA exemptions you get on the basis of your prior qualification or experience.

Jobs and Salaries

As an ACCA professional, you will be an expert in taxation, auditing, business analysis, etc. So you can work as a financial analyst, tax consultant, auditor, accountant, or even in leadership roles like CFO or financial controller across industries worldwide. The range of ACCA salary as per Glassdoor is provided in the following screenshot.

Certified Management Accountants (US CMA)

Through the Institute for Management Accountants (IMA), certifications in Certified Management Accountants (CMA) are intended to instill a professional attitude within the ambit of management accounting. Upon passing two exams, one may earn the title of CMA by finishing the two aspects of the exam within one year.

Eligibility

Students who have a bachelor’s degree or have completed +2 and are pursuing their bachelor’s.

Duration

US CMA can be done in a year but it may also take up to 2 years to complete as well.

Jobs and Salaries

The screenshot below shows what you can earn by earning a US CMA qualification as per payscale.

Chartered Accountancy (CA)

Becoming a chartered accountant requires 3 stages of study and qualification that take around 5 years to complete. CAs are governed by the ICAI (Institute of Chartered Accountants of India). Those who have qualified as associates of the ICAI can prefix ‘CA’ in their names. It is among the top accounting courses in India.

Eligibility

The CA eligibility is a pass +2 certificate with a minimum of 50% marks in commerce.

Duration

The duration of completing CA varies but takes longer up to 5 years or more to complete.

Jobs and Salaries

CAs are highly demanded by various companies all across industries be it financial, accounting, consultancy, IT, manufacturing, retail, real estate, or any other. As per Glassdoor, the screenshot displays CA salaries in India.

Financial Modelling

The financial modelling courses are short-term courses that can be completed within a few months. These are short-term courses that can practically excel you in building industry-specific financial models, applying valuation techniques, analyzing business performance, and much more.

Eligibility

The basic eligibility is to pass your senior secondary to do a financial modelling course.

Duration

It is a short-term course which can be done within 3 months or even less than that.

Jobs and Salaries

You can work as a financial modelling analyst, financial controller, financial representative, or at any other designation or profile and earn competitive salaries but as per Glassdoor is given below.

M.Com in Accounting and Finance

The Master of Commerce (M.Com) in Accounting and Finance is a two-year postgraduate program. Offering programs in accounting and finance, it is a higher structured degree with a focus on various aspects like specialized finance and accounting-specific subjects in financial accounting and cost accounting. MCom is among the top 10 accounting courses to be pursued by commerce students.

Eligibility

To do an MCom one must have a BCom degree or an equivalent bachelor’s degree from an accredited college or university.

Duration

MCom is a UGC-approved 2-year degree course.

Jobs and Salaries

According to Payscale, students with MCom degrees can work at different profiles and earn handsome salary packages.

Diploma in IFRS

The IFRS diploma is a three-month program that equips the students with an in-depth knowledge of the IFRS standards.

Eligibility

You need to be a professional to study IFRS standards so an ACCA or any other professional can do an IFRS diploma as it is among the best accounting courses in India.

Duration

It takes around 4 to 6 months to complete the diploma in IFRS offered by the ACCA organization.

Jobs and Salaries

After studying the standards, you can apply for various job roles like an accountant, consultant, IFRS specialist in finance, finance, planning, and analysis teacher, supervisor, or business analyst. As per Glassdoor, the IFRS salaries are given in the screenshot below.

Diploma in Accounting and Finance

The Diploma in Accounting and Finance is a short-term course that provides basic knowledge on the subject of accounting, financial management, and taxation. It will be conducted in various institutions in India such as Tripura University, GBPUAT, and polytechnic colleges making it one of the best accounting courses in India.

Eligibility

The minimum qualification required to do this diploma in accounting and finance is to have completed your 10+2.

Duration

Many institutes like NACI, DICS, MUMT, and the Indian School of Business offer a diploma in accounting and finance which varies from 3 months to a year.

Jobs and Salaries

The diploma in accounting and finance lets you work in multiple domains at varied salary packages shown in the screenshot attached as per payscale.

MBA in Finance

An MBA in finance is a conventional 2-year post-graduate degree that helps students gain skills and knowledge to work in the financial sector. Most of the students from a commerce background choose to do an MBA in finance making it one of the top accounting courses.

Eligibility

To enroll yourself in an MBA course, you must have a graduation pass certificate from a recognized university or institution.

Duration

MBA is a two-year program but its duration may vary as per institutions which may also include the training period.

Jobs and Salaries

MBA freshers and experienced candidates are highly demanded in the industry. The following screenshot of the ambition box clearly shows the jobs and salaries of MBAs.

Chartered Institute of Management Accountant (CIMA)

CIMA is a management accounting course that enables professionals to work in executive-level positions. It is mainly a UK-based qualification that can be attained only after passing 12 exams across three levels.

Eligibility

CIMA eligibility criteria are passing your 12th standard or O-Level examinations.

Duration

It will generally take 2 to 4 years to pass all the examinations to become CIMA certified.

Jobs and Salaries

CIMA professional’s salary ranges as per job role are given in the screenshot below as per the payscale data.

Certified Public Accountant (CPA)

After passing all four CPA examination papers including Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Regulation (REG), and Business Environment and Concepts (BEC), Certified Public Accountants in America are awarded the title of CPA by the American Institute of Certified Public Accountants.

Eligibility

The CPA qualification requires you to be sound enough to understand the syllabus and concepts, so for that, you must possess a bachelor’s degree in accounting or commerce. You can also pursue a CPA after completing 150 hours of post-secondary education.

Duration

The duration may vary but generally, the candidates take around 18 to 24 months to complete CPA. It is also considered among the top accounting certification courses in India.

Jobs and Salaries

Below are some common job roles and their approximate salary ranges for CPA (Certified Public Accountant) professionals as payscale data.

How to Choose an Accounting Course That Matches Your Goals

It is not easy to make a choice especially when you have numerous choices. Choosing an accounting course depends completely on your goals. It is a crucial decision that can shape your career. There are many things to consider before you decide on choosing an accounting course like,

First of all, identify what interests you, auditing, taxation, financial analysis, or corporate finance. Along with that also check out whether its scope is high and whether it can take you places or not. After that, analyze the syllabus, and review it to see if it covers the skills and knowledge. Practical training is also very important so look for internships or case studies that align with real-world applications.

Moreover, having the know-how of the course provider along with the course is a plus. Check eligibility and other important information including job prospects and salary potential. Last but not least, do not ignore the cost and time investment as you need to dedicate yourself to gain something exceptional.

Therefore, carefully analyze factors that provide the right balance of knowledge, skill-building, and career advancement opportunities.

Conclusion

Accounting courses offer diverse career opportunities across industries. The aforementioned top 10 courses provide a comprehensive mix of global certifications, specialized diplomas, and advanced degrees to cater to various career goals. So, consider the parameters serving as the deciding factors and continue your journey toward success in the world of accounting.

FAQ’s

CA or CFA which is better?

Again comparatively, CFA is a hardcore finance course but CA is an accounting course with a strong focus on auditing, taxation, and financial reporting.

Which course is in demand for accounting?

Many in-demand courses for accounting are ACCA, CMA, CA, CPA and others, so while doing this, make sure it aligns with your goals and aspirations.

Which course is best for an accountant in India?

The best course for an accountant in India is CA, due to its comprehensive focus on auditing, taxation, and financial management. For global opportunities, ACCA or CPA are excellent alternatives.

Which job is best for accounting?

The best jobs for accounting can be Chartered Accountant (CA) for expertise in auditing and taxation, Financial Controller for leadership in financial management, and Financial Analyst for business insights. However, for global exposure, CPA and ACCA roles are also highly demanded.

Which accounting job pays the most?

The highest-paying accounting jobs include Chief Financial Officer (CFO) and Financial Controller, followed by roles like Senior Finance Manager, Chartered Accountant (CA) with extensive experience, and Certified Public Accountant (CPA) in multinational firms.