Have you ever wondered why there are so many types of accounting and what makes each one significant? From handling taxes to tracking business costs, each type of accounting plays a vital role in keeping a business financially healthy. If you’re considering a career in ACCA or similar field of accounting, gaining an understanding of these accounting branches is essential, as ACCA focuses on equipping you with expertise across various financial disciplines.

In this post, we will break down the main types of accounting with their functions in simple terms. Read with us to find out how these accounting types can support business growth and success!

Table of Contents:

Accounting: An Overview

Accounting is the discipline of recording, analyzing, and interpreting financial information to guide business operations and meet regulatory standards. In simple terms, we can say that accounting helps businesses track their financial health and make informed decisions.

Multiple branches of accounting exist to address specific financial functions and needs. This guide aims to discuss in detail what are the types of accounting and provide insights into how they can help businesses organize their finances effectively.

For those aspiring to build a global career in accounting, pursuing an ACCA qualification can be a game-changer. The subjects of the ACCA course, such as Financial Reporting, Performance Management, and Taxation, cover the core areas of accounting, offering a comprehensive understanding of its various branches and their applications in real-world scenarios.

Importance of Accounting in Business

The importance of accounting reaches almost every aspect of business success. Accounting is not just about numbers, it is way more than that! Different types of accounting contribute in their unique ways to a successful business. Each kind provides companies with much-needed information so that they can make smart decisions and are always in compliance. Tax accounting keeps businesses on the right side of the law so that there is no chance of penalty. Financial accounting gives an overview of how the company is doing in general so that the leaders and stakeholders can look through the financial health.

If you’re exploring options like ACCA after CA, it’s clear you’re aiming to enhance your expertise and stand out in the competitive financial world. ACCA complements the knowledge gained from CA, offering a broader, global perspective on accounting practices.

Management and cost accounting focuses on planning for the future and being cost-effective. It tells where resources are best spent and where the savings can be made, guiding businesses in optimizing budgets and driving sustainable growth. By understanding the functions of accounting, businesses can better manage their finances better and plan for the future.

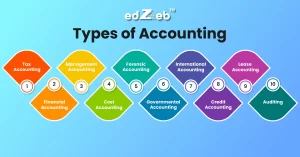

TYPES OF ACCOUNTING | CORE IMPORTANCE |

Tax Accounting | Ensures tax compliance |

Financial Accounting | Offers financial clarity |

Management Accounting | Aids in budgeting and planning |

| Cost Accounting | Controls and reduces costs |

Forensic Accounting | Detects fraud |

Governmental Accounting | Manages public sector funds |

| International Accounting | Ensures global compliance |

Credit Accounting | Manages cash flow |

| Lease Accounting | Tracks lease obligations |

| Auditing | Builds trust through transparency |

What are the Different Types of Accounting and Their Functions

Exploring the specific functions of accounting reveals how each type plays a role in building a complete financial picture for businesses. To understand how businesses manage their finances, it is time to explain the types of accounting they rely on followed by their importance.

Tax Accounting

Tax accounting is all about ensuring that the organizations adhere to the tax guidelines. This includes-

- Following all the government rules regarding computing and filing of taxes.

- Tax consultancy for reducing the liability

Tax accountants keep themselves updated on tax law changes so that companies can take advantage of a deduction or credit that they will use to minimize taxes. They also play an important role in conducting audits as well as resolving tax disputes with the tax authorities.

Tax accounting is crucial for the reason that it allows businesses to stay compliant while avoiding penalties and assists businesses in taking advantage of appropriate tax deductions to save whatever possible.

Financial Accounting

Financial Accounting relates to the presentation of standardized financial statements like–

- Balance sheets

- Income statements

- Cash flow statements

These statements give an idea about the company’s current financial situation and help investors, creditors, and others make judgments regarding the performance of the business. Financial accountants enhance transparency and trust by ensuring that these statements are prepared according to accepted accounting principles.

Financial accounting allows stakeholders to have a very clear view of the position of the company in terms of its financial status. This inspires transparency and compliance to the rules of external reporting.

Management Accounting

Management accounting aids in internal decisions by rendering relevant information about financial data for activities such as

- Budgeting and forecasting

- Performance evaluations

- Cost control

Management accountants analyze the data to provide insights useful for driving strategic initiatives as well as improving operations. They help management make informed decisions about future performance and trends that are directed towards the goals of a company.

With management accounting, businesses can thus plan and allocate resources in effective ways that ensure profitability as well as operational efficiency.

Cost Accounting

Cost Accounting focuses on identifying and managing production costs. This includes:

- Tracking the cost of goods sold (COGS)

- Analyzing overhead costs

- Implementing cost-saving strategies

Cost accountants help businesses understand the full cost of production, enabling them to identify inefficiencies and areas for improvement. By evaluating the costs associated with different projects or products, they play a crucial role in setting competitive pricing strategies.

Cost accounting helps businesses price products competitively, improving profitability by identifying areas to reduce expenses.

Forensic Accounting

Forensic Accounting helps in investigating financial irregularities, such as fraud. It usually involves:

- Investigation of any inconsistency in financial records

- Discovered fraud

- Support in litigation

Forensic accountants collaborate with law enforcement and the legal team to detect financial crimes. This ability to investigate significantly helps businesses protect their assets and preserve integrity.

Forensic accounting protects a business from fraud and promotes compliance.

Governmental Accounting

Governmental Accounting is specialized in public sector entities. Some of the key emphasis is on-

- Budget management

- Financial transparency

- Adherence to governmental standards

Professionals in this field ensure that public funds are utilized effectively under the set policies. They provide critical data that enables government entities to allocate resources effectively while maintaining accountability to taxpayers.

Government accounting ensures public funds are placed in responsible hands, ensures accountability, and supports services to the public.

International Accounting

International Accounting accounts for cross-border transactions while adhering to international standards; for instance, IFRS. It includes-

- Handling currency exchanges

- Navigating international tax regulations

It is quite basic for multinational companies operating in diverse markets. International accountants ensure that companies follow the various regulations while enhancing the financial reporting of various countries.

For companies with international bases, international accounting maintains compliance and also streamlines financial reporting across jurisdictions.

Credit Accounting

Credit Accounting is majorly involved in managing a company’s receivables and payables. It lays a major focus on:

- Tracking customer payments

- Credit risk analysis

- Debt collection

Credit accountants help organizations mitigate the risks of lending that come with patterns of customer payment and creditworthiness. They also ensure that firms have cash flows to cover the needs of operations.

Credit accounting enables organizations to maintain healthy cash flow with low risks of bad debt and ensures that revenues are collected in time.

Lease Accounting

Lease Accounting deals with the management of the financial aspects of a lease agreement based on guidelines like IFRS 16. These include-

- Recording lease-related assets and liabilities

- Calculating interest expenses and depreciation

Lease accountants help companies in navigating complex lease agreements. They ensure that financial obligations are accurately reported. This enhances transparency regarding financial commitments and impacts financial ratios that are used by investors and creditors.

Lease accounting gives an accurate picture of lease obligations and improves financial transparency.

Auditing

Auditing is the process of examining the financial accounts of an organization to check its accuracy and adherence to norms. It can be-

- Internal audit- by staff of the organization

- External audit- by external auditors

Auditors examine whether the internal control mechanism is in place or not. They evaluate the risk management procedure of the organization and suggest how it can be improved.

Auditing verifies the financial information of the firm, ensuring that all the records are reliable, and aids in increasing the stakeholder’s confidence in it.

edZeb– The Premiere Institute for Accountancy Education

At edZeb, we pride ourselves on being a leading education platform for those pursuing a career in accounting. Our programs are designed to equip you with industry-relevant skills, covering diverse areas like tax accounting, management accounting, and taxation. With expert-led courses, practical training, and a focus on real-world application, edZeb offers students a solid foundation to excel in various accounting careers.

Whether you’re new to accounting or an experienced professional looking to deepen your expertise, our courses are crafted to help you succeed in this dynamic field.

Conclusion

Understanding the different types of accounting is essential for any business aiming to stay financially healthy and make informed decisions. Each type of accounting plays a key role in building a strong financial foundation. These branches guide businesses through financial complexities and help keep them on the right track. Recognizing the importance of accounting is the first step toward a successful career in this field.

Ready to deepen your accounting knowledge? Start exploring these areas in detail, strengthen your skills, and set yourself up for success in the dynamic field of accounting.

FAQ’s

What are the 3 golden rules of accounting?

The 3 golden accounting rules are:

- Debit the receiver, credit the giver.

- Debit what comes in, credit what goes out.

- Debit all expenses, credit all income

What are the 3 basic types of accounting?

The three main types of accounting are- Financial Accounting, Cost Accounting & Management Accounting.

What are the career options in the accounting field?

Career options in the accounting field include roles such as auditor, chartered accountant, forensic accountant, mortgage advisor, retail banker, actuary, business development manager, and financial manager.

What are the 5 types of accounts in accounting?

The five account types are assets, liabilities, equity, revenue, and expenses.

What are the Big 4 accounting firms?

The Big Four accounting firms are Deloitte, Ernst & Young (EY), PricewaterhouseCoopers (PwC), and Klynveld Peat Marwick Goerdeler (KPMG).